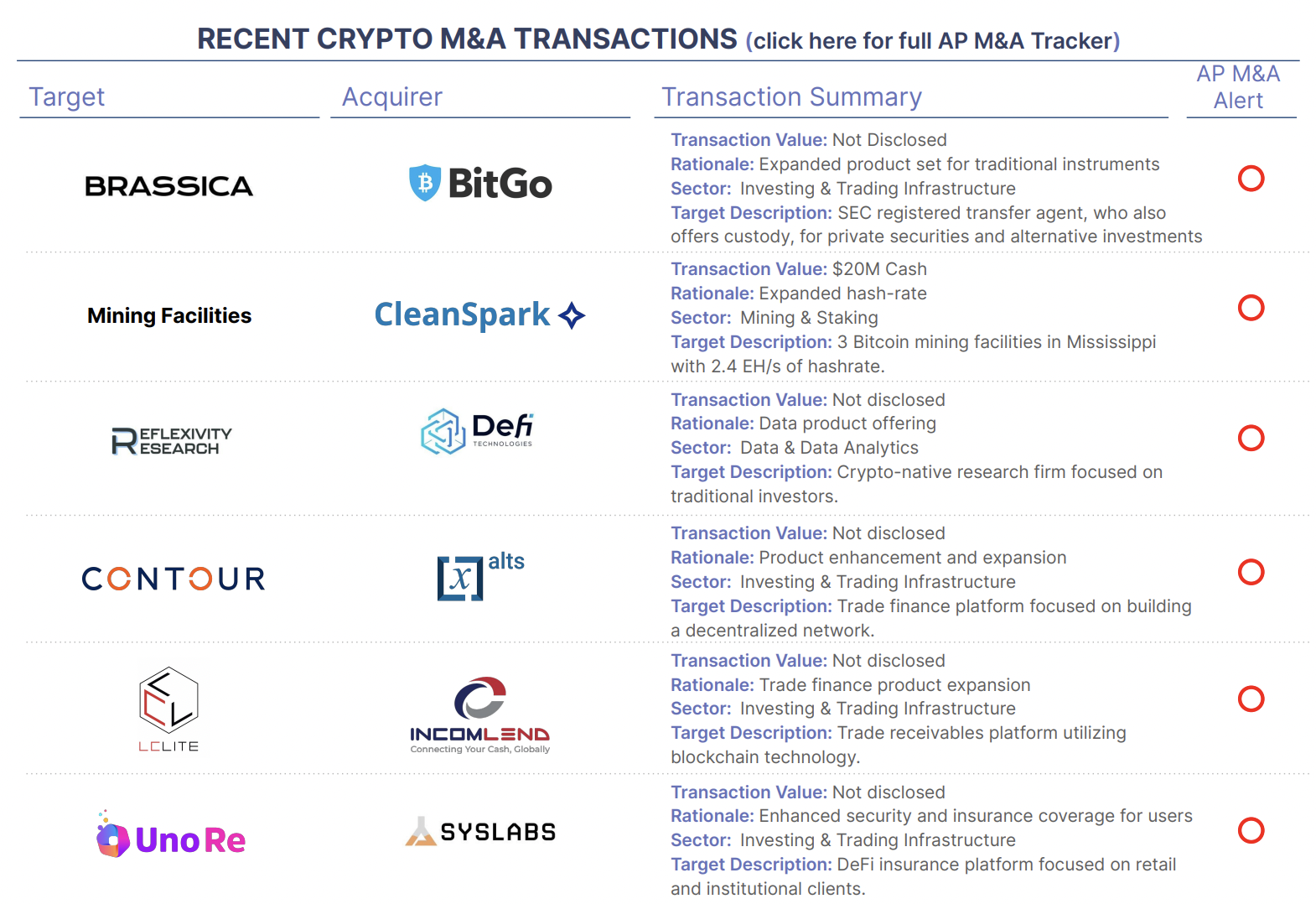

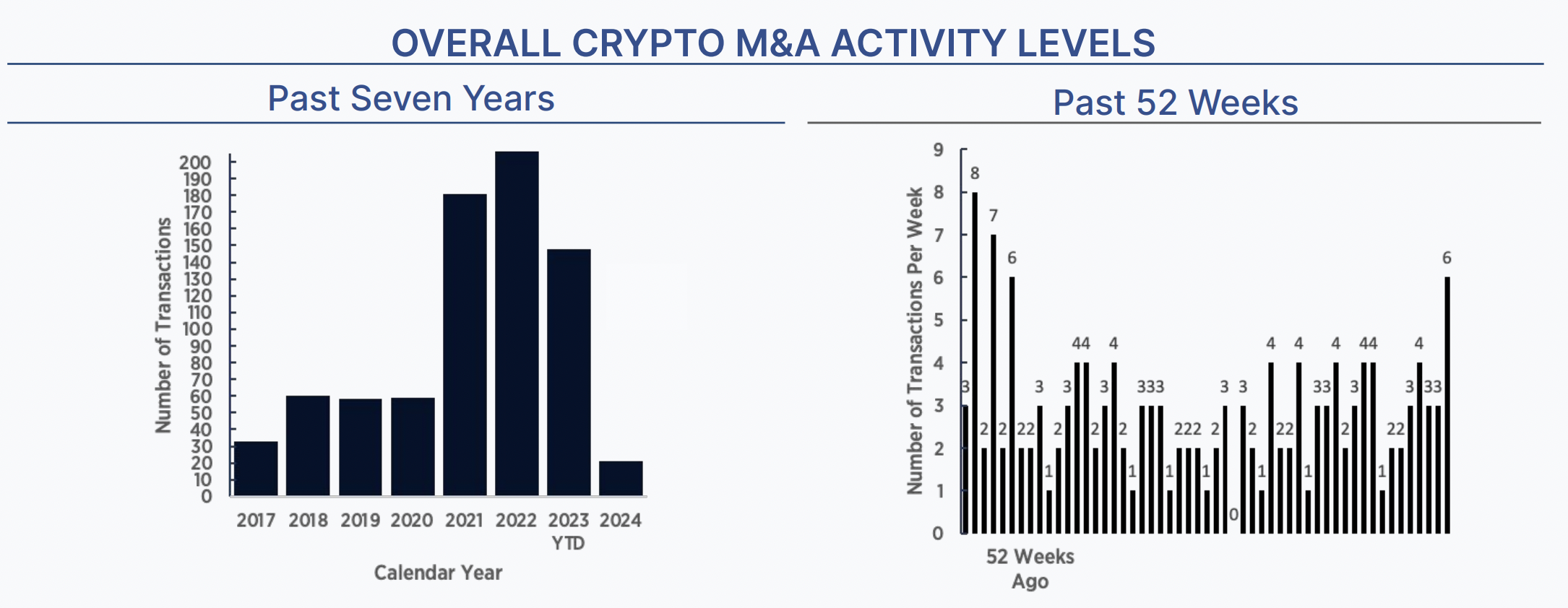

Just when we’d gotten used to three announced transactions a week, the cosmos (with a small “c”) sent us six deals this week.

The biggest deal. Crypto custodian and financial services firm BitGo announced it had acquired Brassica, an alternative assets infrastructure provider. BitGo CEO Mike Belshe put it well: “We currently have a dichotomy in financial services – one side deals with traditional securities and the other deals with up-and-coming blockchain-based assets and cryptocurrencies. With this acquisition, BitGo becomes the first major financial services firm to be able to provide comprehensive infrastructure support for both traditional private securities and blockchain-based assets, while significantly expanding our global presence.” Brassica offers back-end infrastructure services for private securities and alternative investments, including multi-asset custody, record-keeping and transfer agent services. This move by BitGo is seen as a step towards offering tokenized securities (RWA). Terms were not announced, but Brassica investors such as Mercury Fund, Valor Equity Partners and Long Journey Ventures were reported to be receiving shares in BitGo. Brassica had raised an $8M seed round at a $26M valuation in 2023, and BitGo had most recently raised $100M in 2023 at a $1.75B valuation.

Trade finance in Singapore. Two smaller transactions were announced this week: xalts, an HK-based provider of infrastructure for programmable assets, acquired struggling Singapore-based digital trade finance network Contour. Contour had raised $4.9M from Bangkok Bank, Citi Ventures, Standard Chartered, etc. and had signed a few dozen large banks. Also, Singapore-based global invoice financing network Incomlend acquired fellow Singapore Web3-powered trade finance network LC Lite.

How to acquire a DAO. Venture studio SYS Labs this week announced taking a majority stake in Uno Re DAO, a provider of DeFi insurance coverage with $15M in on-chain policies. SYS is behind the Syscoin and Rollux ecosystems, and drove the non-cash merger to strengthen their L2 offerings. The DAO proposal to have SYSLabs replace some Uno Re DAO Core Contributors with SYS Lab executives was approved by 100% of those voting. Uno Re gets new leadership and resources to continue its mission.

Events

If you missed us at the Satoshi Roundtable last week, Architect Partners will next be at ETH Denver (2/29 – 3/3), and Digital Asset Summit (3/18 – 3/20). Please contact elliot@architectpartners.com or arjun@architectpartners.com if you would like to meet.