Today over 550 crypto brokers and exchanges are operating globally, including roughly 300 centralized exchanges (CEX) and 250 decentralized exchanges (DEX). However, the power law distribution is alive and well, with 75% of the daily trading volume occurring on the top 10 trading platforms.

In spite of overall trading volume concentration, even the largest brokers and exchanges have significant geographic and product weaknesses. In March 2022, on the eve of revelations of fraud and mismanagement in our sector, Architect Partners published Crypto Exchanges, which highlights many of the strategic dynamics facing brokers and exchanges and the supporting ecosystem. Needless to say, that dark period delayed the timing of anticipated strategic moves, however, improved conditions today will reinvigorate the corporate strategies that were put on hold.

What’s coming?

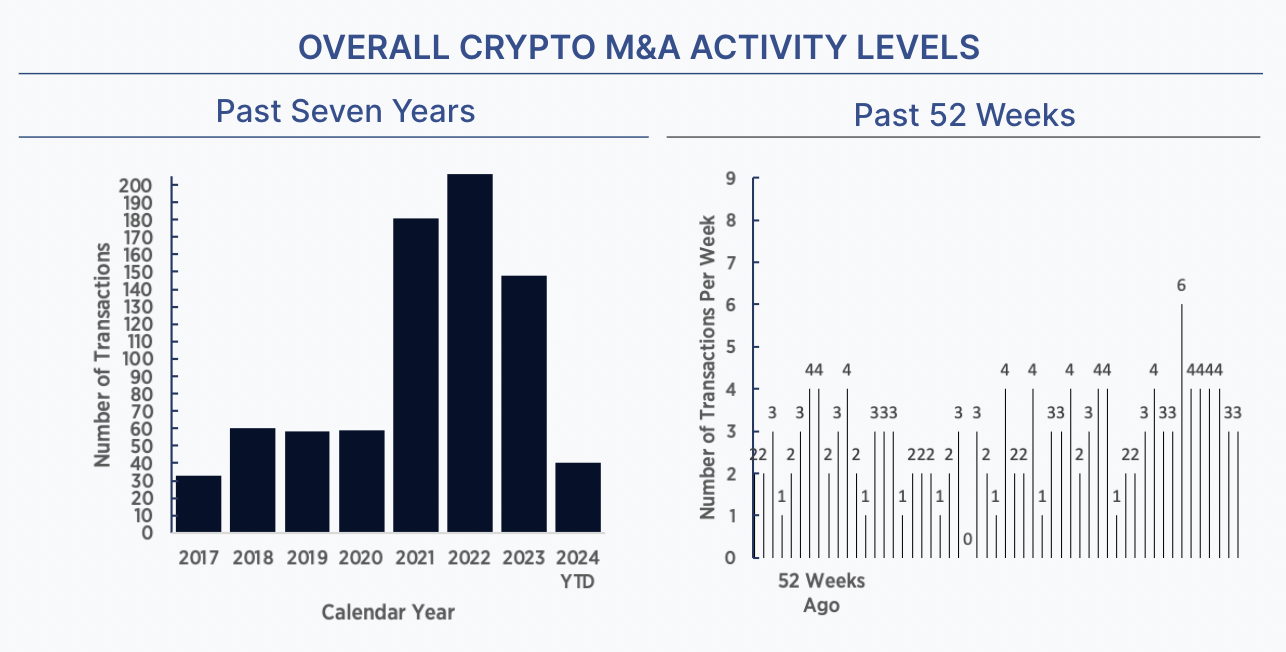

Brokers and exchanges (and other companies who support the trading ecosystem) will use acquisitions as a part of their strategy to fill out the mosaic of product, geographic and regulatory needs. They will find willing sellers. Initially, it will be crypto native businesses focused. However, with improved regulatory clarity such as MiCA, traditional financial institutions will begin participating, likely with a sense of urgency.

The emergence of digital assets (tokenized securities) will make the landscape even more complex. Digital assets are how traditional financial institutions “ease” their way into “crypto” as a first step. Digital assets are also an opportunity for crypto native businesses for further market expansion. There are many parallels to the emergence of the Internet, online brokers and many other categories of fintech innovation (see Family Ties: The Internet and Crypto). It’s crystal clear, timing is the only question.

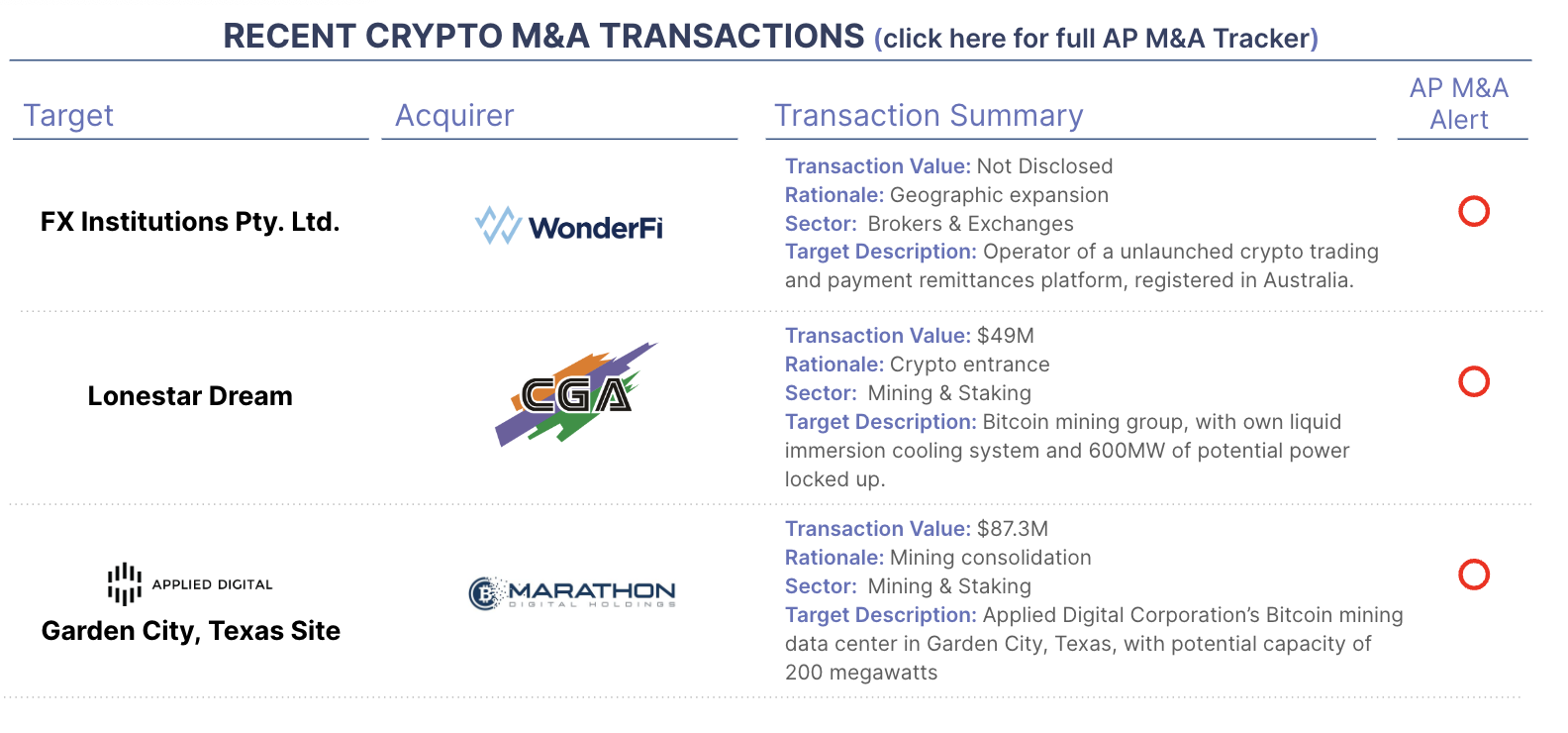

This theme is beginning to show itself, even in the early stages of the current recovery. This week, Canadian broker and exchange, WonderFi, acquired an Australian-based business to stand up OTC trading in Australia. This is the 8th acquisition by WonderFi which has been actively acquiring competitors. While relatively small, this is representative of far more to come in the next 24 months.