Memecoins are here to stay and that is a good thing, as long as everyone knows what a Memecoin is – a crypto asset that is not backed by any asset and has no business model.

But that does not mean Memecoins have no value.

I joined our industry in early 2018, during the height of the “ICO Boom & Bust” and experienced the earliest phases of what has been termed “$#!+coins”. These are tokens that have no reasonable answers to the rationale questions of “what does the token do”, “what benefit does a holder of the token get” and “what is the token’s business model”. Projects that launched a token that did not have viable answers to these questions flooded the crypto market and is the reason why “cryptocurrencies” remains a tainted word. Because 99% of cryptocurrencies were $#!+coins by design and had zero value besides hype.

The “Attention Economy” exists. This references anything that humans invest seconds of their day doing. If time is our most valuable asset (and it is), theoretically, we all assign real value to things that we spend time on. Human society invests meaningful amounts of time on social media, but there is little ability to assign value to that time spent. If one were to sit in any Web2 (Social Media) executive meeting in the late 90s, the key topic to address was “how do we monetize our website?”. With the limited technology options available at that time (online credit card payments were just emerging), the answer became online advertising. In 2024, social media’s primary monetization method remains advertising.

Surely this method of monetization is the worst business model for the users – who deliver the actual value to the website – and an ideal model for the operators. Operators figured out how to incentivize users to provide all of their data for free in exchange for no monetary value and only for attention value. The model should be that users receive monetary value for the amount of engagement they bring to the website and the operators take a cut of that value.

Enter Memestocks. During the height of the pandemic, a new and crude way to directly monetize attention through the stock market emerged. GameStop (GME) and AMC (AMC) immediately became social media sensations because they were early examples of users being able to generate monetary value by attracting attention. Traditional and purist investors (if they even exist still) cried foul and that Memestocks were fraudulent and ruining the fundamentals of the stock market.

This week both GME and AMC stocks went on a frenzy because of a single tweet of an image of a person leaning forward in their chair from one of the Founders of the Memestock movement. But this happened when TradFi markets opened on Monday at 9:30am EST. Minutes after this tweet on Sunday evening, previously existing $GME and $AMC tokens minted on Solana traded up from $2M to $160M and $100K to $35M by Tuesday.

Enter Memecoins – the next evolution of monetizing the Attention Economy. To be clear, these tokens are not backed by any asset and do not have a business model. But that does not mean they do not have value. Dogecoin ($22B), Shiba Inu ($14B), Pepe ($4B), and dogwifhat ($2.5B) are proving that Memecoins have an emerging place in free markets. These are early experiments that are showing a future where we are able to directly assign value to creators of things that attract attention.

I have never been a supporter of $#!+coins and, in 2024, believe the majority of them will do significantly more harm than any benefit they provide to our industry, but to date, there have been over 8 million coins that have been minted (created). If we are clear with our terminology and understand that the vast majority of coins are not backed by an asset and do not have a business model, then maybe Memecoins do have a permanent role to play and maybe that role is assigning value to the Attention economy. The question is “who’s paying attention”?

—

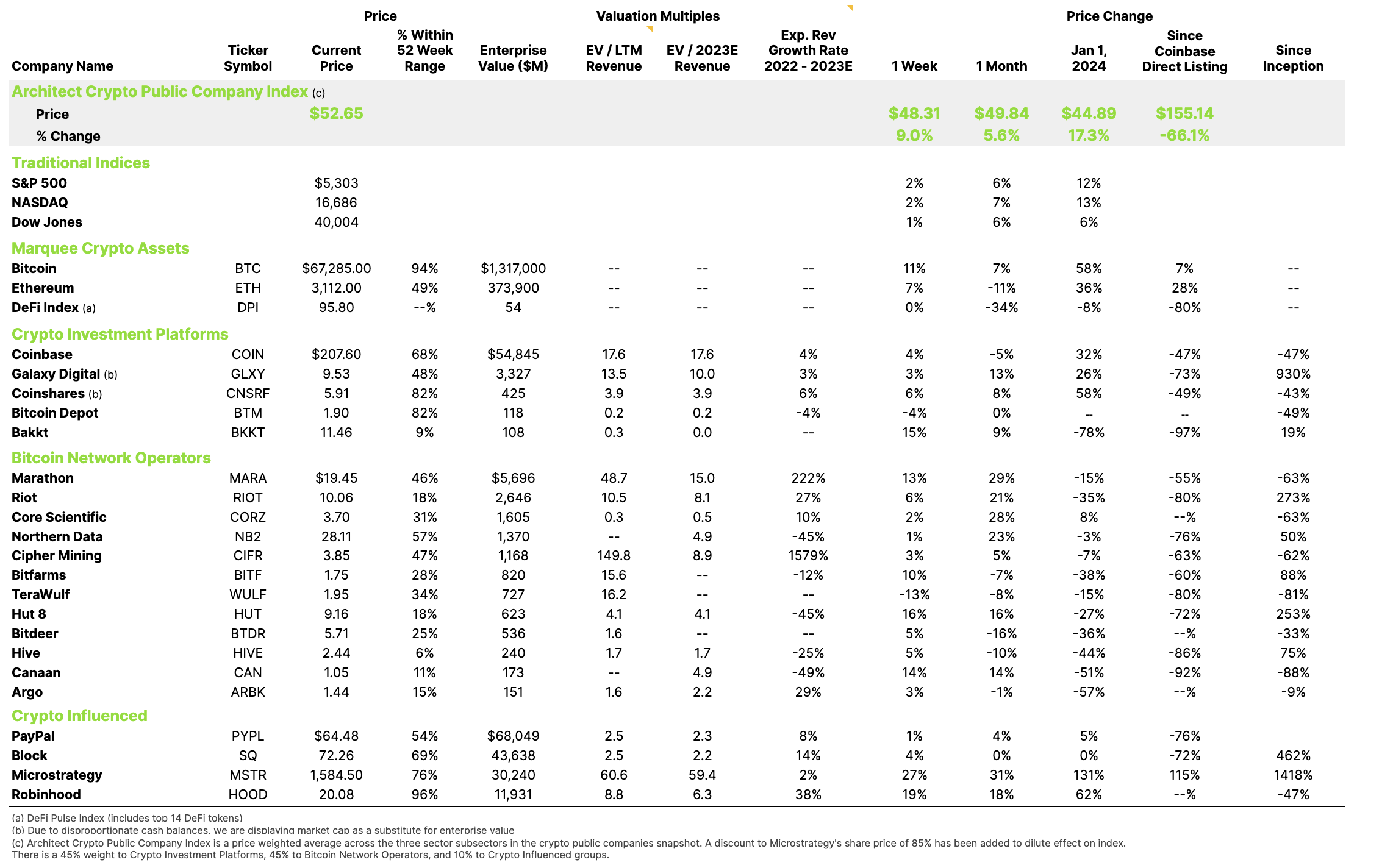

Running a 24/7/365 operation is difficult. Many might say near impossible, certainly by early 2000 standards. But in the worlds of content streaming and crypto, 99%+ uptime is the standard that customers expect and that companies must deliver. This week, Coinbase experienced a system wide outage for ~3 hours that caused some headlines and initial concerns, which is warranted given our industry’s history with hacking and bad acting. Expectedly, Coinbase handled the process with real-time transparency and communication that assuaged concerned market participants. This is important to note as we compare how TradFi exchanges currently operate 97,500 minutes/year (6.5 hrs/day * 5 days * 50 weeks) versus Crypto Exchanges operating 524,160 minutes/year. This makes 180 minutes of downtime seem much less meaningful. Crypto Exchanges are setting a new standard for providing institutional access to trading asset classes literally all the time. Will TradFi exchanges ever operate to this standard?

Coinshares announced their most successful quarter ever.

Architect Partners will be speaking at Digital Asset Week SF May 21-22 and will be at Consensus in Austin May 27 – Jun 1. Please reach out if you’d like to connect at either event.