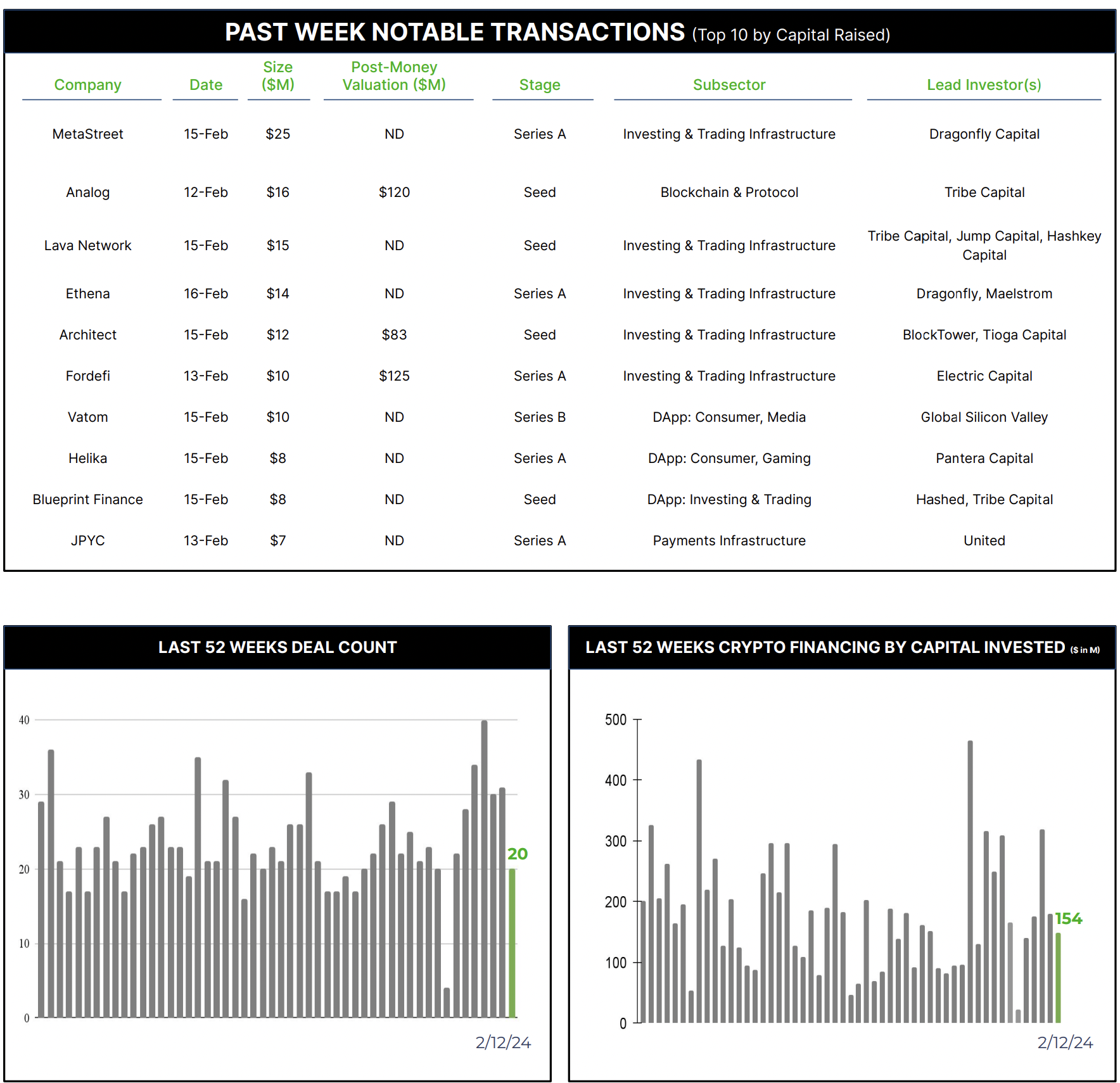

20 Crypto Private Financings Raised ~$154M

Rolling 3-Month-Average: $193M

Rolling 52-Week Average: $174M

Architect Partners’ namesake, Architect (Financial Technologies) raised $12M in a Seed+ round led by Blocktower and Tioga Capital. Created in the wake of the FTX collapse, Architect provides technology for the financial markets that bridges across futures, options, and digital assets. They offer a low latency OMS/EMS/PMS, advanced data, automated post-trade flow, and introducing brokerage services.

Following its $18M seed raise in 2022, Fordefi raised $10M from Paxos, Electric Capital, and Alchemy. Fordefi specializes in MPC self-custodial wallets tailored for institutions. With this capital, they aim to extend this technology to crypto exchange and investment platforms, allowing for a larger retail focus.

These two investing & trading infrastructure deals are pertinent to a potential trend that may be developing this year. Every week, usually, we see one category tend to have more capital raised than other categories: Investing & Trading Infrastructure. This week, it represented 5 of the top 10 transactions. Year to date, it has only represented 5% of transactions by count. In 2023, it represented 35% of all capital raised and 20% by count. We will wait to see if one of the most popular subsectors starts to fade from dominance.

Events

Architect Partners will be at ETH Denver (2/29 – 3/3) and Digital Asset Summit (3/18 – 3/20). Please contact elliot@architectpartners.com or arjun@architectpartners.com if you would like to meet.