May 12th – May 18th

PERSPECTIVES by Eric F. Risley

Another week, another record falls.

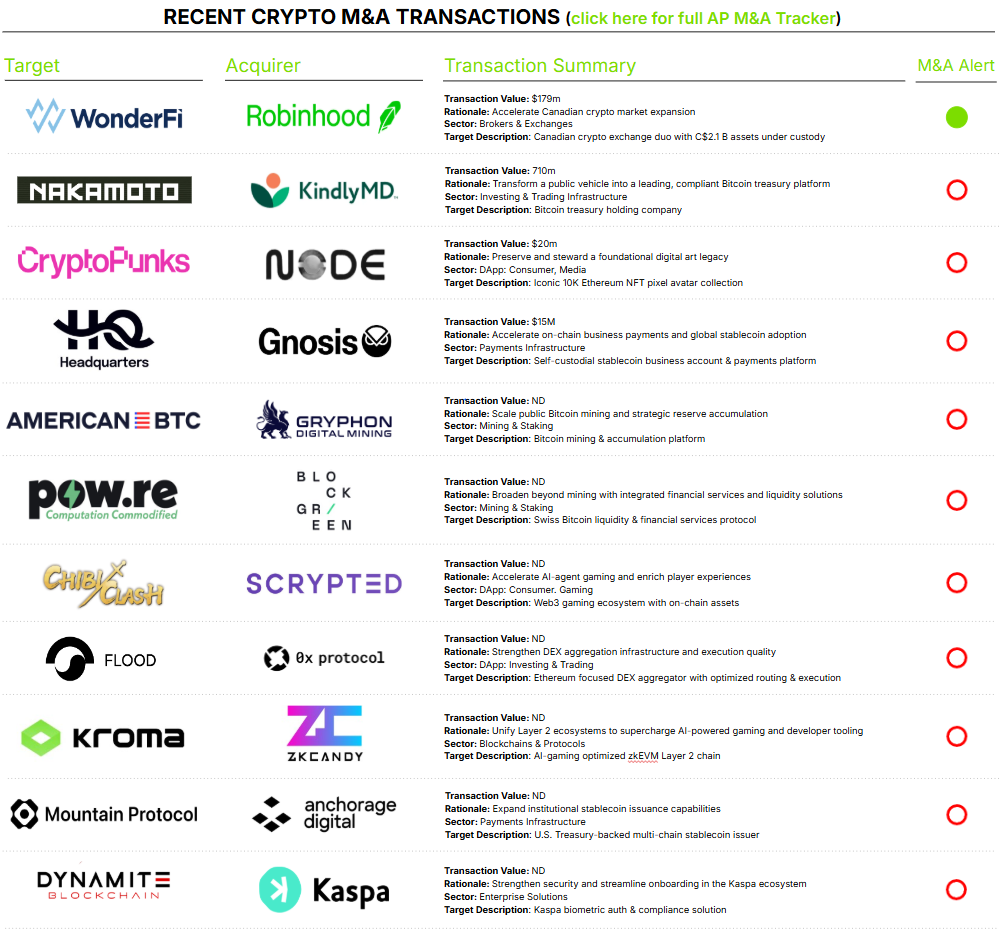

This past week featured 11 announced crypto M&A transactions, an all-time record number. While the number of transactions is promising, we tend to focus on strategic significance and size. This week, three themes emerged.

First, the theme of “bridge” M&A refers to traditional financial-services firms acquiring or building their crypto businesses. This week, Robinhood continued its commitment to building its crypto business through the acquisition of Canadian crypto brokerage WonderFi. This is the second crypto-brokerage acquisition by Robinhood after it acquired Bitstamp in mid-2024. In contrast to the premium valuations we have been seeing recently, this transaction was a far more modest 4.0x 2024 actual revenue. More in our M&A Alert here.

Second is the “get public” theme. In this case, a reverse public-company merger of Nakamoto and KindlyMD, together with a concurrent 710 million-dollar financing, aims to build “the first global network of Bitcoin treasury companies”. As described in the press release, “We (Nakamoto) believe a future is coming where every balance sheet, public or private, holds Bitcoin. Nakamoto seeks to be the first publicly traded conglomerate designed to accelerate that”. We will see what that means with time.

Third is the rising importance of stablecoins. Anchorage acquired the team, technology, and licenses of Mountain Protocol, an issuer of the USDM stablecoin. Anchorage will use this expertise and these capabilities to support other stablecoins in the future, winding down the USDM stablecoin in an orderly manner.