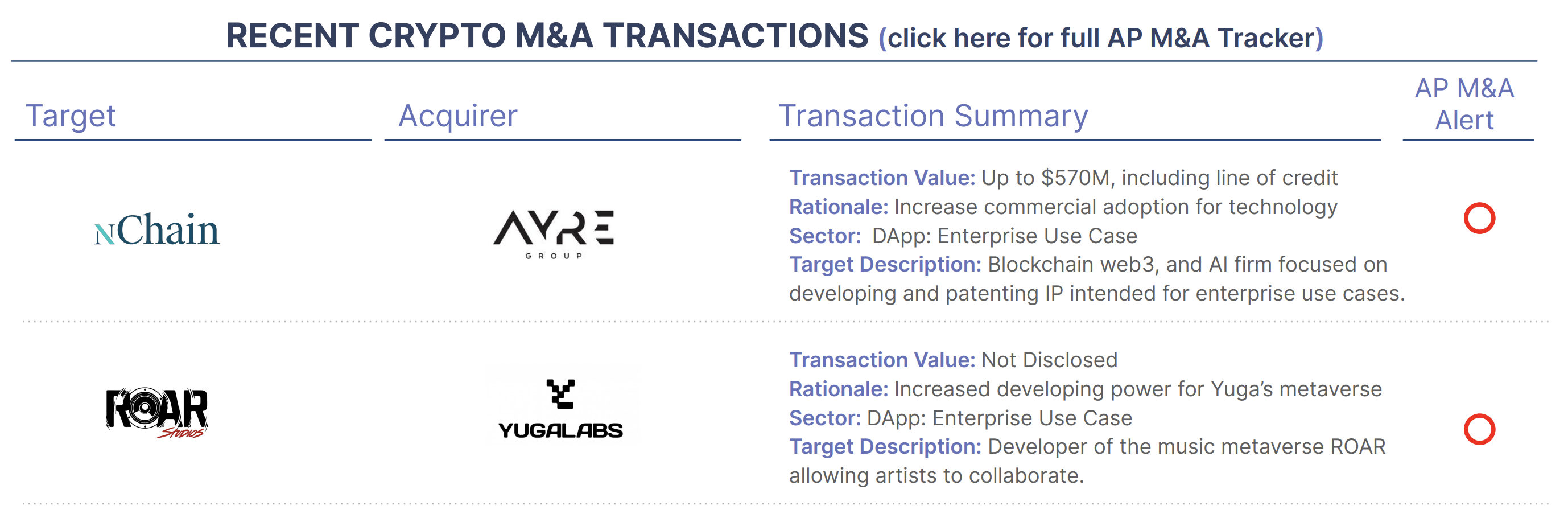

Ayre Group, a global investment firm, has agreed to acquire nChain, a global blockchain technology company founded in 2015 with 240 employees and is the developer of the Bitcoin SV Node software, Teranode and LiteClient. The deal could be worth up to $570 million consisting of an equity acquisition of nChain by the Ayre Group, an IP licensing deal for Ayre Ventures portfolio companies, and a line of credit. The acquisition will give Ayre Group a controlling interest in nChain, which holds nearly 800 patents related to blockchain technology and claims that they have over 3000 more patents applied for. nChain’s IP portfolio covers a wide range of areas, including Web3, non-fungible tokens, and smart contracts. The acquisition is expected to close in the third quarter of 2023.

Yuga Labs, the company behind the Bored Ape Yacht Club (BAYC) NFT collection, has acquired Roar Studios, a company that develops immersive media experiences. The acquisition will help Yuga Labs to further develop its Otherside metaverse, which aims to create a decentralized, user-owned virtual world. Roar Studios is known for its work on ROAR, a platform that allows artists and fans to connect, collaborate, and compete in an immersive, real-time entertainment world. Yuga Labs CEO Daniel Alegre said that the acquisition of Roar Studios will help accelerate the execution of the company’s vision for Otherside and Yuga’s ecosystem more broadly. Roar Studios CEO Eric Reid will join Yuga Labs as General Manager of Otherside. The acquisition of Roar Studios shows that Yuga Labs is committed to building a leading metaverse platform, and it brings together two of the most innovative companies in the space. Terms were not disclosed.