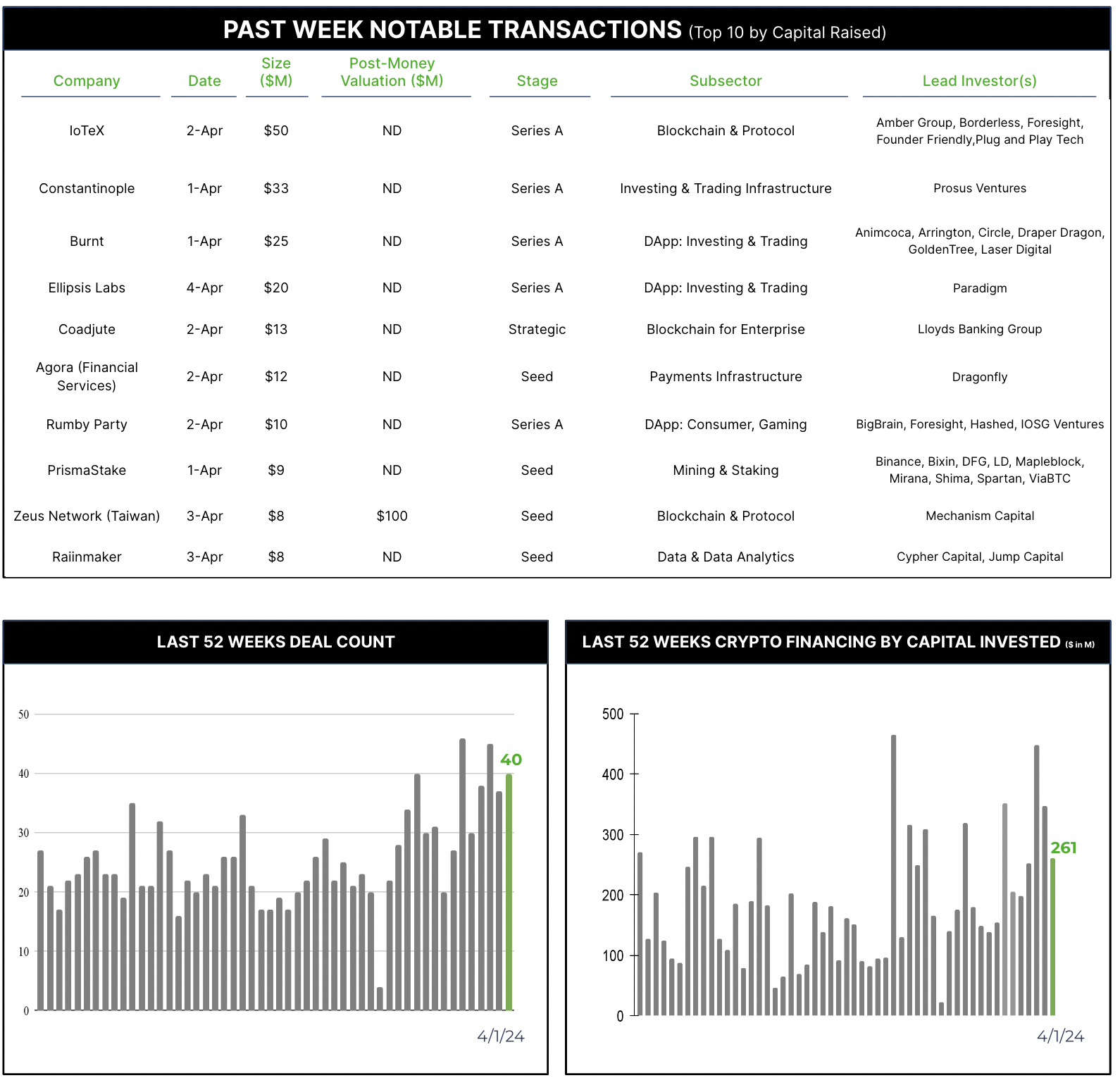

40 Crypto Private Financings Raised ~$261M

Rolling 3-Month-Average: $250M

Rolling 52-Week Average: $184M

Ethereum’s current processing capacity of 20 transactions per second is a bottleneck that hinders the scalability of dApps that rely on the Ethereum blockchain. Along with the significant growth of DeFi, which requires real-time interactions, and the popularity of NFTs with marketplaces requiring quick minting and trading, congestion continues to increase leading to slower transaction confirmation and higher fees.

Competition from alternative L1 chains, such as Solana and Cardano, offer EVM compatibility, faster transaction speeds and lower fees. In addition, Layer-2 chains, such as Polygon, have been developed to increase processing speeds.

Another approach is to re-architect the entire system, while maintaining complete EVM compatibility. This is the approach Monad Labs took, and today announced a $225M financing for their Ethereum Layer-1 competitor. Since this transaction was announced today, it isn’t noted in our list of last week’s Notable Transactions, but it was significant enough to demand some attention in today’s Snapshot.

Monad re-architected and optimized all levels of the stack. Optimization included parallel execution of code and superscalar pipelining. Monads optimization supports 10,000 transactions per second, with a 1-second block time. And just as important, Monad’s EVM is 100% compatible (a compatibility layer is not needed) with Ethereum’s EVM allowing developers to use their existing code as it exists.

As a Layer-1, Monad offers a scalable, performant chain that remains decentralized, and with much lower fees.

Monad will use the funds to fully commercialize the network, offering developers the simplicity of EVM with the performance of Solana.