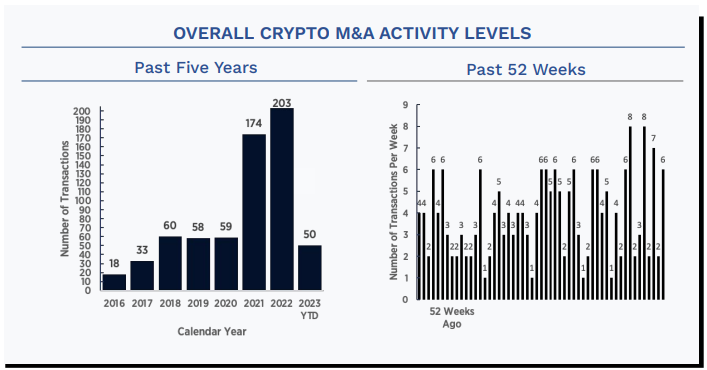

In contrast to a very slow previous week, there were six deals announced this week. This appears to be yet another data point indicating that there is simply no discernable pattern in M&A activity at the moment. One week is quiet, the next busy, and so on. The majority of the deals are relatively small with very little transparency around pricing and valuation in general. The deals this week, as in past weeks, have represented a variety of areas within crypto, including NFTs, financial services, Web3 marketing, and infrastructure.

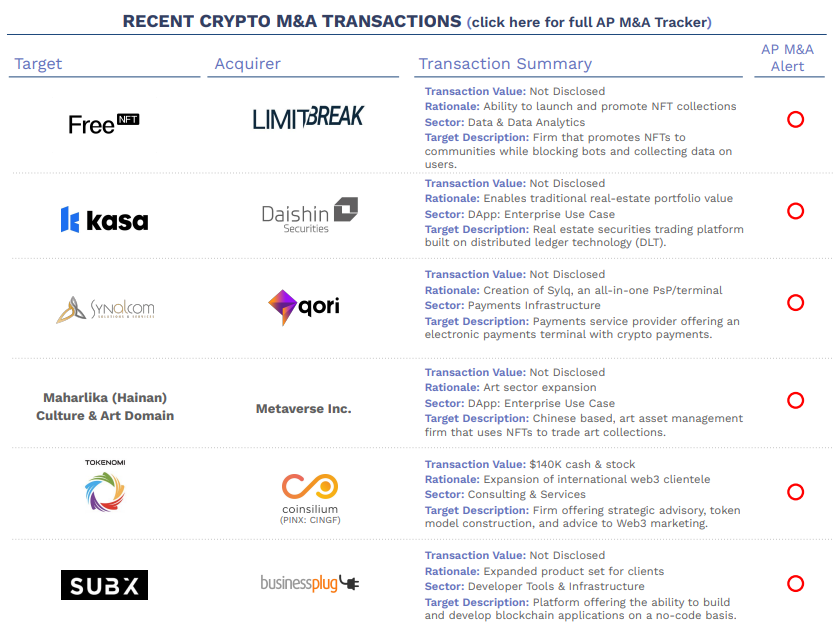

The two NFT deals were Limit Break’s acquisition of FreeNFT and Metaverse’s purchase of Maharlika Culture & Art Domain. Limit Break is a blockchain-based gaming company with free-to-own online gaming. Target FreeNFT gives away NFTs to collectors. In the second NFT-related deal, acquirer Metaverse Inc. is a provider of product development and digital marketing services and target Maharlika is a Chinese-based, art asset management firm that uses NFTs to trade art collections.

In the first of two financial services deals, Daishin Securities acquired Kasa Korea, a real estate securities trading platform built on DLT. In the second deal, payments platform startup Qori acquired Synalcom, a Payments service provider offering an electronic payment terminal with crypto payments enabled, to form Sylq. Sylq is an all-in-one PSP/Payments Gateway that also has crypto payments.

In a small Web3 marketing deal, Coinsilium Group acquired Tokenomi, a firm offering strategic advisory, token model construction, and advice on Web3 marketing. Finally, in the infrastructure deal this week, Businessplug acquired SUBX, a platform offering the ability to build and develop blockchain applications on a no-code basis.