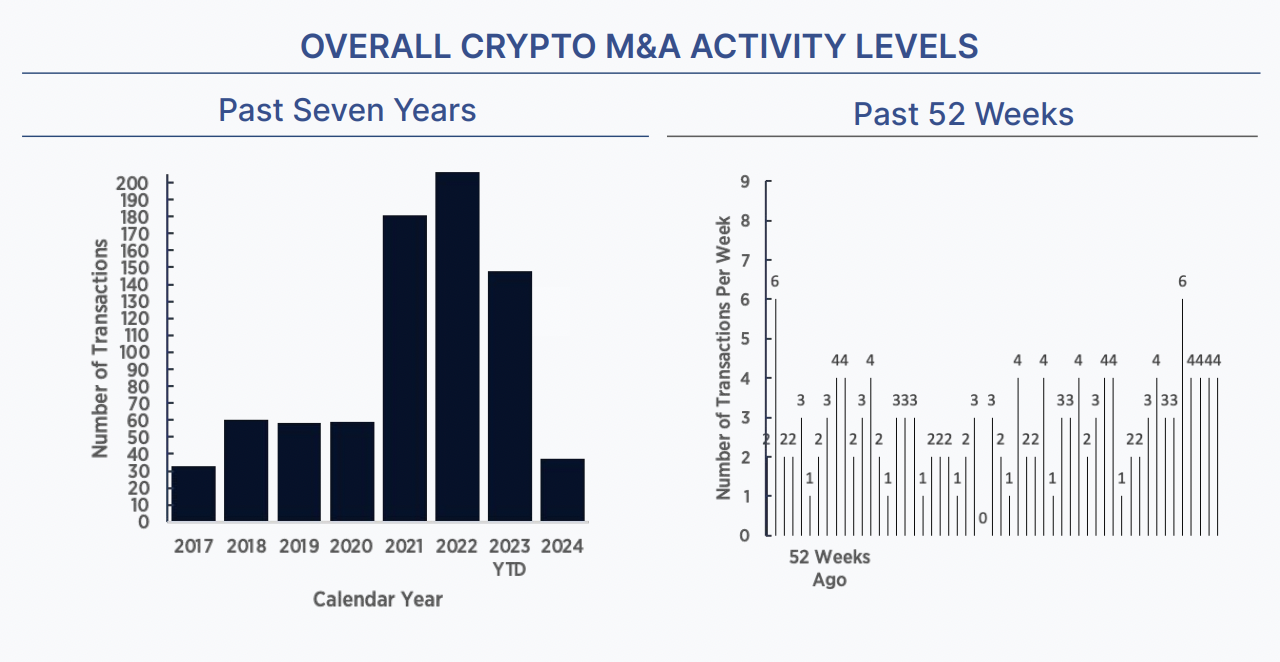

For the fourth week in a row, we’re tracking four announced M&A transactions in the crypto/digital assets space.

Infinity Capital, a cybersecurity and blockchain firm reportedly based in Dubai, announced in Forbes it had acquired Andro, a Medellín-based company specializing in blockchain infrastructure for consideration “in excess of seven figures”. Little is known about Infinity, but Andro is an early stage startup offering beta-stage stablecoin protection infrastructure which balances users’ portfolios and sells if a coin depegs.

CryptoBlox Technologies Inc., a smallcap (CSE: BLOX) Vancouver-based company, announced the acquisition of Blockchain Fintech Unipessoal LDA (“Blockchain Fintech”), a Portugal-based blockchain-based financial developer, for CryptoBlox shares worth up to $11M in initial consideration and earnouts. Blockchain Fintech is pre-revenue, and CryptoBlox has a market cap of $34M CAD, down from $600M in 2021. Last year CryptoBlox announced the acquisition of Red Water Acquisition Corp, an Alberta crypto mining project in development, also for $11M CAD including earnouts.

Dutch crypto trading platform Coinmerce entered into a joint venture with the crypto fund Icoinic. Coinmerce will have a majority stake. Coinmerce is a straightforward trading platform registered with the Dutch central bank (plus French and Spanish registrations in 2023) that supports 300+ coins. When Binance and BUX exited the Netherlands market last year, users were directed to transfer their accounts to Coinmerce. Icoinic is an Amsterdam-based hedge fund focused on alternative strategies in digital assets. With this merger, Coinmerce announced its aims to provide an alternative to the Bitcoin ETF.

Finally this week, The9 Limited (NASDAQ: NCTY), a Shanghai-based Internet company, has agreed to acquire 51% of Shenma Limited for $1 million in cash and The9 stock valued at $14.3 million based on achieving certain milestones and an IPO. We wrote about The9 years ago when they had the exclusive license to operate and distribute World of Warcraft in China – at that point, The9 had a market cap of over $20 billion. Since the WoW license was given to NetEase, The9 has diversified into online gaming and crypto, with recent forays in crypto mining in the U.S., Canada and Kyrgyzstan. Shenma, an AI-generated content (AIGC) driven digital human SaaS platform, represents yet another pivot. The9’s current market cap is $25 million.

Events

Architect Partners will be at Digital Asset Summit London (3/18 – 3/20) and the Game Developers Conference in San Francisco (3/18-3/22). Please contact elliot@architectpartners.com or arjun@architectpartners.com to meet.