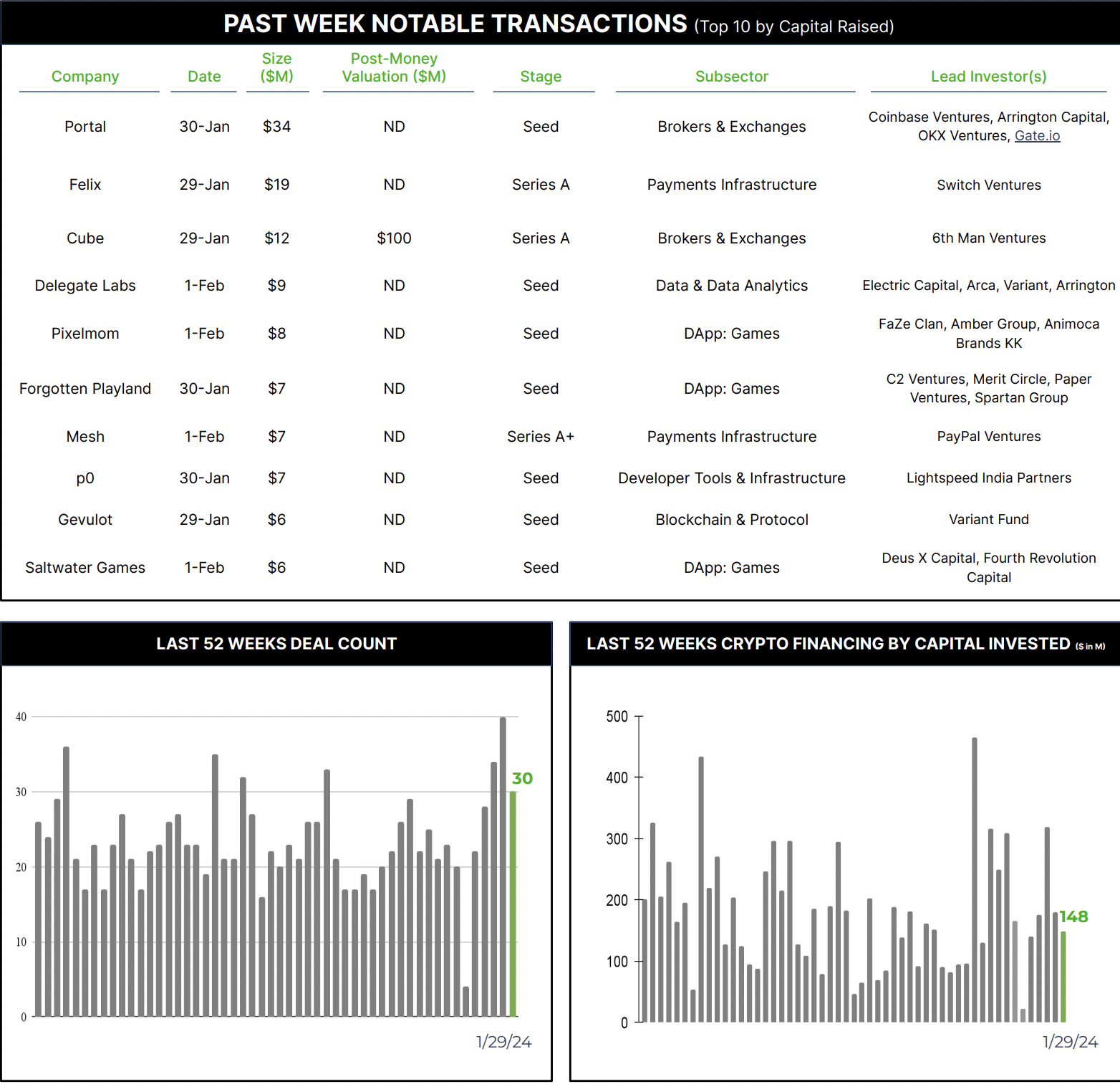

30 Crypto Private Financings Raised ~$148M

Rolling 3-Month-Average: $218M

Rolling 52-Week Average: $180M

Although this was the lightest week in terms of capital raised since the New Year, deal count remained significant and roughly 40% higher than the 2023 weekly average.

The increased deal count that we have seen over the past 5 weeks is likely due to a trend we have seen before, lots of Seed-stage deals. Year to date, out of the ~160 financings we have seen, 49% are Seed-stage, exactly in line with 2023.

This is not to stay late stage financings aren’t happening. As evident by last week’s perspective, significant capital has been raised this year ($2B), which would be a 160% increase compared to 2023 using the January run rate.

In other news, unlike other crypto initiatives announced by major companies that feature a press release and not much else, PayPal has continued to push the use of its PYUSD stablecoin. This week, PayPal Ventures used PYUSD to invest in Mesh, a crypto payments & transfers platform. While not a large-scale investment, it marks the first time that PayPal has used its stablecoin to fund an investment.

Events

Architect Partners will be at ETH Denver (2/29 – 3/3) and Digital Asset Summit (3/18 – 3/20). Please contact elliot@architectpartners.com or arjun@architectpartners.com if you would like to meet.