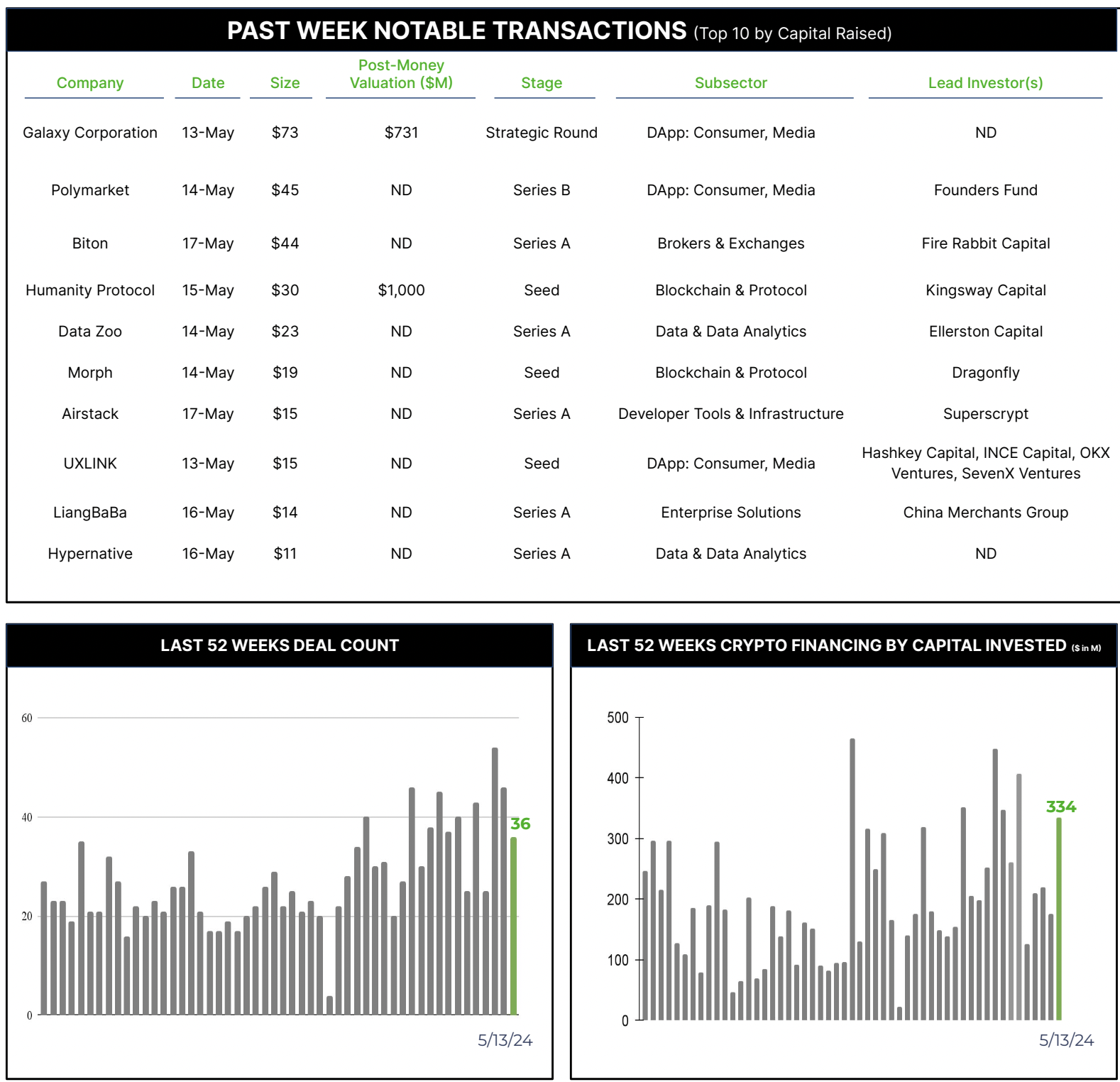

36 Crypto Private Financings Raised ~$334M

Rolling 3-Month-Average: $266M

Rolling 52-Week Average: $195M

Venture capital funding for crypto-related companies continues to show upward momentum. A couple of weeks ago, undisclosed funding amounts distorted the picture downward, and this past week saw 36 deals that brought in ~$334M led by South Korean Metaverse company Galaxy, with $73M at a post money valuation of $731M.

A strong interest here is non-speculative use cases for blockchain technology and last week saw a couple of very interesting financings within that group:

Polymarket raised $45M Series B

Prediction markets are surprisingly accurate, though it’s not a perfect science. Reliability can vary by topic. However, prediction markets offer a valuable tool for forecasting, often exceeding the accuracy of polls, as people trading in prediction markets have a financial stake in being right. This motivates them to research and place bets reflecting their true beliefs, potentially leading to a more accurate collective prediction than simple polls. And, they’re profitable!

Polymarket is a decentralized prediction market platform utilizing the Ethereum blockchain and smart contracts to enable users to speculate on the outcomes of real-world events. Polymarket announced a $45M Series B led by Founders Fund, and including Vitalik Buterin, Dragonfly, and ParaFi.

This funding reinforces faith in prediction markets as a business model despite Polymarket’s regulatory issues within the United States. In early January 2022, the Commodity Futures Trading Commission (CFTC) reached a settlement with Polymarket for $1.4 million. The CFTC alleged that Polymarket’s event-based binary options contracts functioned as unregistered swaps, falling under the Commodity Exchange Act (CEA), causing Polymarket to shut down its US operations.

In order to investigate the possibility of operating in the United States, Polymarket hired Richard Jaycobs, a futures industry executive.

Humanity Protocol raises $30M seed round and becomes a unicorn

Humanity Protocol represents an innovative approach to digital identity verification in the Web3 space. Humanity Protocol focuses on creating a decentralized verification system for human identity using blockchain technology and a verification process that involves scanning their palm veins. The verification data is stored on a decentralized network, eliminating reliance on a single entity and enhancing security. Additionally, Humanity Protocol leverages zero-knowledge proofs, a cryptographic technique that allows verification without revealing the actual palm scan data. This protects user privacy.

Human Protocol will compete with Worldcoin, but they differ in their approach, particularly regarding privacy and verification methods. Human Protocol utilizes palm vein scanning, a technology proponents claim is more secure and user-friendly than iris scanning. Worldcoin Initially used iris scanning, but switched due to privacy concerns. Their current verification method is not believed to be publicly revealed yet (as of May 22, 2024).

The $30M round at a $1B valuation, was led by Kingsway Capital and included Animoca Brands, Blockchain.com, and Hashed, among others.

CONSENSUS: Architect Partners will have a full team in Austin next week. Feel free to reach out if you would like to connect.