Building a business in crypto is hard, even for the most reputable and well positioned “TradFi” (traditional finance) companies.

Last week, Cboe – Chicago Board Options Exchange (CBOE) – announced their plans to wind down Cboe Digital Spot Market in Q3 2024 and to transition digital asset derivatives trading and clearing into existing derivatives and clearing business lines.

Cboe was one of the earliest TradFi adopters of BTC, launching BTC Futures Trading in December 2017.

Cboe then made one of the most significant Bridge M&A transactions in crypto by acquiring ErisX in October 2021, paving the way for the launch of Cboe Digital with digital asset spot, derivatives and clearing capabilities.

We constantly say in M&A that timing is one thing that none of us can control and nine months later, Cboe wrote down $460M on the ErisX acquisition, defensibly as we were in the heart of the Great Purge.

Despite the writedown, Cboe continued building digital asset derivative products, including margined BTC and ETH futures that launched in Jan 2024.

We highlight the Cboe Digital journey because there are real consequences and implications for the politicized, directionless, paralyzed, [enter your preferred adjective] and completely inept state of U.S. regulation that plagues our industry. For 50 years, Cboe has done it the right way for all other products they service. If one of TradFi’s most successful exchanges can’t operate within today’s U.S. crypto asset framework, what choices must other high quality businesses make?

—

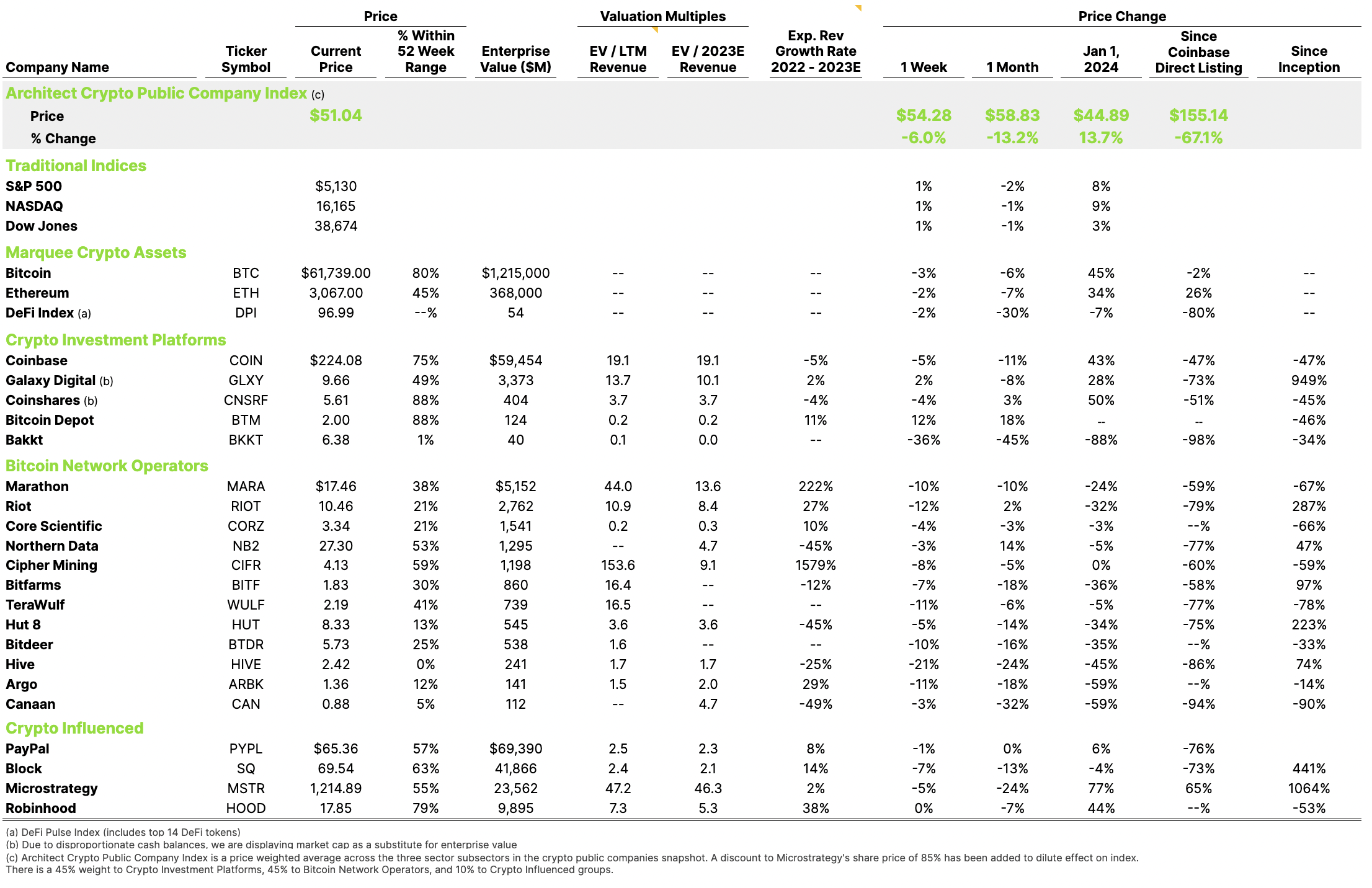

Coinbase’s Quarterly Shareholder Letter is now required industry reading and consistently one of the best written perspectives of our industry. Biggest takeaway is Q1 Adjusted EBITDA was $1.0B – more than full year 2023.

The Bitcoin Lightning Network is one of the first Bitcoin Layer2 protocols that is focused on the BTC as a medium of exchange (i.e. payments) use case. This week, Coinbase also announced their integration of Bitcoin Lightning through the important work of the Lightspark team. For those that question if BTC will ever be used to pay for every day goods and services, this is a very important step towards making this a reality. (I expect crypto payments to be part of everyday life by 2030.)

MicroStrategy hosted their Bitcoin for Corporations conference this week, where Michael Saylor unveiled MicroStrategy Orange, an enterprise platform for building decentralized identity (DID) applications on the Bitcoin blockchain. DID will be one of the most important innovations to spawn from blockchain and it is notable that one of the highest profile BTC companies is launching a DID for enterprises on the Bitcoin protocol. Also notable is the conference was geared to educate publicly traded companies on, essentially, how to use BTC on corporate balance sheets and for treasury management purposes. Zero companies in the S&P 500 have BTC on their balance sheet today. How many will have some BTC by 2030?

BlackRock (BLK), Hamilton Lane (HLNE), and Tradeweb Markets (TW) participated in Securitize’s $47M round this week, further validating the tokenization of real-world assets trend. I continue to say that 75% of securities will be owned in a digital structure on a blockchain by 2030. Announcements like this will force TradFi companies to get involved with tokenization initiatives, so expect more to come, especially from publicly traded companies who have a lot to lose.

Not a public company, but notable that Tether announced a $4.52B profit in Q1 2024. Tether is making the case of becoming one of the most successful companies of all time when measured by profit generated from number of employees (<100).

The last two weeks we delved into publicly traded BTC Miners. Nat Brunell’s Mining the Future Podcast featuring five CEOs of publicly traded miners hits on all the key topics and is a must listen for those seeking to understand the current state of the BTC mining industry.