Does an institutional crypto asset trader care if the trade occurs on a centralized exchange like Coinbase, a decentralized exchange like Uniswap or via a more informal, over the counter venue? The nuanced answer is yes but the simple answer, much of the time, is no. What is desired is the ability to make an informed decision with the necessary information and the ability to act on that information. In the world of traditional institutional trading the trusted market data and software that enables this is called an Order Management System (OMS) complemented by the Execution Management System (EMS).

In traditional financial markets, the OMS and EMS have been critical for the institutional trader for years, but until recently, this technology had not been available in crypto. In traditional finance, there are only a handful of exchanges, whereas in crypto there are dozens of major exchanges that orders must be routed to for optimal execution. Institutions were forced to build their own version (very hard and expensive) or have a limited view of the market and depend on a few trading partners to execute their desired strategy and trades. Perhaps fine when markets are relatively inefficient and algorithmic trading strategies were “rich with profit”, however, those days are largely gone.

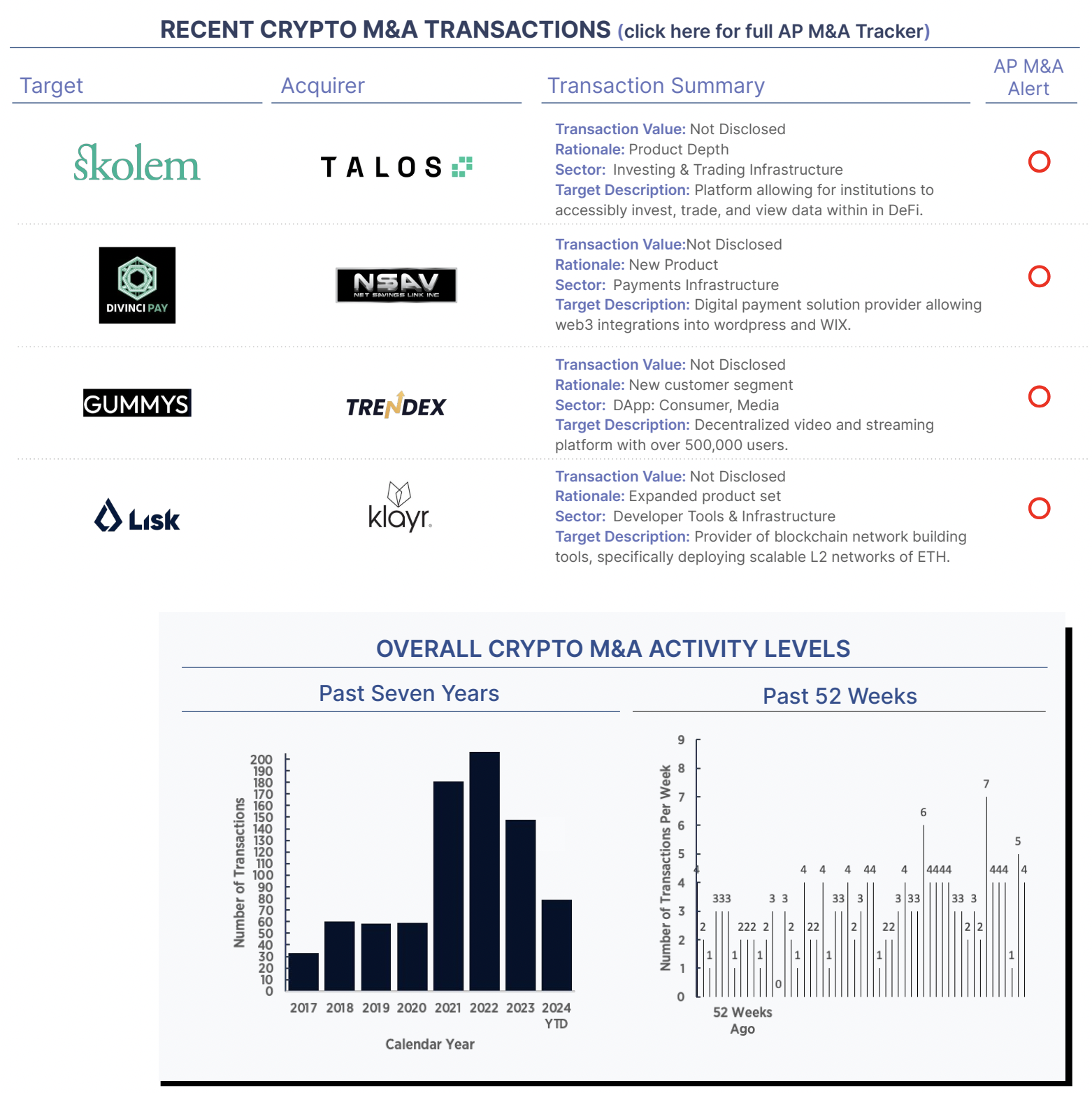

Talos is one of the few companies who have built a truly institutional-grade OMS | EMS to bring the necessary full market visibility to sophisticated crypto traders. Others include CoinRoutes and Elwood Technologies. Talos is backed by sophisticated trading market savvy institutional investors, including General Atlantic, DRW, Fidelity, Citigroup and BNY Mellon. This week Talos announced the acquisition of Skolem, a peer but focused exclusively on DeFi execution markets, an increasingly important execution venue for institutional traders. This follows Talos’ recent acquisitions of Cloudwall and D3X Systems.

Talos, and their lead growth investor, General Atlantic, are executing the time proven strategy of product extension via acquisition. Benefits of this strategy, rather than building these capabilities internally, include accelerated time to market, acquiring not just a proven product but the talent that built it and adding customers and associated revenue. Challenges are certainly present as well, including integrating the products into a cohesive single product (in this case) and onboarding new talent as a group. This playbook has been deployed successfully for years by tech companies and will continue to be the primary driver of crypto-related acquisitions for some time.