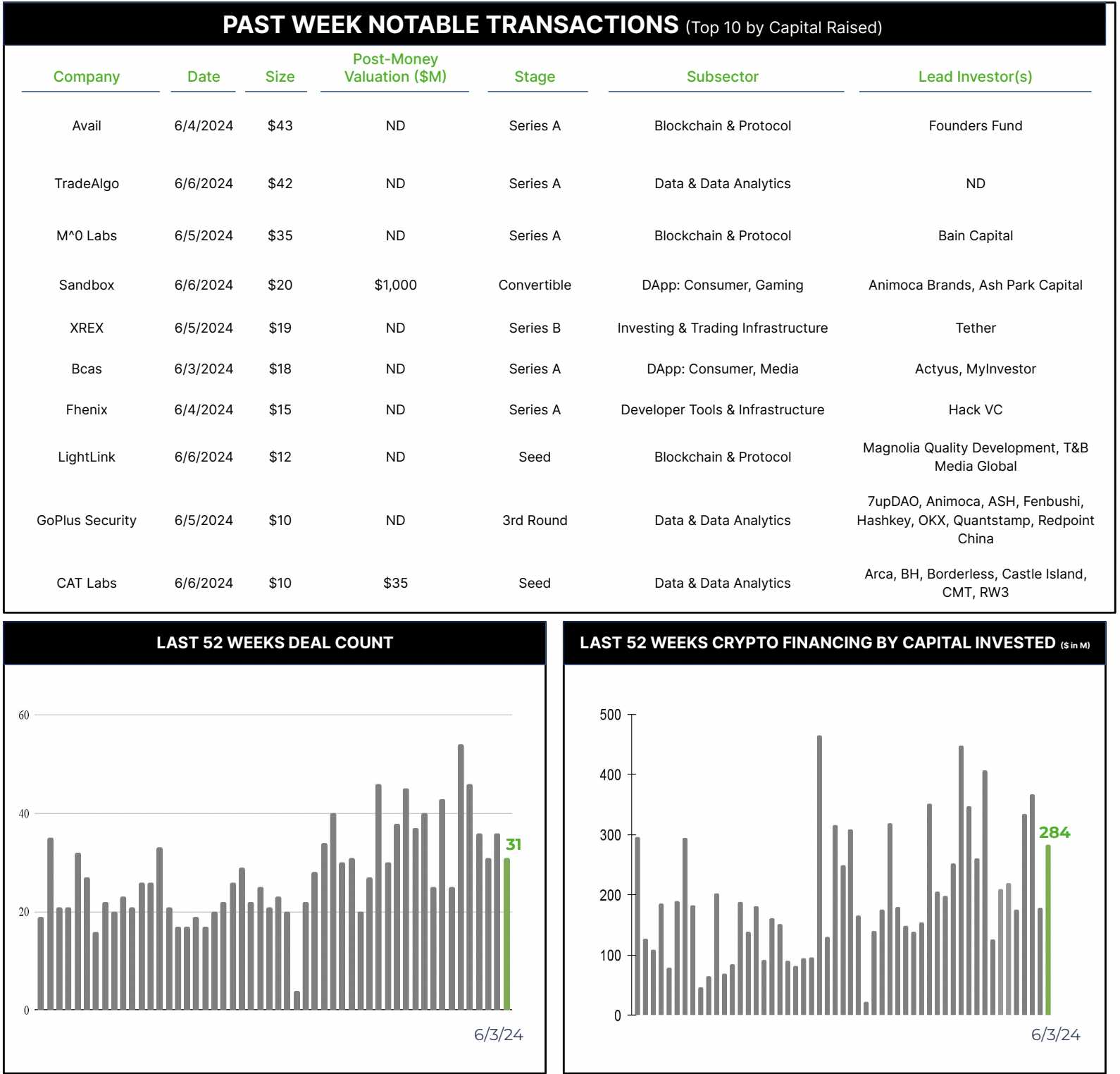

31 Crypto Private Financings Raised ~$284M

Rolling 3-Month-Average: $268M

Rolling 52-Week Average: $198M

Blockchain scalability and interoperability are crucial development topics for blockchain solutions. Scalability is essential to ensure that blockchain networks can handle increasing transaction volumes and user adoption without compromising performance. Scalability solutions aim to enhance the processing capacity of blockchain networks without sacrificing security or decentralization.

Interoperability is critical for enabling seamless communication and data exchange between different blockchain networks. This allows for the creation of more complex and versatile applications that can leverage the unique strengths of various blockchain ecosystems.

The successful implementation of scalability and interoperability solutions will be pivotal in unlocking the full potential of blockchain technology. These solutions can enhance the overall functionality, efficiency, and usability of blockchain applications. This, in turn, will facilitate broader adoption across various industries.

Avail Raises $43M Series A

Avail is developing a strong solution for blockchain scalability and interoperability, and recently closed on a $43M Series A, bringing total funding to date to $75M. Founders Fund, DragonFly Capital, CyberFund, SevenX, Figment, Nomad Capital, LocalGlobe, Altos Ventures, and many other VCs participated in the financing.

Avail, a modular blockchain project spun off from Polygon, focuses on enhancing data availability and scalability for blockchain applications. It allows developers to build customizable and scalable applications by decoupling the data availability layer, making it easier to manage data and reduce costs. This approach enables developers to focus on execution and settlement, leading to faster, more efficient, and scalable applications.

Avail’s architecture is designed to be protocol-agnostic, open-source, and community-owned. It aims to unify Web3 by providing a comprehensive full-stack architecture comprising three solutions: Avail DA (data availability), Avail Nexus (a cross-chain coordination hub), and Fusion Security (a shared security layer protected by a basket of crypto-assets). This integrated approach enables seamless interaction and security across different blockchain ecosystems. Developers are free to choose whichever technologies they like, and can build custom blockchains for their specific use cases.

Avail has made significant progress since its spin-off positioning it as a key player in the blockchain scalability and interoperability space. Recent announcements include:

- In a recent incentivized testnet. Avail DA processed over 118 million transactions and facilitated more than 140GB of data submissions, which is very close to the total data submissions of all L2s in 2023

- Announced a partnership with dWallet Network to introduce programmable native Bitcoin rollups and the launch of its data attestation bridge to Ethereum.