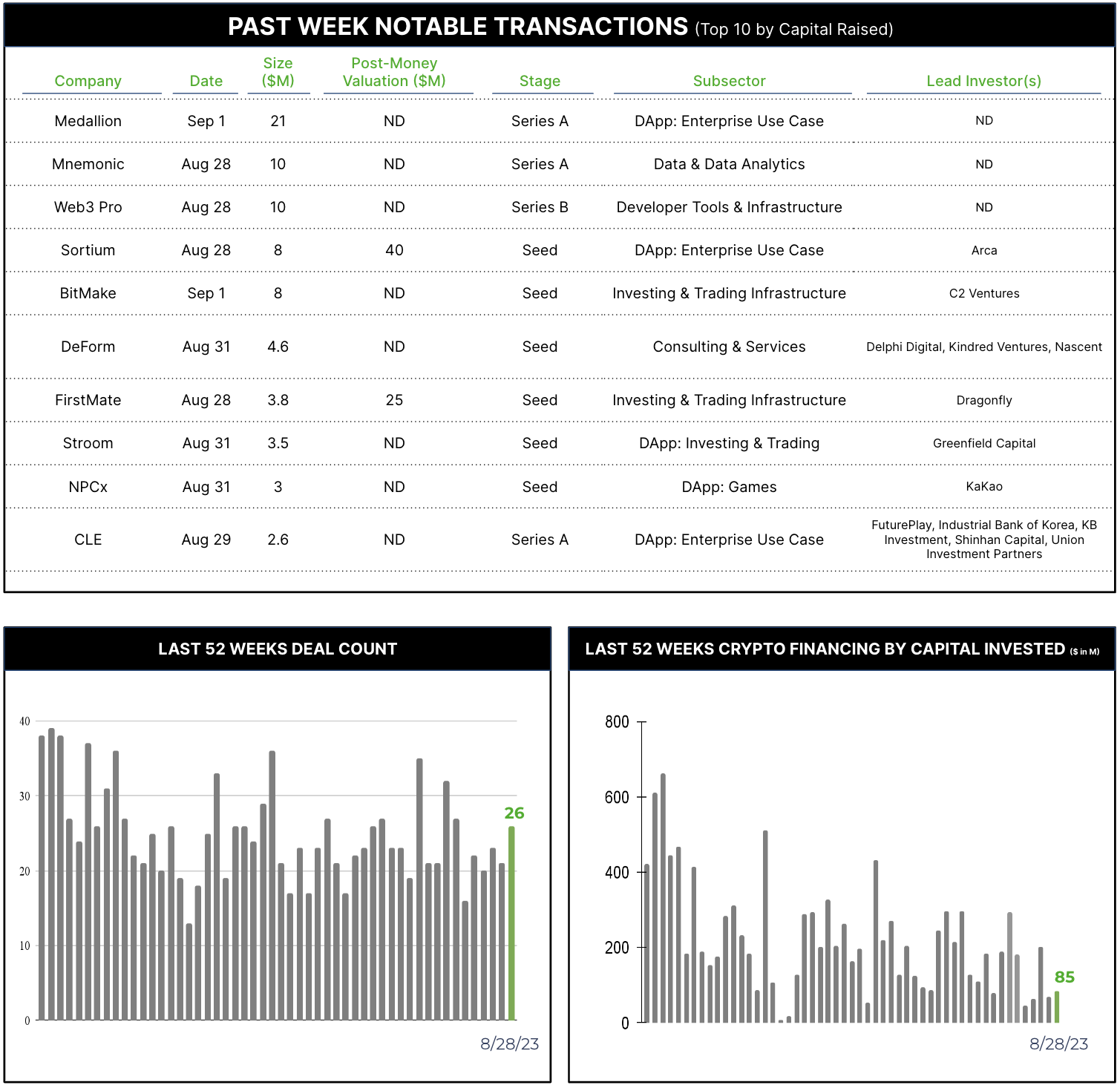

26 Crypto Private Financings Raised ~$85M

26 Crypto Private Financings Raised ~$85M

Rolling 3-Month-Average: $136M

Rolling 52-Week Average: $219M

Segment Overview

Below average capital flows this week, but deal count creeping up to the average. Double clicking on the data, most were earlier & smaller raises, so a lot of seed & pre-Series A deals done. “Money may never sleep, but big money takes a vacation this week.” is a quote I just made up to describe this week.

Selected Highlights

Medallion, Mnemonic and Web3 Pro were the top 3 in money raised with a collective $40MM+ captured. All are in NFT space or its variants. All three are more toward the infrastructure segment. Lead investors were not disclosed

Why Notable?

Loosely I think of them as NFT 2.0, moving beyond the crazy speculative phase to an actual use case. These firms can help overcome the negative perception when people hear “NFT”. Infrastructure in general continues its dominance as a capital attractor regardless of what it supports.

Sortium raised $8MM with our friends at Arca leading the round. Sortium is an AI platform for gaming and virtual production industries, using both large language models and generative AI. Sortium also has a blockchain component, tokenizing items produced.

Why Notable? Even though it’s an AI forward firm, using the blockchain to tokenize assets to show provenance and ownership marries cutting edge technologies from two spheres.

Patterns

No notable patterns for the week beyond the usual infrastructure and DApps as the main deal segments.

Turning to the future, we have heard from several investors they are back and actively looking after the summer slow down. While it hasn’t been hundreds of investors telling us this, it is enough to make it feel like Q4 should see an easing of the money spigot. Whether it’s a full turn or a partial turn of the spigot is the main question in my mind

Conferences

We will be at Permissionless (Sept. 11-13); Singapore Digital Asset Week + Token 2049 (Sept. 10-21); and Mainnet (Sept. 20-23). If you will be there, let’s schedule time to connect.