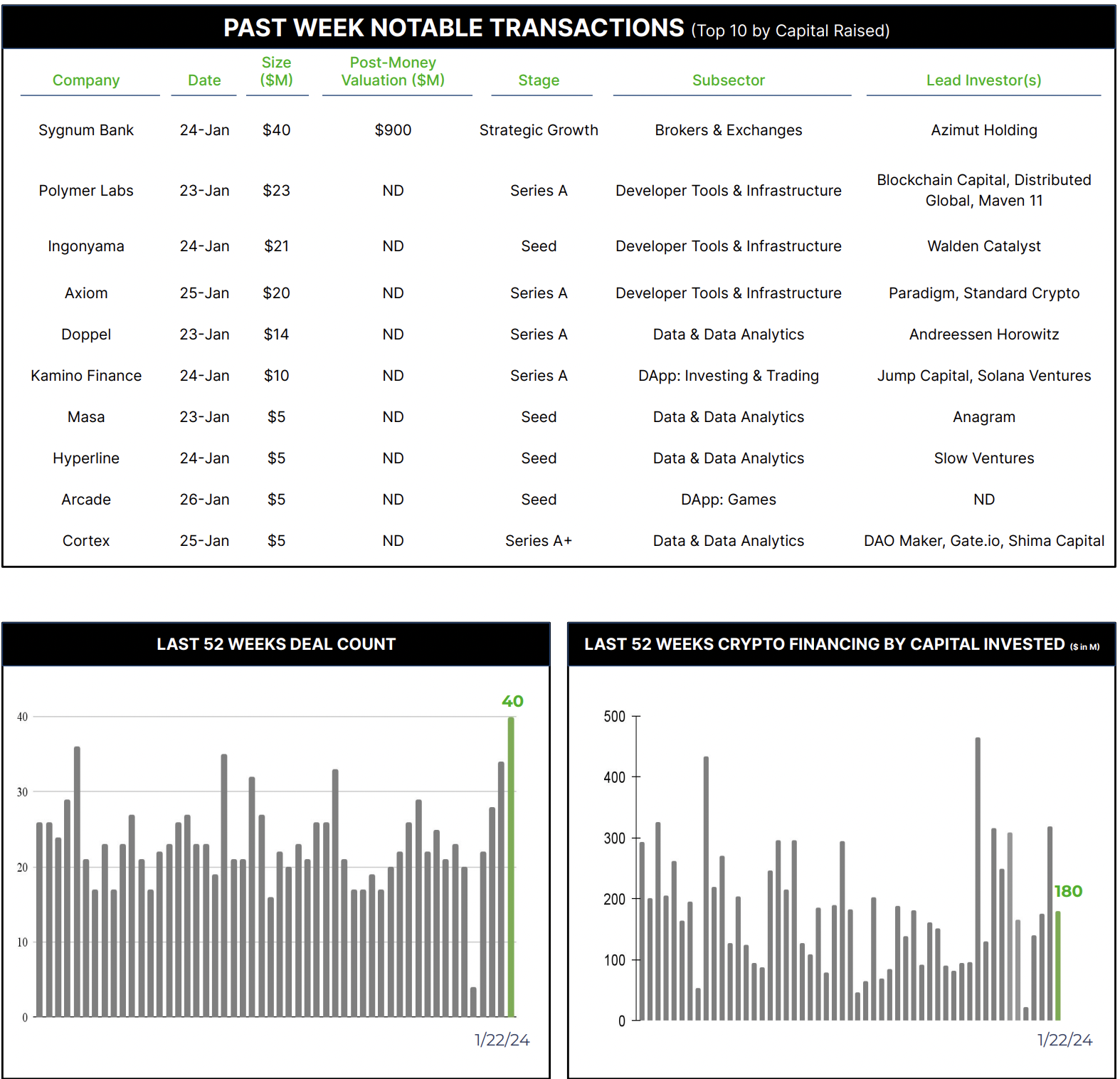

40 Crypto Private Financings Raised ~$180M

Rolling 3-Month-Average: $207M

Rolling 52-Week Average: $183M

This week, there were 40 private financings, the most in over 2 years. Although 11 of the financings did not have disclosed financing values, this is a positive sign for the private financing market and remains a part of a trend upward, following weeks with 22, 28, and 34 deals.

In addition, meaningful financings, with reputable investors, are happening. Last week, HashKey raised $100M at a $1.3B valuation and FlowDesk raised $50M from strong names such as Cathay Innovation, EuraZeo, Speedinvest, and BPI.

And this week Switzerland-based, Sygnum Bank raised $40M at a $900M valuation from an Italian asset manager with $100B in AUM, Azimut Holding (Read our full analysis on the transaction here).

Although not a perfect capital raise – allegedly a long time in the market spent raising & not a significant uptick in valuation from the previous round – this does build upon the trend we are seeing in January 2024: real deals getting done from real investors at significant valuations.

On another note, Eric Risley, Managing Partner of Architect Partners, published a report using data to look at the analog between the early development of the Internet and Crypto. Read Family Ties: The Internet and Crypto.

Events

Architect Partners will be at the Satoshi Roundtable (1/31-2/7), ETH Denver (2/29 – 3/3), and Digital Asset Summit (3/18 – 3/20). Please contact elliot@architectpartners.com or arjun@architectpartners.com if you would like to meet.