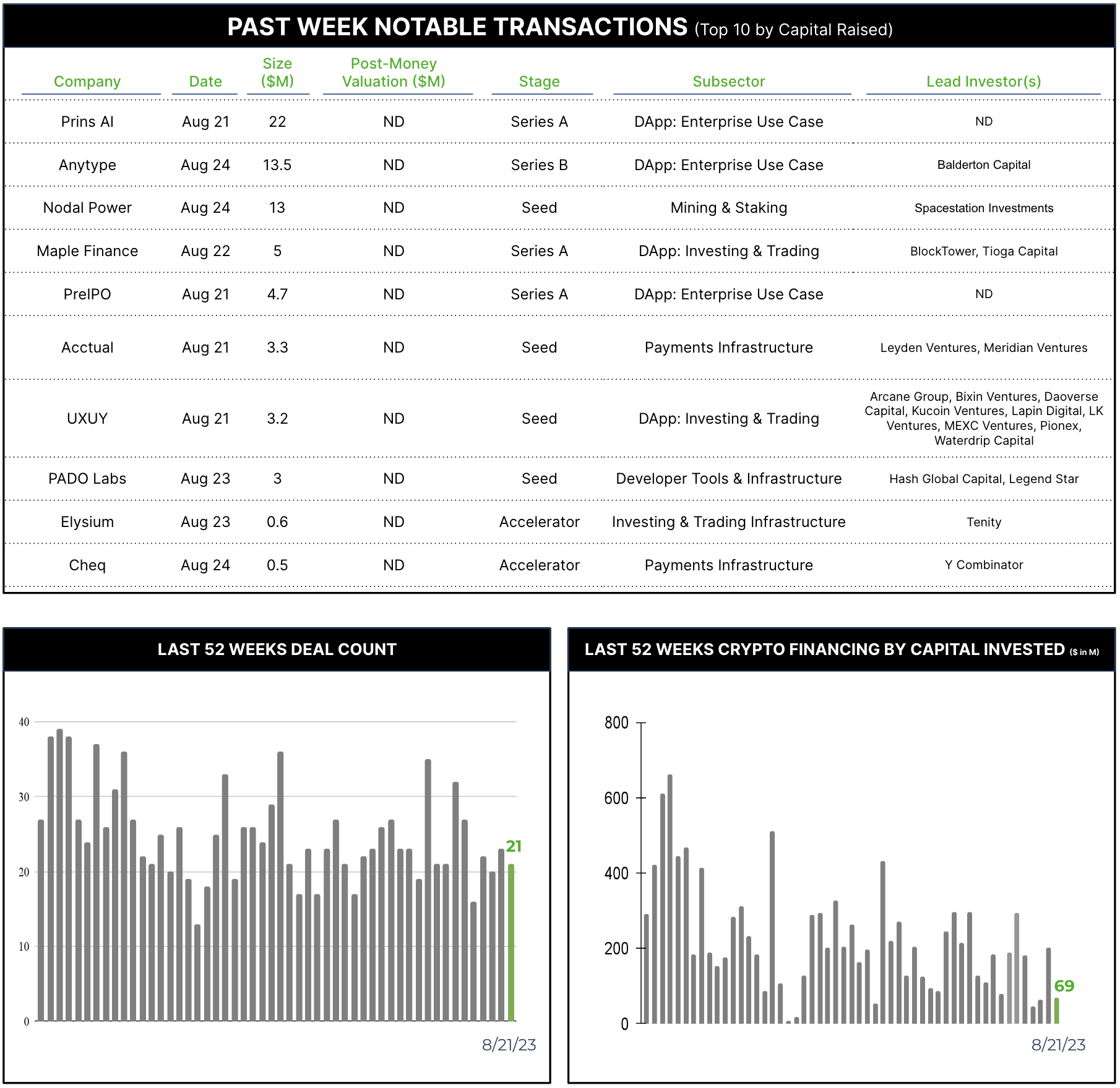

21 Crypto Private Financings Raised ~$69M

21 Crypto Private Financings Raised ~$69M

Rolling 3-Month-Average: $154M

Rolling 52-Week Average: $222M

Segment Overview

Happy end-of-August! Too early to feel the crisp fall air, but glimpses are starting to show in Halloween candy already on display. I continue to lobby our firm to buy the 12 foot skeleton as our mascot to bring to every conference we attend, but no takers yet. Deal counts are at a consistent level for the month but reported capital is still low due to undisclosed amounts and summer slow down.

Selected Highlights

Circle sold an undisclosed stake to Coinbase. Circle is the 2nd largest stablecoin provider with a 21% market share. Coinbase is the well known crypto trading firm.

Why Notable? These firms have have a commercial relationship, and have now deepened their connection. This transaction has been well covered by the media, and our view is that this makes sense. Stablecoins have become a fundamental part of trading infrastructure. Exchanges often use their own stablecoin, but haven’t been as widely adopted as 3rd party providers like Circle. WIth PayPal’s recent launch of their own stablecoin, we are seeing the product used beyond the crypto ecosystem to ease friction in traditional finance. Coinbase is closely watched by everyone, so we expect other firms to take serious look at similar partnerships.

Maple Finance raised $5MM led by BlockTower Capital and Tioga Capital with six additional investors chipping in. Maple Finance is a DeFi lender, and will use the funds to focus on Asia growth where they claim regulations are clearer.

Why Notable? Lenders certainly have had a rough go, with the segment littered with debris from the high profile blow ups of Celsius and BlockFi. With widely varying regional regulatory frameworks, the slowdown in trading, and general crypto headwinds, lenders are searching for sustainable growth. That Maple FInance was able to raise in a beaten down segment in a slow market shows deals can still get done with tempered expectations.

Nodal Power raised $13MM from Spacestation Investments. Nodal Power is a startup using landfill emissions to power bitcoin mining.

Why Notable? Bitcoin mining has had a continual push to find green energy sources. Harnessing methane emissions from landfills is a new wrinkle for me, although we have seen other firms use similar flaring capture from oil production.

Patterns

Infrastructure continues to be the main segment attracting capital, with a mix of DeFi and CeFi technologies.

Conferences

We will be at Permissionless (Sept. 11-13); Singapore Digital Asset Week + Token 2049 (Sept. 10-21); and Mainnet (Sept. 20-23). If you will be there, let’s schedule time to connect.