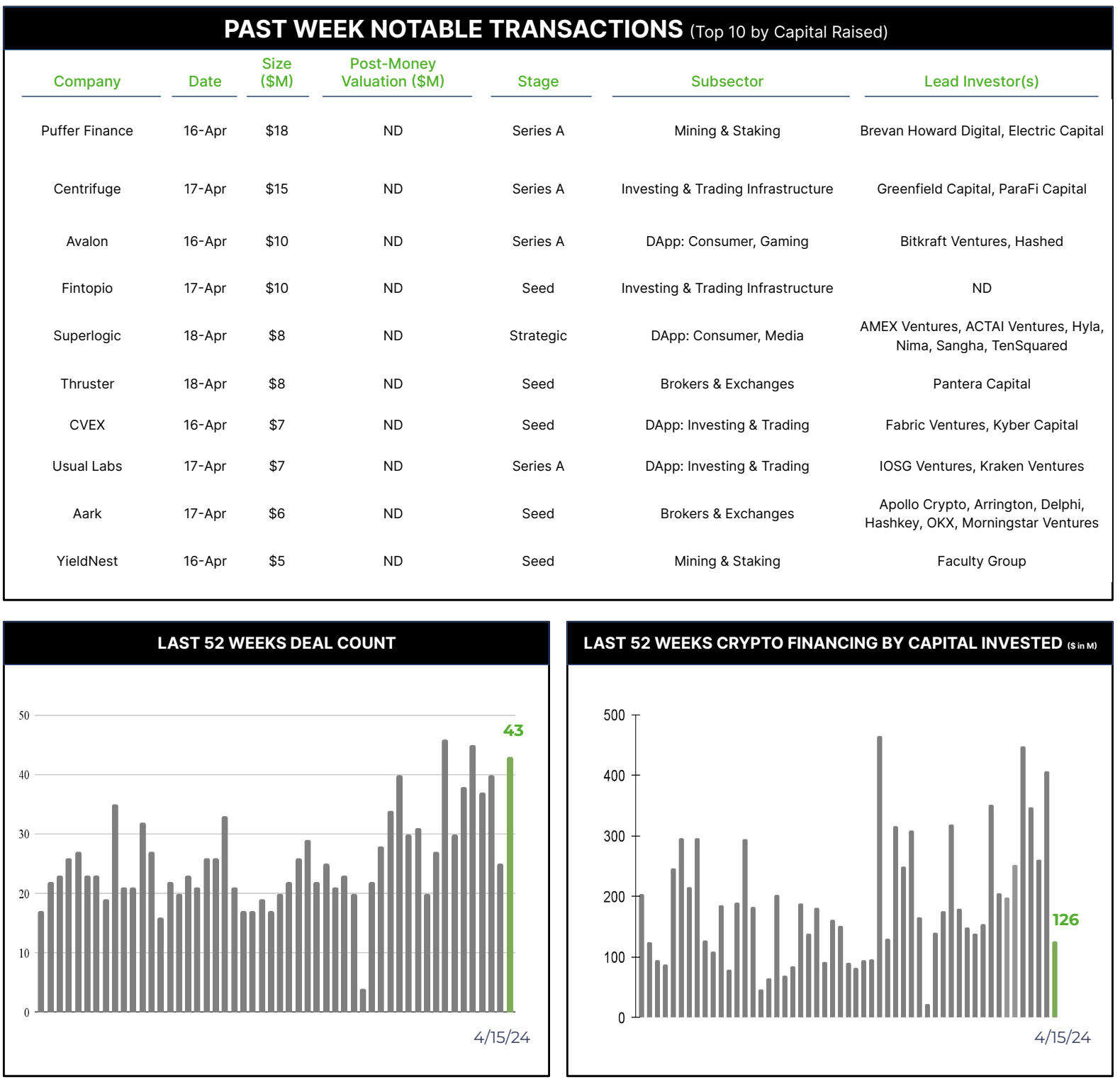

43 Crypto Private Financings Raised ~$126M

Rolling 3-Month-Average: $245M

Rolling 52-Week Average: $183M

Tokenization of real-world assets is a process that involves converting physical assets, such as real estate, art, or commodities, into digital tokens on a blockchain. These tokens represent ownership or a share in the asset and can be bought, sold, or traded. This process enhances liquidity, accessibility, and efficiency in traditionally illiquid markets.

The market for tokenized real world assets (“RWA”) is expected to grow significantly with a total market value of tokenized assets expected to significantly exceed $16 trillion by 2030 according to some reports.

There are many leading DeFi platforms supporting RWA tokenization. Centrifuge has taken a slightly different approach than most by serving as a bridge between traditional finance and DeFi and bringing non-crypto asset structured credit markets to DeFi. Centrifuge allows borrowers to tokenize RWA and use them as collateral to secure financing in a cost-effective and fully transparent manner to connect borrowers with investors.

Last week, Centrifuge announced a $15M Series A funding round led by ParaFi Capital and Greenfield. Additional investors included Arrington Capital, Bloccelerate, Borderless Capital, Circle Ventures, Edessa Capital, Gnosis, IOSG Ventures, Modular Capital, ProtoCap, Re7 Capital, Scytale Digital, Skynet Trading, Stake Capital, The Spartan Group, TRGC and Wintermute Ventures.

The funds will be used to scale and expand the business. Centrifuge is also planning an institutional-grade lending market for RWAs, built on Base and integrated with Coinbase Verification. These integrations will allow institutions to quickly and safely participate with real-world assets.

Continued funding of tokenization of RWA is critical for economic activity going forward, as it democratizes investment, enhances liquidity, drives efficiency and transparency across diverse asset classes, and creates avenues for innovation to rethink certain financial markets.