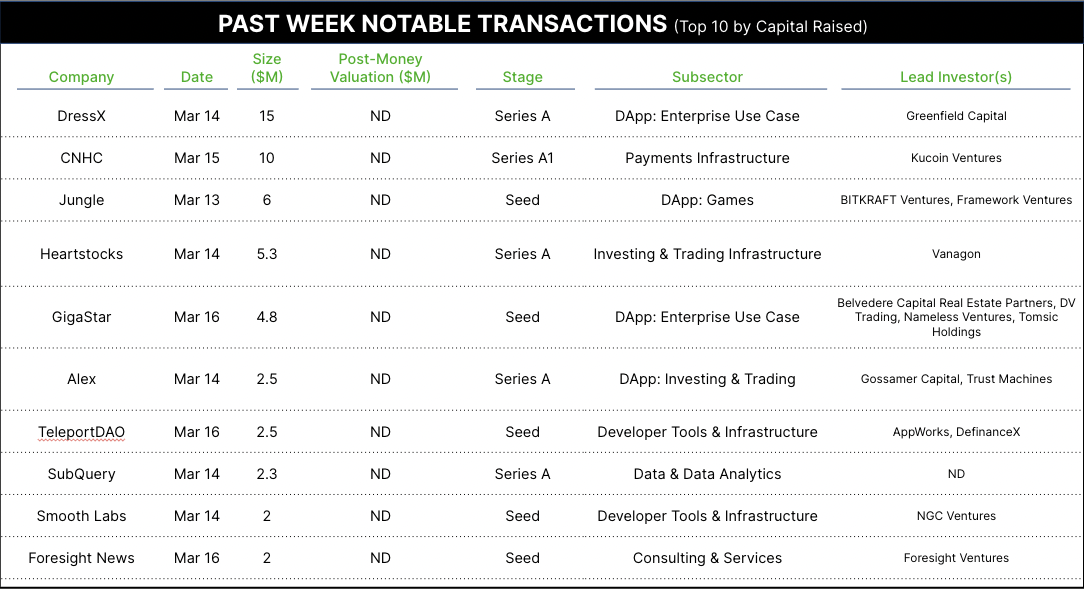

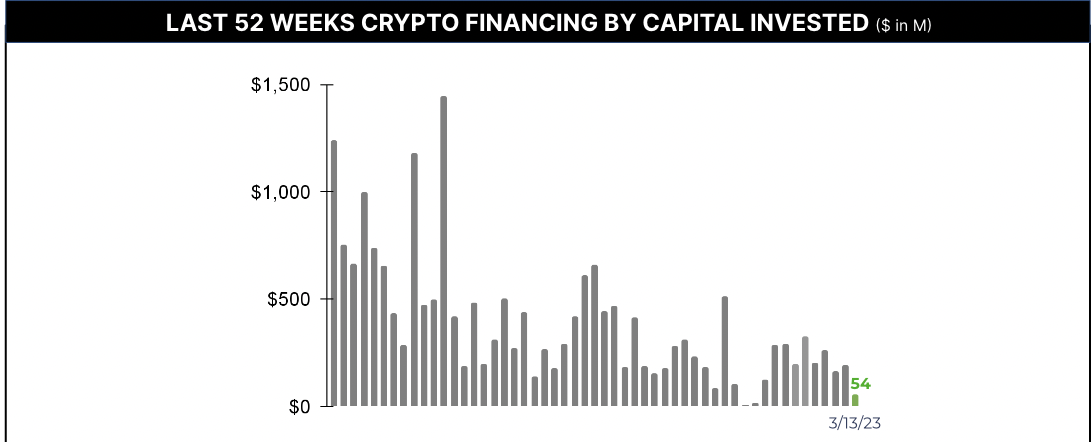

17 financings raised ~$54M

Last week was one of the quietest since Architect started reporting on weekly private financings in the crypto space. Perhaps this is not surprising, given the turmoil in tech banking and crypto banking. But remember that these deals originated months ago, as announcements typically lag investment, so we’re likely to see the banking mess affect the next few months.

Stepping back, we looked at our report from six months ago. For the snapshot dated September 21, 2022, some 40 financings raised $661M – over 10x compared to last week. That long-ago week had four deals in investing/trading infrastructure – this week has only one. Not shocking with BTC dipping below $20,000 and exchange volumes down by 70-80 percent. And the September 2022 week led with LootMogul raising $200M – compared to the largest round last week at $15M.

It’s not just the crypto sector – in the broader tech sector, many of the crossover investors that bid up late-stage valuations last year have gone quiet. And Series A raises are back in the $2.5M-$10M range of a few years ago. What’s to like about this? We are heartened that early-stage is still relatively active, even though valuations are down. This shows that builders are still building.

We are also heartened at where the investment is going. One week does not establish truth, but the ten deals shown to the right reflect a (healthy) shift towards developer tools and the other functions required to build and deploy applications. Entrepreneurs and investors appear to be looking beyond the early, more speculative use cases.

Looking at the Game category, Jungle of Brazil has raised $6 million for its Web3 mobile shooter. “We are committed to creating fun-first hybrid games that are mobile-first and blockchain-enabled,” said Jungle CEO Joao Beraldo. Architect is at the Game Developer Conference 2023 in San Francisco this week, and this is not the kind of headline we saw a year ago. In private conversations with developers a year ago, the gaming community was unhappy with the hype garnered by early play-to-earn models like Axie Infinity, and hoping to see more games take Beraldo’s “fun-first” approach. We are looking forward to seeing new product launches this week, and will likely have new financings to report for game companies next week.

Finally, a quick quiz for our loyal readers. We have been calling this weekly report the Crypto Private Financings Snapshot. In 2023, does this still hold? Do you prefer crypto, digital assets, blockchain, or another label entirely? Please send your thoughts to arjun@architectpartners.com.