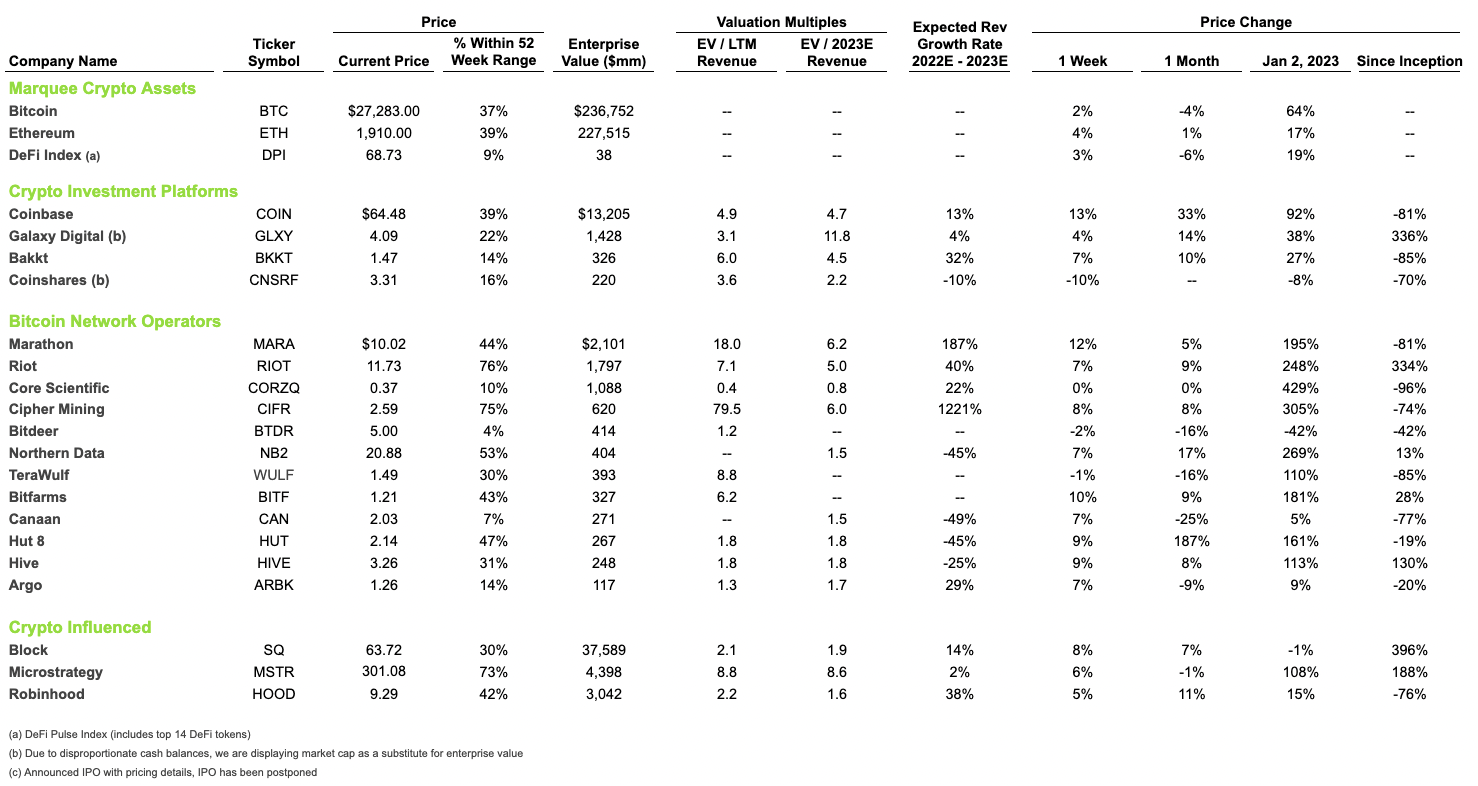

Let’s talk about Bitcoin Network Operators again.

As highlighted in the past, Bitcoin Network Operators have demonstrated admirable trust-building efforts with what has become industry-standard, monthly operation reporting. Marathon beat the crowd this month, publishing their May 2023 report an impressive 24 hours after the end of the month.

Marathon’s CEO, Fred Thiel, highlighted our transaction fee thesis mentioned in our May 19th report. Over time, we anticipate transaction fees will constitute an increasing proportion of compensation earned by Bitcoin Network Operators. This was summarized by Fred Thiel:

“The increased production was due to an increased hash rate and a significant increase in transaction fees, which accounted for approximately 11.8% of the total bitcoin we earned in the last month. The emergence of Ordinals significantly increased transaction fees in May, which in some cases, were so high that they exceeded the 6.25 BTC block reward. With our scale and our improved uptime during the month, we were able to capitalize on this opportunity. While such abnormally high transaction fees are historically rare, we believe these events can serve as a positive sign for the future of mining economics.”

We expect transaction fees to continue to be somewhat volatile, influenced by transaction volume and network transaction validation capacity, however, the trend is likely upward over the next several years.