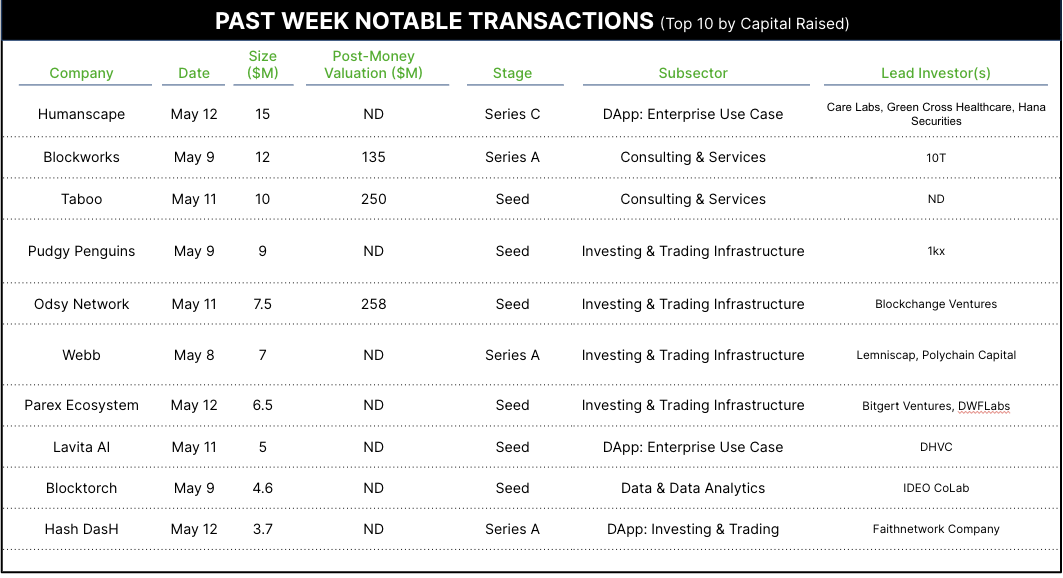

23 Crypto Private Financings Raised ~$88M

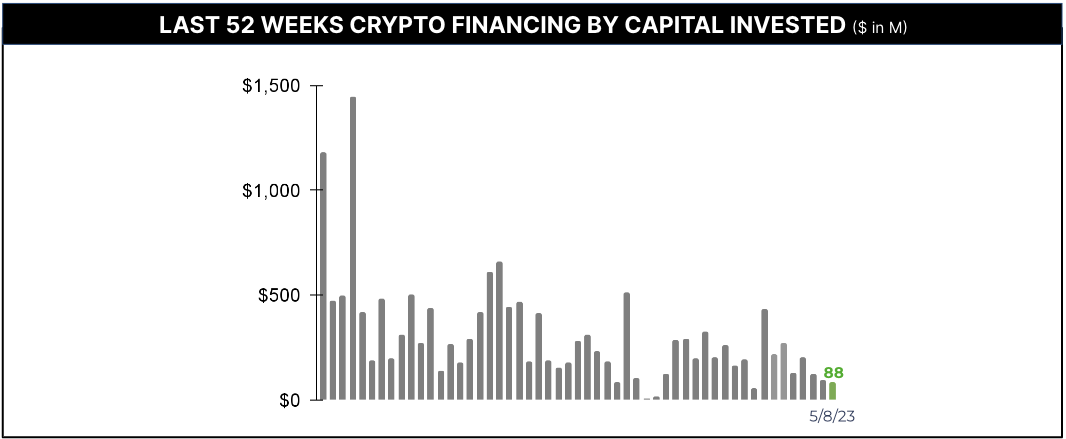

Last week was another slow period for announced financings in the crypto segment – Architect tracked 23 financings, with $88M in funding disclosed. At this point, May is shaping up to be the slowest financing month in the past year.

In the largest announced deal, Seoul-based Humanscape raised a $15M Series C round led by prior investors Care Labs, Green Cross Healthcare and others plus new investor Hana Securities, bringing total capital raised to date to about $35M. Humanscape is a digital health company with offerings including Mami Talk, a parenting and childbirth app expanding to Southeast Asia and Rare Note, a blockchain-based observational research clinical data management solution. In 2019, Humanscape launched the HUM token, now listed on a handful of DEXs mainly in Korea with a market cap of $100M.

The second-largest raise was reported by Blockworks, the crypto media firm, with a $12M Series A at a valuation of $135M. This round was led by 10T, the growth equity “picks and shovels” crypto fund with $1.2B under management and with participation from crypto-focused Framework Ventures and crypto angel investor (and Blockworks content contributor) Santiago Santos. The company reported that this was their first outside capital raise. Blockworks reports it will use the funding to accelerate their research and data analytics offerings, providing subscription-based access to research, data and analytics, governance, and real-time news. We are familiar with Blockworks – they have quoted Architect Partners in a handful of recent articles.

The third largest round announced last week was a $10M seed raise by Indian adult entertainment and media platform TABOO for their privacy-centric, censorship-resistant blockchain content platform. This round was at a supposed $250M valuation, led by an unnamed “ex-JP Morgan senior executive”.