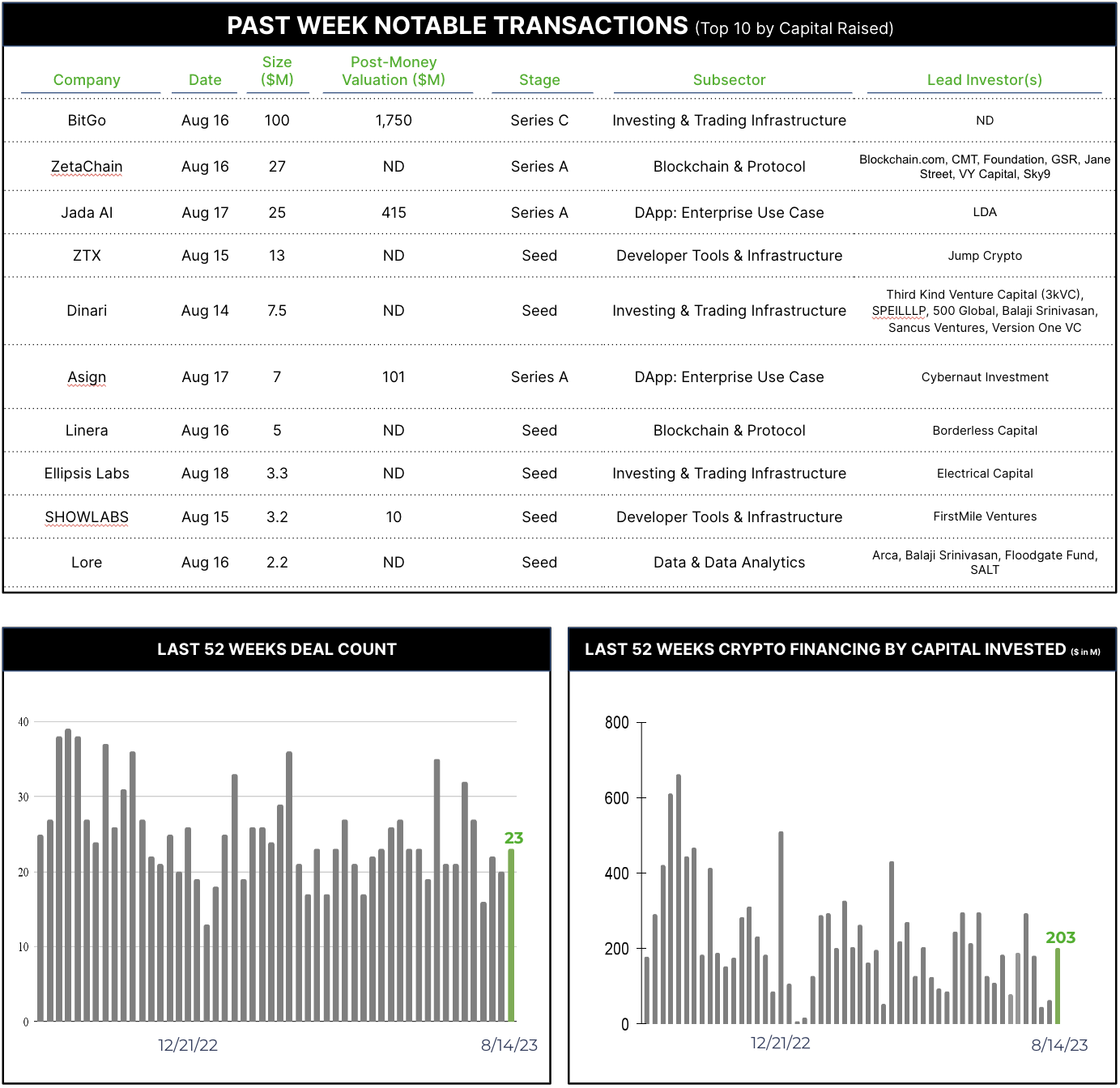

23 Crypto Private Financings Raised ~$203M

Rolling 3-Month-Average: $166M

Rolling 52-Week Average: $230M

Segment Overview

Led by BitGo, this week featured three, $20M+ capital raises and the total capital raised for the week was above the three-month rolling average. A trend developing?

Selected Highlights

BitGo raised $100M from new, strategic investors at a $1.75B post-money valuation. BitGo is an NYDFS-regulated qualified custodian (QC) providing custody, financial services, and core infrastructure to over 1,500 institutional clients globally. The company is the leading crypto custodian, processing 20% of all Bitcoin transactions by value, and has top-tier clients such as Nike, Bitstamp, Pantera, eToro, and Mysten Labs (read more on this financing in our Financing Snapshot here).

Why Notable? BitGo has sustained their business during a very difficult period (measured by AUC & number of customers) and recently introduced the BitGo Go Network to address the gaping hole left by the demise of Silvergate and Signature’s settlement networks. Attracting institutional capital today, at scale, is a very welcome signal of confidence for the industry.

ZetaChain raised $27M from a large group of impressive investors, including Blockchain.com, CMT, Foundation, GSR, Jane Street, VY Capital, and Sky9. ZetaChain seeks to become a blockchain solution for interoperability, allowing projects, users, and developers to migrate across numerous chains without hiccups.

Why Notable? This is a healthy-sized round for a project that is still in its test net phase demonstrating the importance of solving the age old problem of technology, user and network islands. History taught us that the suite of widely adopted communication protocols embedded in TCP/IP is what allowed the Internet to bloom. What allows the same powerful network dynamics to be created for the innumerable blockchain islands in existence today?

Dinari raised a $7.5M seed round, which included investors such as Susquehanna. Dinari offers non-U.S. individual investors access to U.S. equities.

Why Notable? Dinari notes that far more individual in many countries have a digital wallet holding crypto assets than have access to a brokerage account. Their vision is to allow those that hold a digital wallet to access U.S. equities through their digital wallets using a token-based structure.

Patterns Early-stage financings (seed and series A), by count, continue to dominate, representing 86% of all announced financings. For important context, crypto is demonstrating exactly the same trend as the overall technology financing markets.