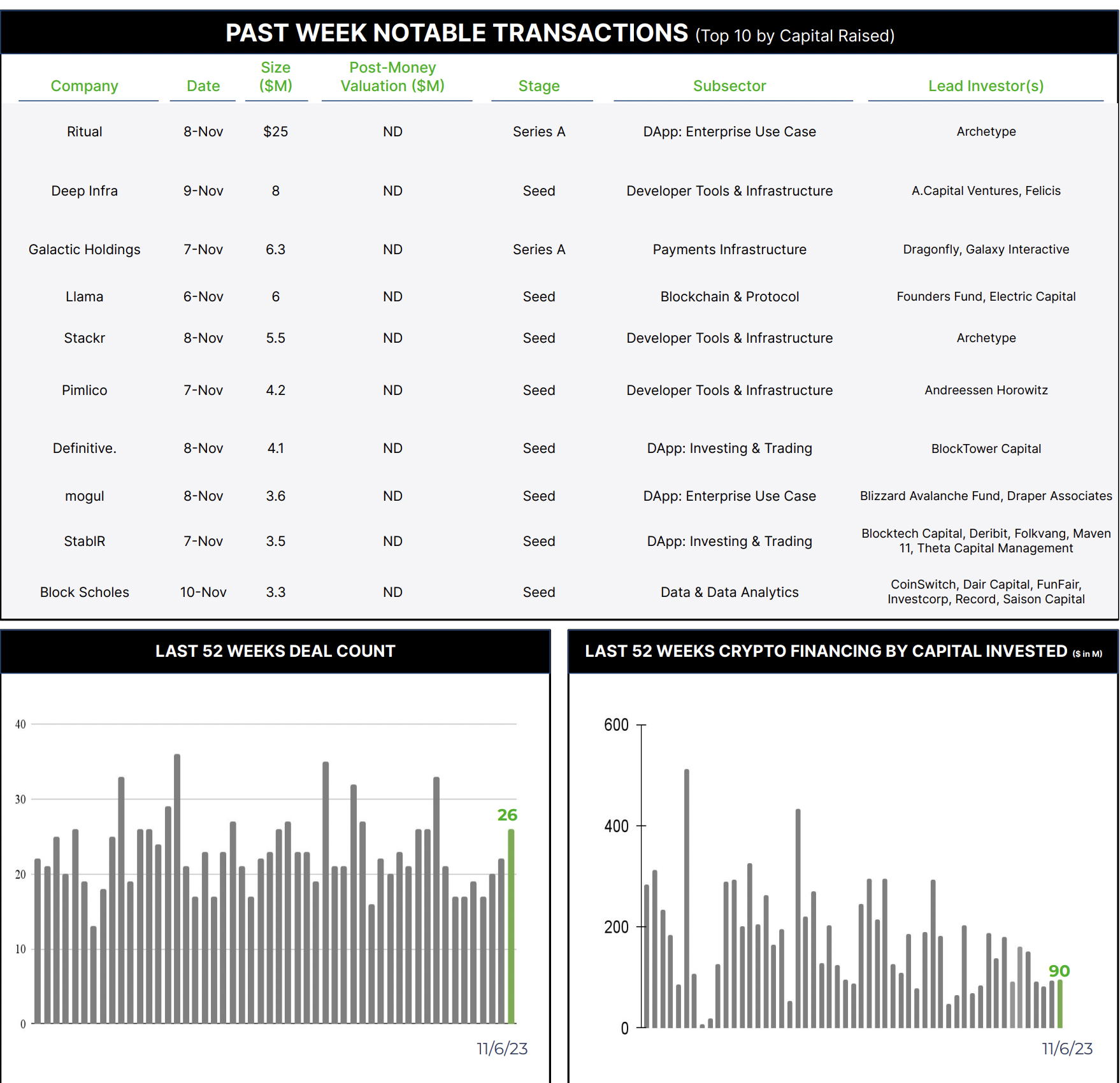

26 Crypto Private Financings Raised ~$90M

Rolling 3-Month-Average: $119M

Rolling 52-Week Average: $175M

Deal flow picked up slightly again this past week though total proceeds remain steady and modest at $90 million.

Selected Highlights

Tokenization and stablecoins are having a bit of a moment in the sun. High-profile prognostications like Larry Finke’s clarion for the coming age of tokenization have been reinforced by numerous legitimate applications, including among the largest financial players. BlackRock tokenized one of its money markets funds on JPM’s Onyx blockchain as collateral in an OTC derivatives trade with Barclays. Citi has piloted internal tokenized deposits to transfer client liquidity between branches and has used digitized tokens with Maersk and a canal authority as an alternative to bank guarantees and LOCs in trade finance.

Stablecoin initiatives are also numerous, including PayPal’s PYUSD built by Paxos, Midas’ new U.S. Treasury-backed tokens to increase yields for the DeFi community, and Deutsche Bank and Standard Chartered’s SC Ventures using the Universal Digital Payments Network to test on-chain stablecoins and CBDC-based interbank transfers as an alternative to SWIFT messaging.

Amidst this buzz, Agrotoken, an Argentinian startup, announced a pre-Series A round led by Visa. Agrotoken uses a platform built on Ethereum, Polygon and Algorand to tokenize agricultural commodities. Its current round solidifies a collaboration with Visa that began in 2022, and follows an agreement penned this summer with Banco Galicia to use AgroTokens as collateral for agricultural loans – an intriguing use of tokenized digital collateral to access Argentina’s rich agro-assets as a stabilizer against the Peso’s penchant for hyperinflation.

Stablecoins promise fast and frictionless payments, a means of storing and transferring value that can be insulated from cross-border frictions, and access to alternative assets and commodities without the inherent FX and inflation volatility of fiat and fiat-based instruments. Long-lauded use cases seem to be finally taking shape, and investment support for these initiatives presents another example of capital flowing to teams building infrastructure in the down market.