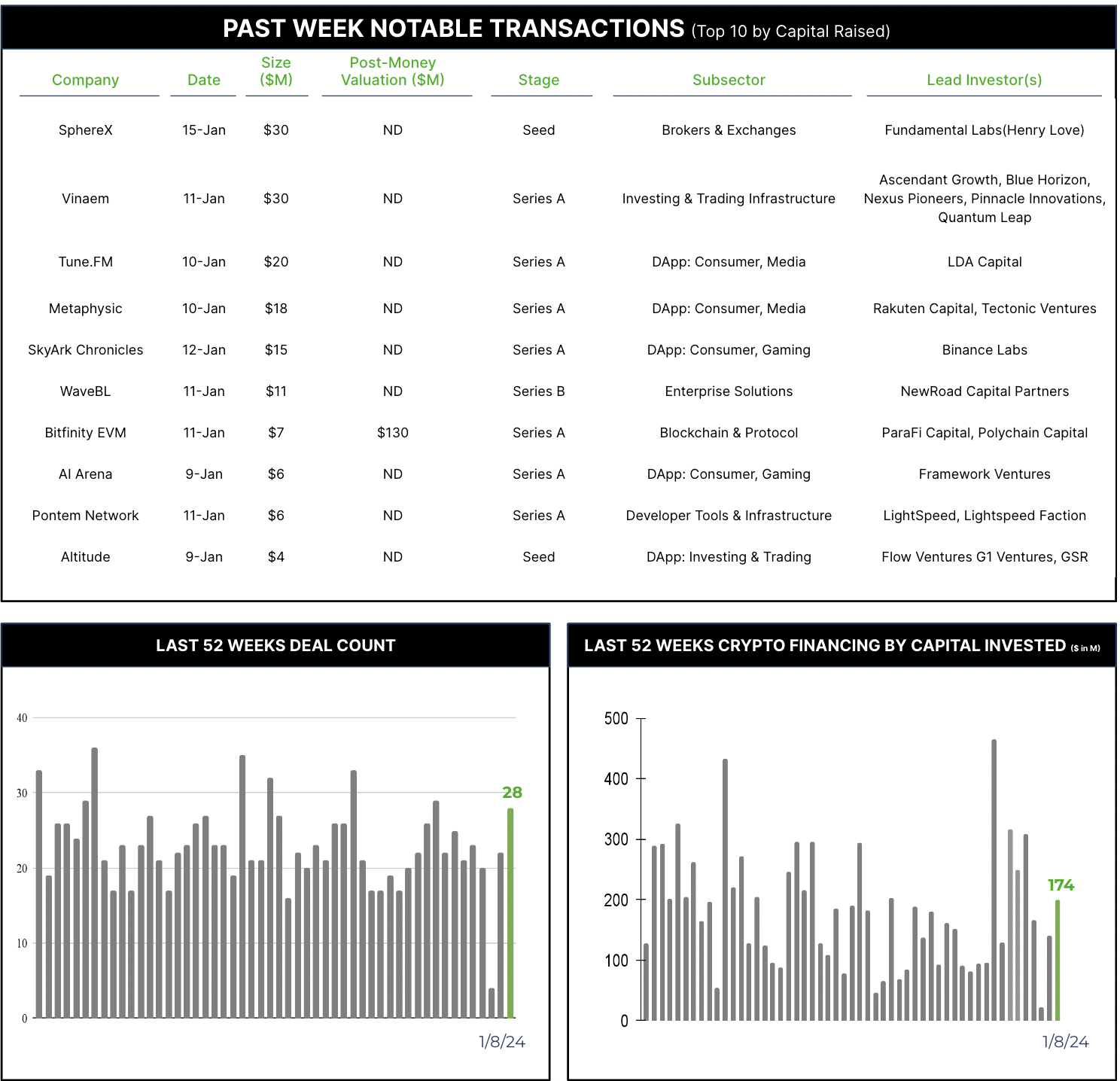

28 Crypto Private Financings Raised ~$174M

Rolling 3-Month-Average: $189M

Rolling 52-Week Average: $183M

Private financings maintained their muted trend over the last few weeks, with $174M raised, slightly below both the near and medium-term averages, which have hovered between $180M and $190M. Earlier stage rounds for DApps in media, gaming and trading saw the most activity, with the sole medium stage (Series B) going to the trade document management platform, WaveBL.

Documentation is essential across almost every business function, from customer relations to compliance and reporting and everything in between. Efficient management of business documents has presented a consistent and evolving challenge, with storage rooms full of filing cabinets first scanned into servers, and eventually migrated onto cloud-based collaboration, management and storage solutions that, at least in theory, never require an actual physical document. But the push to paperless systems has created new challenges including version control, verification, storage, and the security and integrity of digital records.

Blockchain technology seems an intuitive solution, enabling instantaneous and immutable verification of the location and history of all records throughout the business cycle. And numerous initiatives have attempted to realize this potential. WaveBL was launched in 2015 to focus on the electronic transfer of trade documents and now claims to have issued almost 500,000 electronic bills of lading in 136 countries. Their current investment of $11M from new strategic investors tops off $26M announced in June to close their Series B round. Proceeds will be used to expand offerings and increase sales, marketing and R&D resources.

As highlighted in our 2023 report, we view document management as a key area to watch for blockchain enterprise solutions. WaveBL’s successful raise and apparent market traction also supports our thesis that established players offering tangible real-world solutions will receive continued support as the crypto sector matures beyond the speculation of its formative years into practical, real-world solutions.