February 10th – February 16th

PERSPECTIVES by Eric F. Risley

Let’s talk about asset safekeeping.

Custody services simply ensure that only authorized individuals have access to assets. Crypto has addressed this need through the emergence of specialized companies that act as guardians for digital assets. These companies safeguard the private keys needed to access them, similar to how a traditional bank (or trust company) would hold securities for its customers. Custodians for digital assets often include features like multi-signature security and insurance coverage for loss. Everyday consumers can elect to use these services for convenience, while institutional investors are required by regulation to do so. As a result, custody services have become both essential and valuable.

Crypto custodians started as focused, custody-only businesses. Increasingly, that has changed, in part due to the extraordinary success of Coinbase, which opted to incorporate custody services into its broader product offerings. For Coinbase’s institutional clients, custody is tightly integrated with trading and other “prime brokerage” services, such as access to leverage.

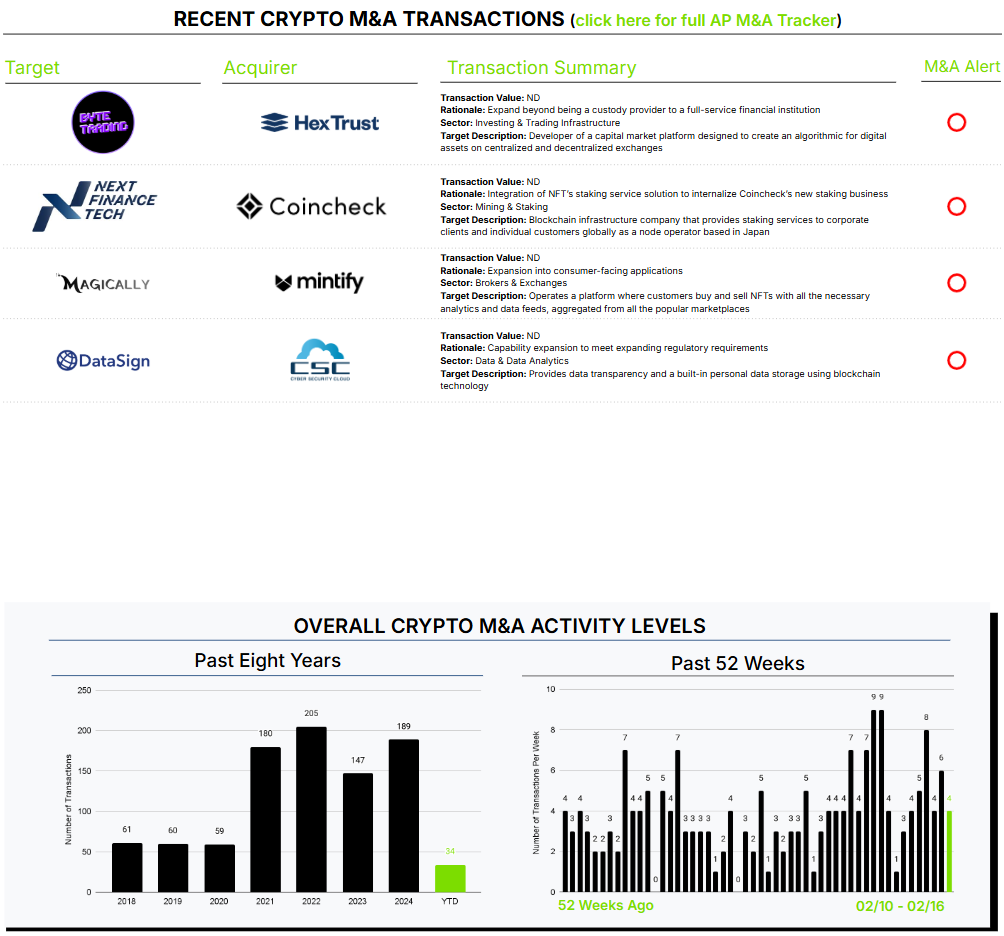

These competitive dynamics have prompted many custody specialists—such as BitGo and Anchorage—to begin offering a broader array of services, including staking, settlement, and, more recently, institutional trading execution. This week, Hex Trust demonstrated a similar move by acquiring Byte Trading, signaling its entry into trading execution services.

This trend may continue. Historically, in traditional financial services, custody services have long thrived within companies like BNY Mellon, Northern Trust, and State Street as specialized providers, separate from execution services. In crypto, this has been inhibited by reputational concerns, regulatory uncertainty, and, most recently, by the existence of SAB 121—a rule that required custodians that are banks to hold 1:1 cash reserves for all custodied crypto assets, an unbearable burden. Now that SAB 121 has been repealed, the U.S. regulatory environment has shifted markedly, and the time appears ripe for traditional providers of custody services, such as those mentioned above, to formally introduce crypto custody services. Some will build; some will acquire.