Is it M&A or something else?

As merger and acquisition practitioners, we are highly attuned to this question. A helpful frame of reference is whether the acquired company is or can become a sustainable business, or not. The former have to potential to achieve what we like to call “premium-value” outcomes, the latter, very rarely. This week featured two examples of the latter.

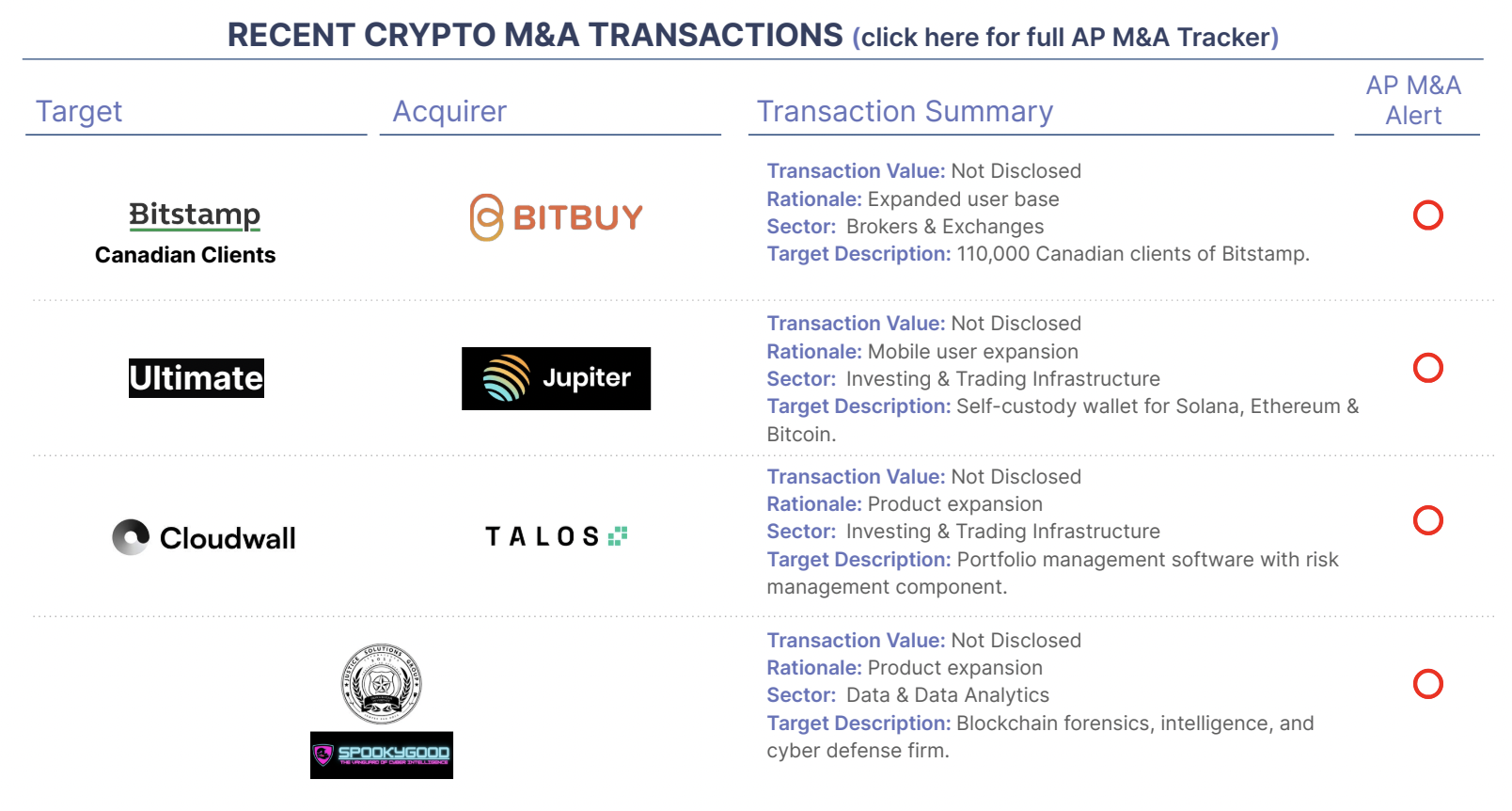

Seven months ago, in October 2023, Bitstamp announced their decision to exit the Canadian market due to regulatory uncertainty. They were one of numerous other crypto exchanges and businesses making the same move. At that time, Bitstamp’s Canadian clients were told they could withdraw funds until January 8, though after that “customers must deactivate their Bitstamp accounts.” This week, three and half months after the indicated shutdown, Bitbuy, a Canadian crypto exchange owned by WonderFi (TSX, $WNDR), announced it was acquiring 110,000+ Canadian clients from Bitstamp in return for a revenue share for an undisclosed period of time. More questions than answers here but clearly a sale and acquisition of customer accounts who were encouraged to leave Bitstamp long ago.

Similarly, Jupiter, a “swap aggregator”, acquired Ultimate, a mobile crypto wallet. As part of the transaction, it was announced the wallet will be shut down and its mobile developer team will join Jupiter. This form of transaction is commonly referred to as an “acquihire”.