Download the full report above.

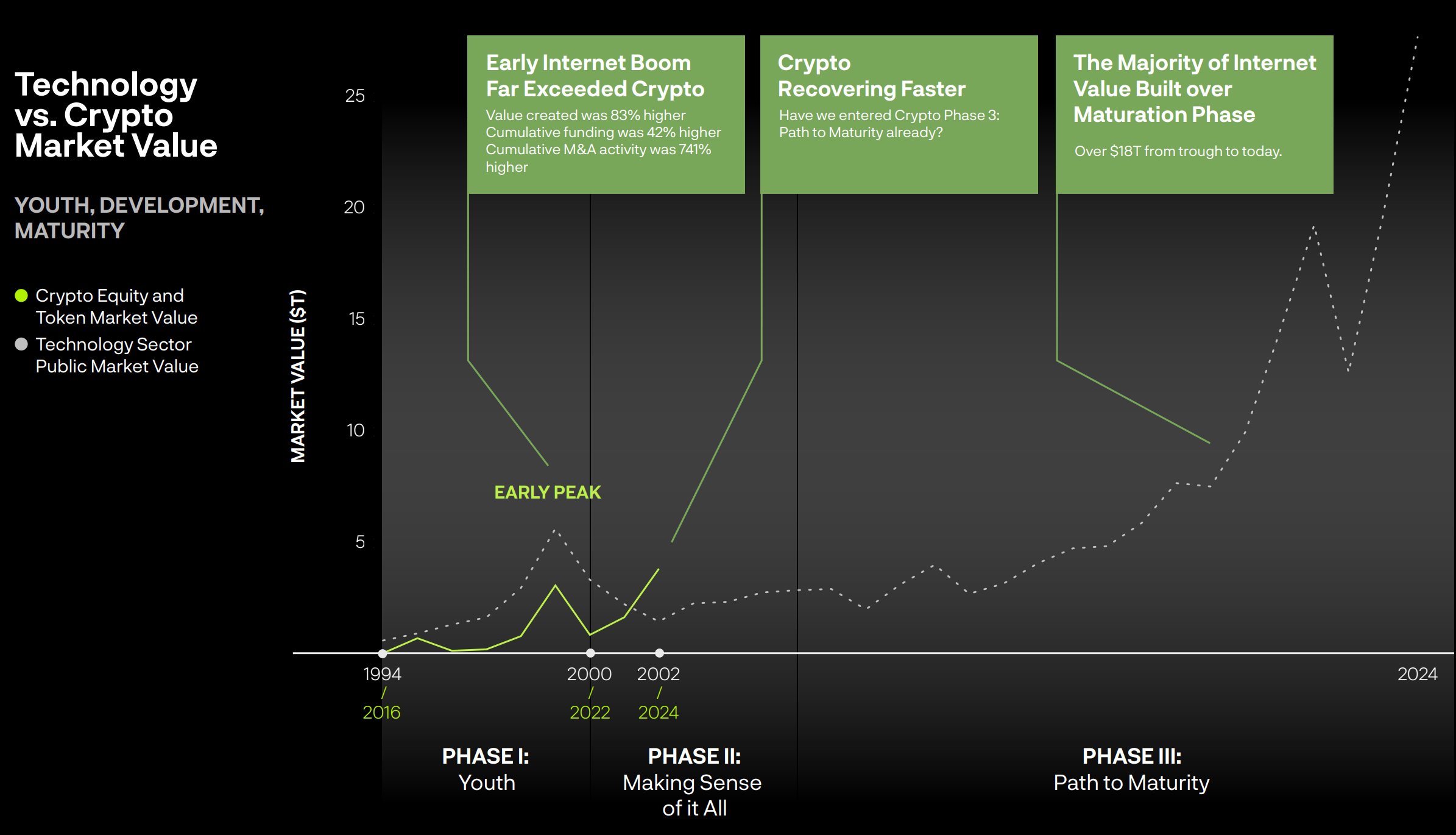

One year ago, on January 5, 2024, we published Family Ties: The Internet and Crypto. We made the case that the Internet and crypto worlds share remarkable similarities. This February 2025 report updates progress over the past year with both data and qualitative observations. This is meant as a continuation of our original report, not a replacement. For important context, please refer to our original report Family Ties: The Internet and Crypto.

Key takeaways from our 2025 report include:

Crypto surpasses the Internet in value creation for the first time in history. This is measured by reconstructing data from the formative years of the Internet and comparing them to the similar portion of the crypto life cycle.

Crypto capital invested to-date has returned 25x. $138B invested today worth $3.4T.

Crypto recovering from its “Winter” far faster than the Internet post Dot.com crash. Three years vs. 17 years to recover to their respective early peaks.

Crypto Users Still Lag. The Internet attracted more users with a diverse array of use cases which crypto hasn’t delivered yet.

VC Leaning Back In. Venture Investment was up over the past year again recovering far more quickly than the Internet.

M&A on an Upswing. Strong Q4 2024 uptick with anecdotal evidence this may be persistent.

To read the full report, click above.