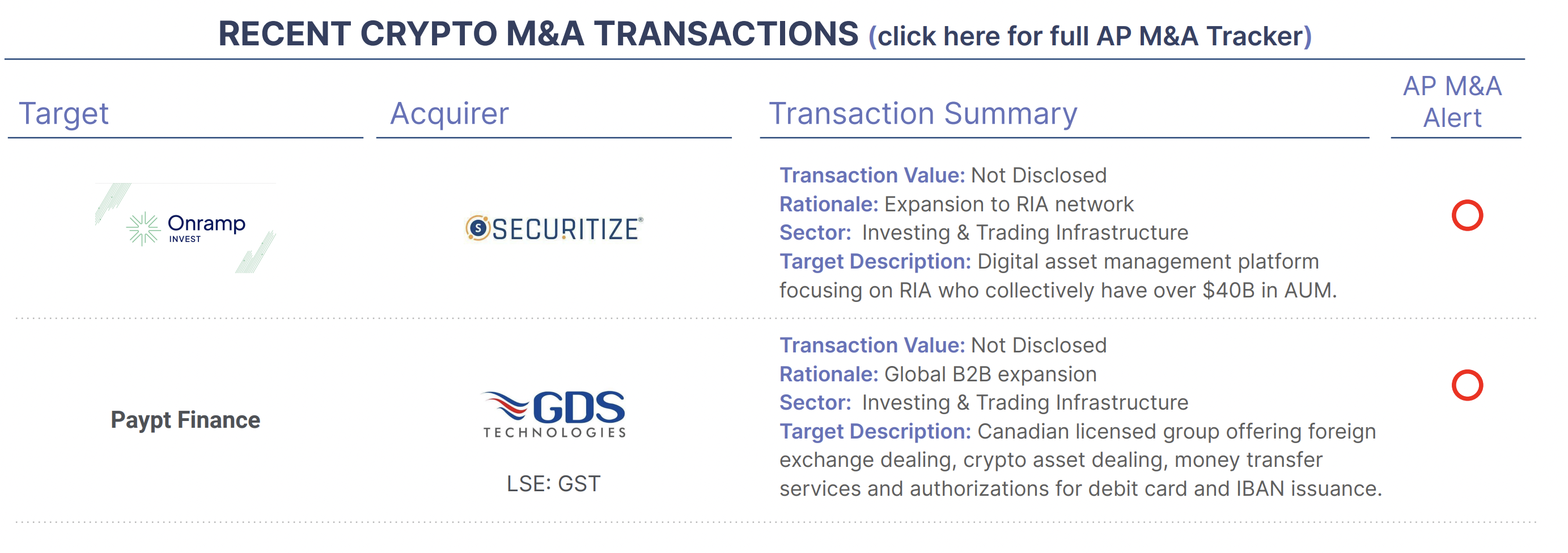

Securitize, a provider of tokenized alternative assets, has acquired Onramp Invest, a digital asset wealth platform. The acquisition will give RIAs (registered investment advisors) access to a wider range of alternative assets, including private equity, private credit, real estate and sales of private stock. The platform also offers access to a variety of educational resources, market research, and tools to help RIAs make informed investment decisions.

Tokenization is essentially a financial infrastructure play, and this deal suggests that the long-anticipated wave may finally be on the horizon. Different players in the sector have focused on different asset classes, but all have struggled to some degree to connect with investor appetite. Matching Securitize’s recent headway tokenizing private funds with the distribution capability of Onramp’s RIA network makes a lot of sense. The deal structure is also sensible, as the two companies started collaboration earlier this year, found it to be successful and consummated the full acquisition. Their collective success could bring validation and momentum to the tokenization space as a whole.

GSTechnologies Limited has acquired PAYPT Finance Ltd, a Canadian company holding a Canadian Money Services Business (MSB) license. The acquisition will allow GSTechnologies to provide a financial service hub to all of its B2B customers.

PAYPT’s MSB license encompasses a range of financial activities, including foreign exchange dealing, cryptoasset trading, money transfer services, and the issuance of debit cards and IBANs. The acquisition is aligned with GSTechnologies’ strategy to expand its B2B Neobank operations beyond the UK.