March 17th – March 23rd

PERSPECTIVES by Eric F. Risley

Broker and exchange consolidation is in full swing, finally.

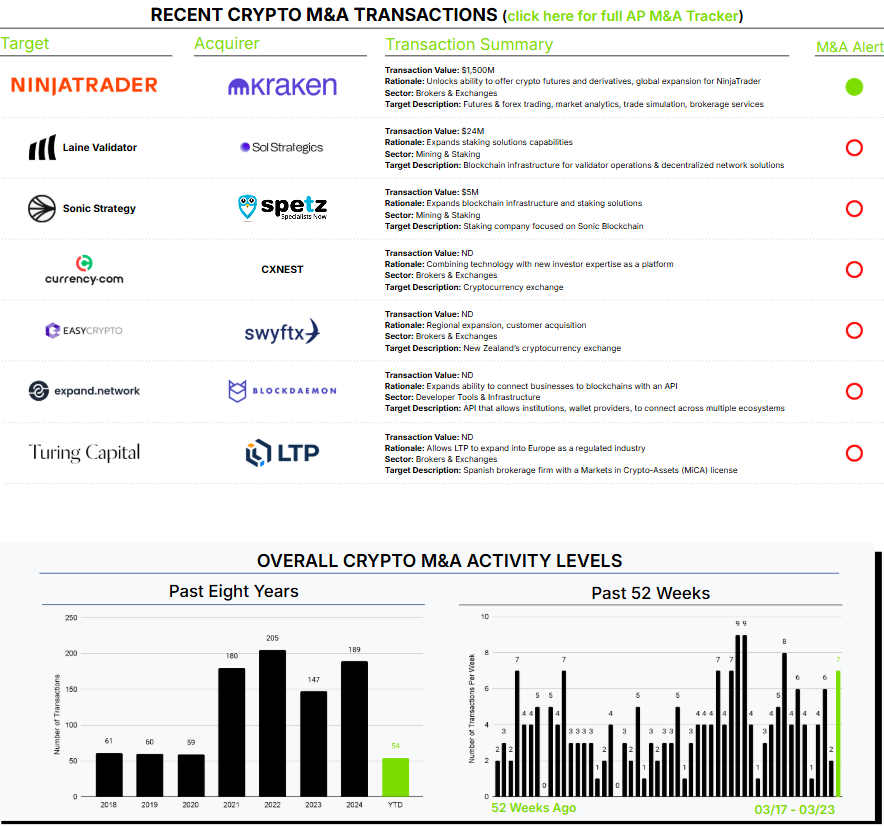

Kraken’s acquisition of NinjaTrader made headlines as the largest crypto M&A transaction in the industry’s history. NinjaTrader offers futures and foreign exchange trading services across a wide variety of assets—beyond just crypto—to retail investors. As highlighted previously, acquisitions between traditional financial services and crypto businesses are becoming increasingly common. In this case, the crypto specialist is embracing traditional financial markets, with Kraken adding the trading of futures contracts for stock market indices, bonds, gold, crude oil, and foreign exchange to complement its historical crypto-only focus. We have a more detailed analysis in our M&A Alert here.

Three additional broker and exchange transactions were announced this week, marking a record for any single week. Swyftx, the second-largest crypto broker in Australia, acquired EasyCrypto, the largest crypto broker in New Zealand. In line with geographic expansion, LPT acquired Turing Capital Brokerage, offering MiCA-licensed access to Spain and the EU.

Although still a work in progress, regulatory clarity is improving. As highlighted below—taken from our Year-End 2024 Crypto M&A and Financings Report in January—this topic remains a critically important gating factor for the broadening of crypto M&A activity, particularly regarding the entry of traditional financial institutions.

“There are several gating factors preventing additional buyers from jumping in, starting with regulatory clarity. When we see bridge transactions TradFi buying crypto natives) we know those regulatory hurdles are low enough to commit capital. Really only Robinhood acquiring Bitstamp fits, but it is something we closely monitor. Also favorable are reverse bridge transactions (crypto native buying TradFi), and crypto.com has done two of them in Q4. The weaving together of TradFi and crypto natives makes sense to us and we expect more to come.

In sum, not enough activity to say itʼs a healthy market, but we are hearing optimism we havenʼt heard for the past two years. This optimism is coming from large and small players, with several large players sharing they are reviving acquisition efforts of scale. So we expect headline consolidation deals in the upcoming year.”

Michael Klena, Partner