December 9 – December 15 (Published Dec 18th)

PERSPECTIVES by Todd White

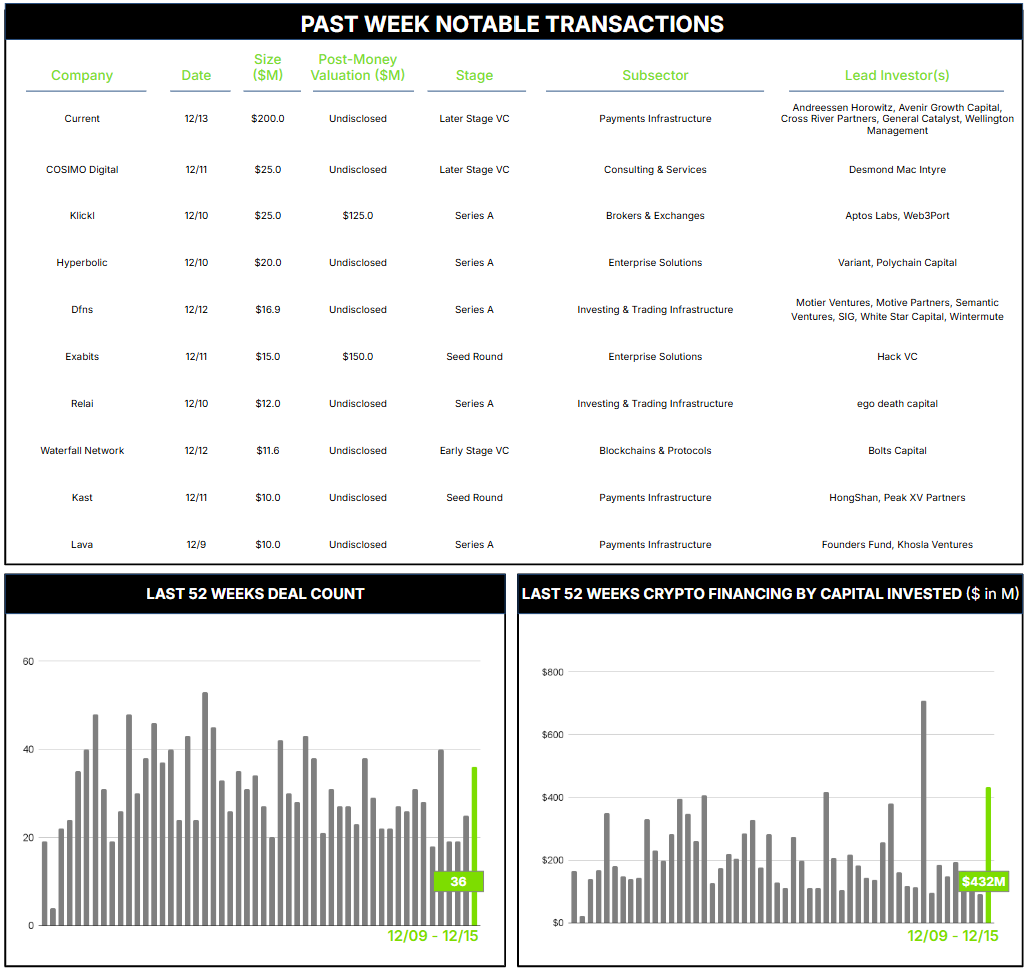

36 Crypto Private Financings Raised: $432M

Rolling 3-Month-Average: $211M

Rolling 52-Week Average: $216M

The delineation between the Fintech and crypto/blockchain worlds can be fuzzy. Fintech, short for financial technology, can be broadly thought of as technological innovation for the finance industry. Yet, it is increasingly difficult to find any financial institution that is not almost completely reliant on integrated technology, so it seems Fintech is being increasingly subsumed into just plain old finance.

Crypto can be even harder to define. Original conceptions of decentralized digital money seemed like a nice subset of Fintech, but expanded use cases and new offshoots deploying blockchain technology have pervaded beyond finance into supply chain, identity, art, healthcare, logistics, and media… just to name a few. Crypto has arguably become a technical phenomenon unto itself. Yet much of our sector remains very much financially focused and, along with the rest of Fintech, may also inevitably be melded into plain old finance.

Regardless of semantics or taxonomy, the intersection of the two can be an exciting space. Two such examples received notable funding rounds this week.

Current is a consumer-focused tech platform that is bringing crypto into banking. Their tech enables enhanced consumer banking services, such as paycheck access, savings pods, a secured charge card connected to member balances, and earned wage access. These services include crypto trading, with members able to buy and sell cryptocurrencies from within the app as an integrated financial service. Following an impressive 90% growth in revenue for the year, Current closed a rare $200M growth round with support from existing investors Andreessen Horowitz, Wellington Management, and Avenir, with new participation from General Catalyst and Cross River (which also collaborates with warehouse funding).

Klickl is a UAE-headquartered open finance platform bringing banking services into Web3. Their tech enables banking, digital payments, and crypto trading services on a Web3 interface, as the region’s first fully licensed service of its kind. Their $25M Series A featured support from Web3Port Foundation, Aptos Labs, and other notable investors.

It is encouraging to see these and other initiatives receive solid funding support as 2024 draws to a close, with one of the strongest financing weeks we’ve seen lately. We look forward to publishing our annual sector review and to the hopefully exciting times ahead in 2025.

———————————————————————————-

Contact ryan@architectpartners.com to schedule a meeting.