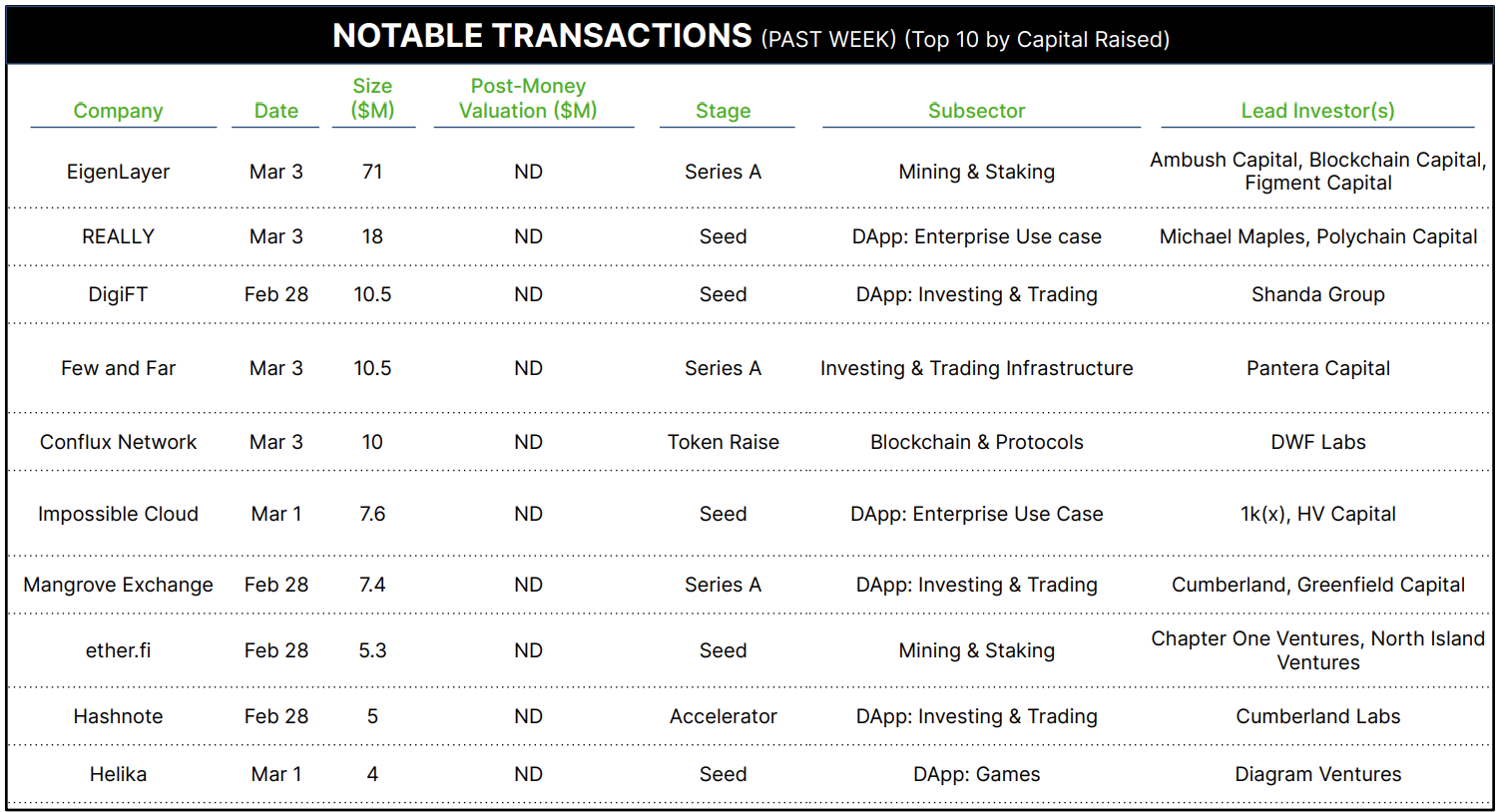

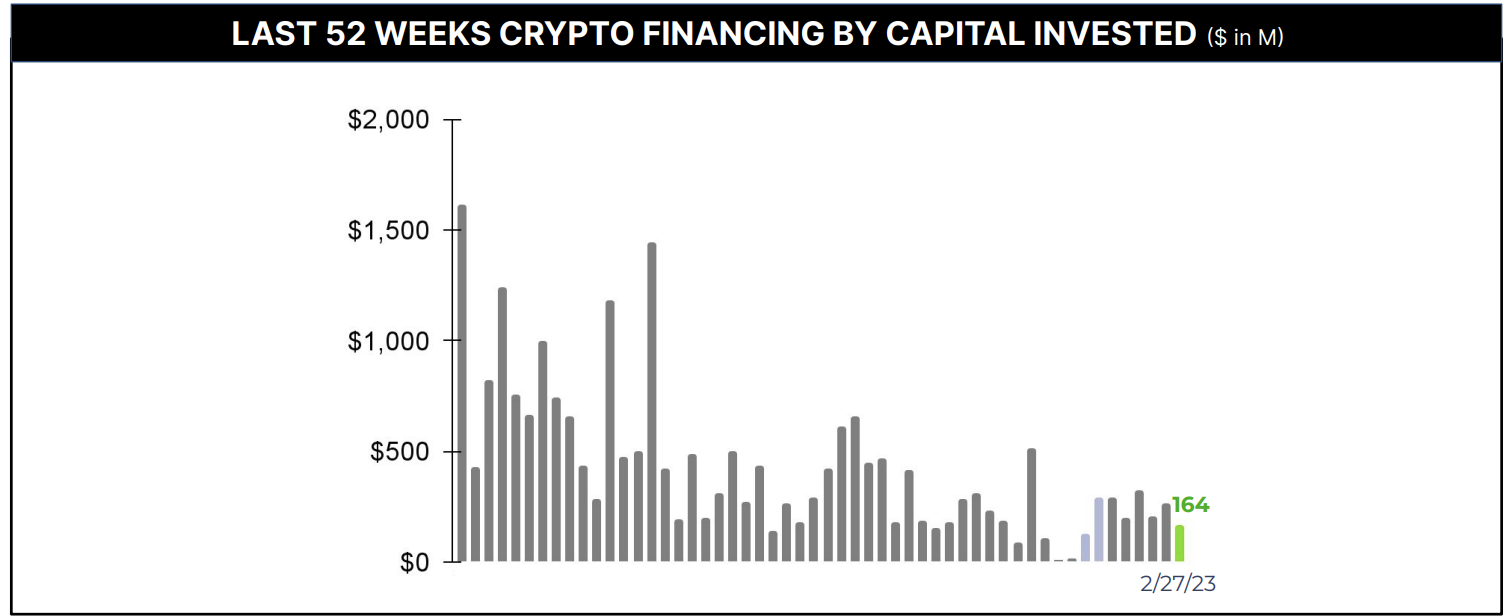

31 financings raised ~$164M

Certainly a historic week with two U.S. Banks – Silvergate and Silicon Valley Bank (SVB) – no longer independently operating.

Both institutions provided critical market infrastructure to the crypto industry and both scenarios played out in shockingly fast timelines, measured in hours.

Silvergate’s SEN network essentially allowed its customers 24/7/365 access to the U.S. Banking system, which was vital for crypto market participants operating in an industry that is always open.

SVB was the preferred banking partner for most private investment funds, especially VC funds, and while not exact, I’d estimate two thirds of U.S. crypto venture funds have their LP capital currently locked up at SVB.

Additionally, it’s been reported that Circle has $3.3B of its USDC reserves at SVB.

Less than 24 hours since SVB’s announcement, the combined loss of both institutions (little ability to transact over the weekend without SEN & questions over the safely of SVB deposits) is having an immediate effect on crypto markets as USDC – arguably the most important stablecoin – is under duress as its peg to the U.S. Dollar is challenged.

We have not hit “max pain” in crypto yet and that is now a real possibility if crypto companies cannot access the U.S. banking network, if SVB does not return depositor capital and if USDC does not defend its peg.

The seemingly standard-operating-procedure investment that most believe took down SVB was likely made by other U.S. banks, so I expect further distressed bank announcements.

Key weaknesses in today’s U.S. banking system will be highlighted and heavily discussed, and it takes market defining events, like these today, to push proven market solutions to the forefront of adoption which, when properly implemented, can provide real solutions to these ongoing structural weaknesses.

For example, this Wednesday, we participated in Jones Day’s FinAccelerate event that focused on DeFi products that are leading the innovation transition across all industries.

I appreciate being inspired by hearing each Founder’s journey, why they are dedicating their lives to affecting real change, and how they are achieving market adoption.

New solutions are live today in government reporting; international money transfer & trade; retirement & aged care funding; compliance & financial crime risk management; data & market intelligence; prediction & gambling markets; whiskey ownership; carbon credits; and universities, sports associations & nonprofits.

Learning from this historic week by innovating forward instead of regulating backward is essential as long as we keep in mind that innovation will not escape the vortex of regulation and law.

Silvergate and SVB were innovators to the U.S. Banking system and are reminders of how difficult the innovation journey is.