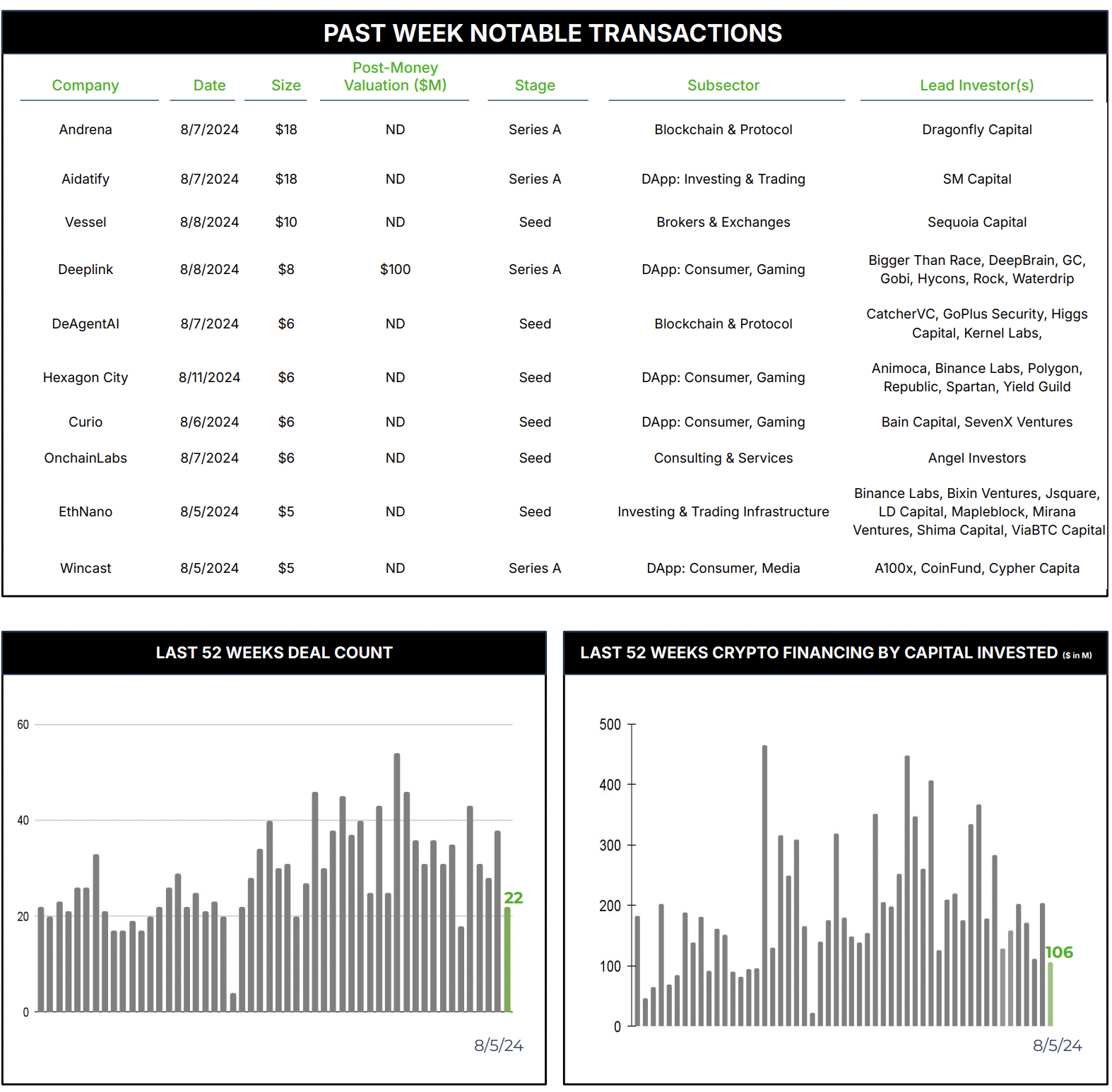

22 Crypto Private Financings Raised ~$106M

Rolling 3-Month-Average: $201M

Rolling 52-Week Average: $194M

With 22 deals and a mere $108M of invested capital, this past week demonstrated notably subdued activity in the market. Given subdued activity over the last few weeks, we’ll be closely monitoring whether this represents a summer lull or signals a more prolonged trend.

In our ongoing effort to spotlight interesting blockchain applications and business models, we turn our attention to Andrena.

Andrena, a high-speed Wi-Fi Internet provider, is developing DAWN (Decentralized Autonomous Wireless Network), a decentralized broadband protocol. This initiative leverages blockchain technology and decentralized physical infrastructure networking (DePIN) to create a mesh Internet access system. The company’s approach involves deploying wireless base stations on rooftops, potentially disrupting the traditional ISP model.

Wireless, mesh networked Internet coverage (and the possibility of shared resources) is not a new concept. Silicon Valley is littered with “corpses” that attempted to solve this problem. Andrena’s decentralized solution perhaps has the best opportunity for success in relation to past attempts.

Andrena has successfully raised $18 million in an extended Series A funding round, led by Dragonfly Capital, bringing its total funding to $33.45 million. This level of investment suggests strong market confidence in Andrena’s decentralized broadband concept. The company’s plans to cover over three million households at launch indicate a substantial addressable market, with potential for global expansion.

The DAWN protocol incorporates Solana blockchain technology for token incentives, allowing users to purchase and exchange DAWN tokens for network Internet speed. This tokenization model could create a new economic ecosystem within the Internet service provision space, potentially attracting both users and investors interested in the intersection of blockchain and telecommunications.

The decentralized broadband model proposed by Andrena draws parallels with the democratization of energy production through solar panels. Just as consumers can generate their own electricity and sell excess back to the grid, DAWN aims to enable users to do the same with Internet bandwidth. Thus, Andrena’s decentralized broadband model represents a significant shift in the Internet service provider landscape. If successful, it could lead to increased competition, potentially driving down costs for consumers and spurring innovation in the sector. However, regulatory, technical, and security challenges, and the need for widespread adoption remain key hurdles for the company to overcome.