August 11 – August 17 (Published August 20th)

PERSPECTIVES by Michael Klena

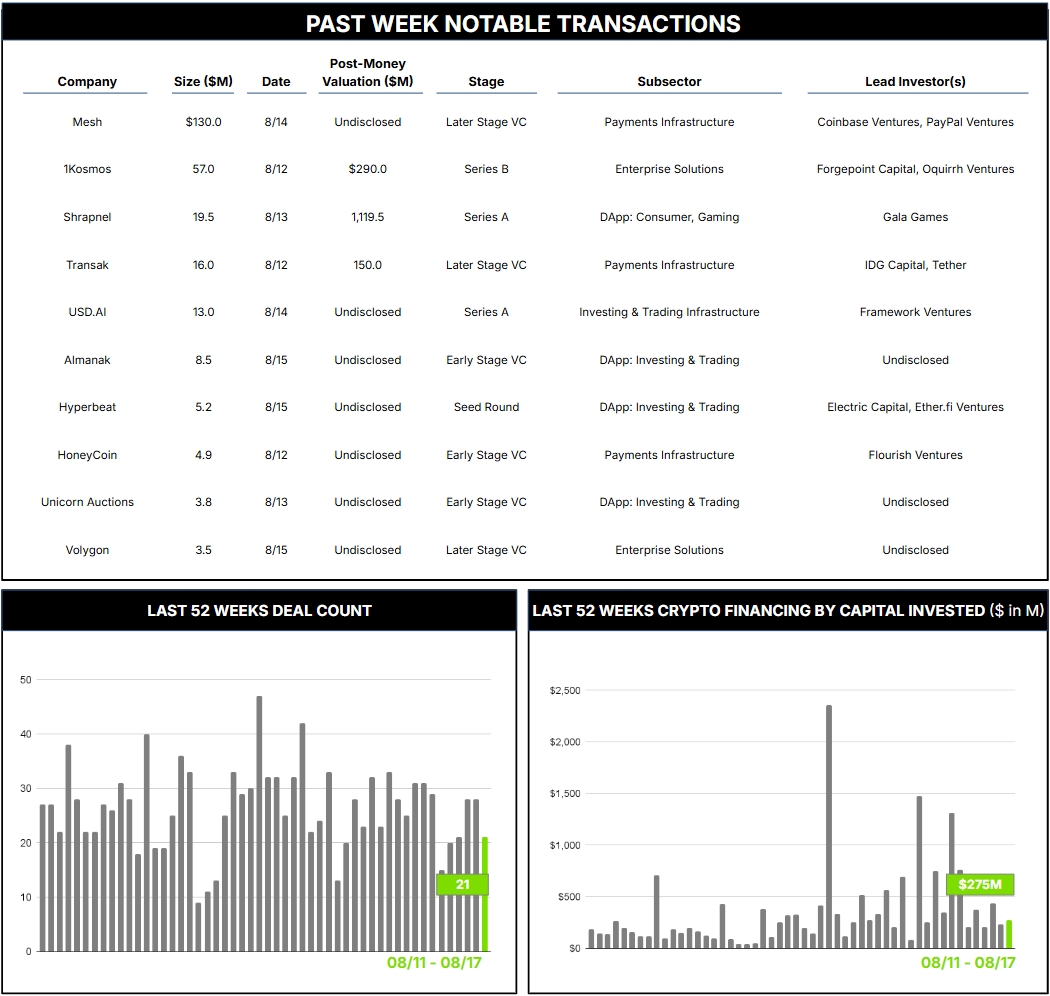

21 Crypto Private Financings Raised: $274.9M

Rolling 3-Month-Average: $551.9M

Rolling 52-Week Average: $349.2M

Overall, it was a slower week as people take the last of their August summer vacations. We expect the slowdown to continue over the next few weeks, and we hope you can also take time off, recharge, and return with unmatched enthusiasm.

Mesh’s $130M financing led the week as a later-stage raise. It is effectively a continuation of the $82M raised in March, with mainly corporate VCs such as Coinbase Ventures, Uphold, Bybit’s venture arm, and PayPal Ventures participating. This likely signals they are users as well as investors. Mesh operates in the relatively hot space of payment orchestration, adding efficiency to the still arduous process of moving money and accepting crypto payments. For example, they provide PayPal users ways to accept crypto payments and convert to fiat, using PayPal’s stablecoin as the means of settlement. PayPal embedding its own stablecoin in the process is a whole topic on its own, but it is a clear example of innovative tools (stablecoins) being integrated into traditional finance (payments).

While Mesh is focused on the point-of-sale piece, the entire process requires significant infrastructure to accept and convert payments in minutes. Several firms are building efficiencies across the payment cycle, including Bridge and 1Konto. Many enter the payment flow at different points and then expand to cover more of it. Traditional money movement between institutions remains stuck on legacy technology, with settlement measured in days rather than minutes, and that friction continues to attract challengers.

Another deal to note is the $57M raise by 1Kosmos. 1Kosmos operates in the identity and security space. This sector has seen significant hype over the years, with only a few companies gaining real traction in fixing the identity and login process. We believe this market has room to grow beyond niche use cases.