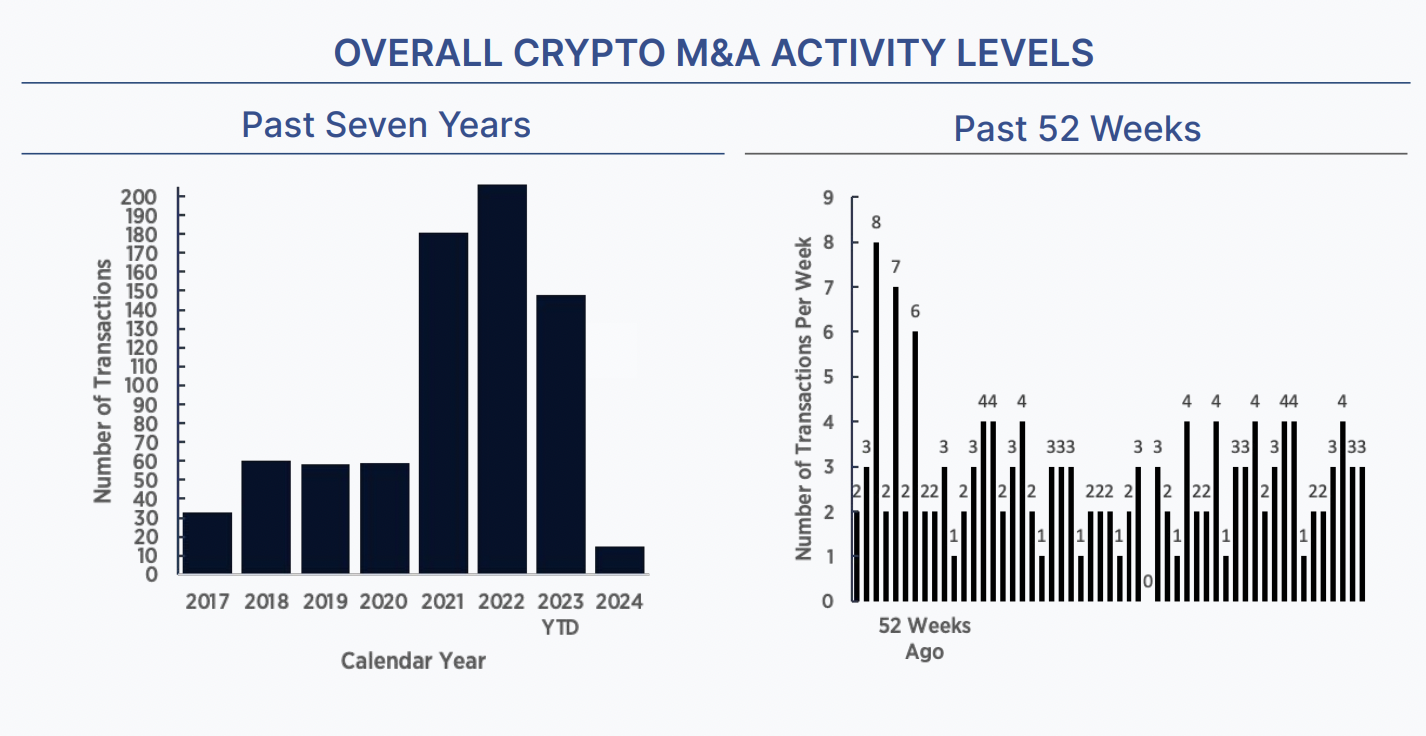

Right on trend, only three announced M&A transactions this week, and only 1 with disclosed value.

Art Blocks, a platform for generative art that has raised $6M, acquired Sansa, a marketplace for art NFTs and secondary sales. Art Blocks runs the well-known Marfa digital art festival, and has moved towards NFTs, opening an NFT marketplace for its artist community last year. Sansa was part of the Art Blocks ecosystem and this is a logical combination of forces.

Lokotech Group AS, a listed European company, announced the acquisition of a 66.6% stake in Powerpool.io, a six-algorithm mining pool, for about $1M.

The biggest deal this week was around parts of Qredo, a well-known web3 infrastructure provider, being placed into administration (akin to bankruptcy in the U.S.) in the U.K. Dan Tapiero’s 10T and 1RT firms acquired the remaining “substantial” assets of Qredo through their new U.K.-based entity, Fusion Laboratories. The two creditor firms led Qredo’s bridge financing round and reorganized the company late last year after a year-plus of decline in revenues and cash. Two dozen key Qredo employees shifted over to Fusion, the remaining ~40 were laid off.

Qredo was founded as a L2 protocol featuring instant cross-chain swaps and settlements. They raised $35M in July 2021 via the QRDO token, and also raised $94M in venture capital, including $80M in a Series A in February 2022 led by 10T with Coinbase, Avalanche, Terra and others at a $460M post-money valuation. QRDO’s market cap reached as high as $300M in November 2021 and is currently $18M, as their business has fallen off markedly with the crypto market decline.

Qredo recently shut down Anker, a hybrid (both DEX and CEX features) derivatives exchange, just months after launch. The company has stated it will now focus on web3 wallets and custody.

Events

Architect Partners will be at the Satoshi Roundtable (1/31-2/7), ETH Denver (2/29 – 3/3), and Digital Asset Summit (3/18 – 3/20). Please contact elliot@architectpartners.com or arjun@architectpartners.com if you would like to meet.