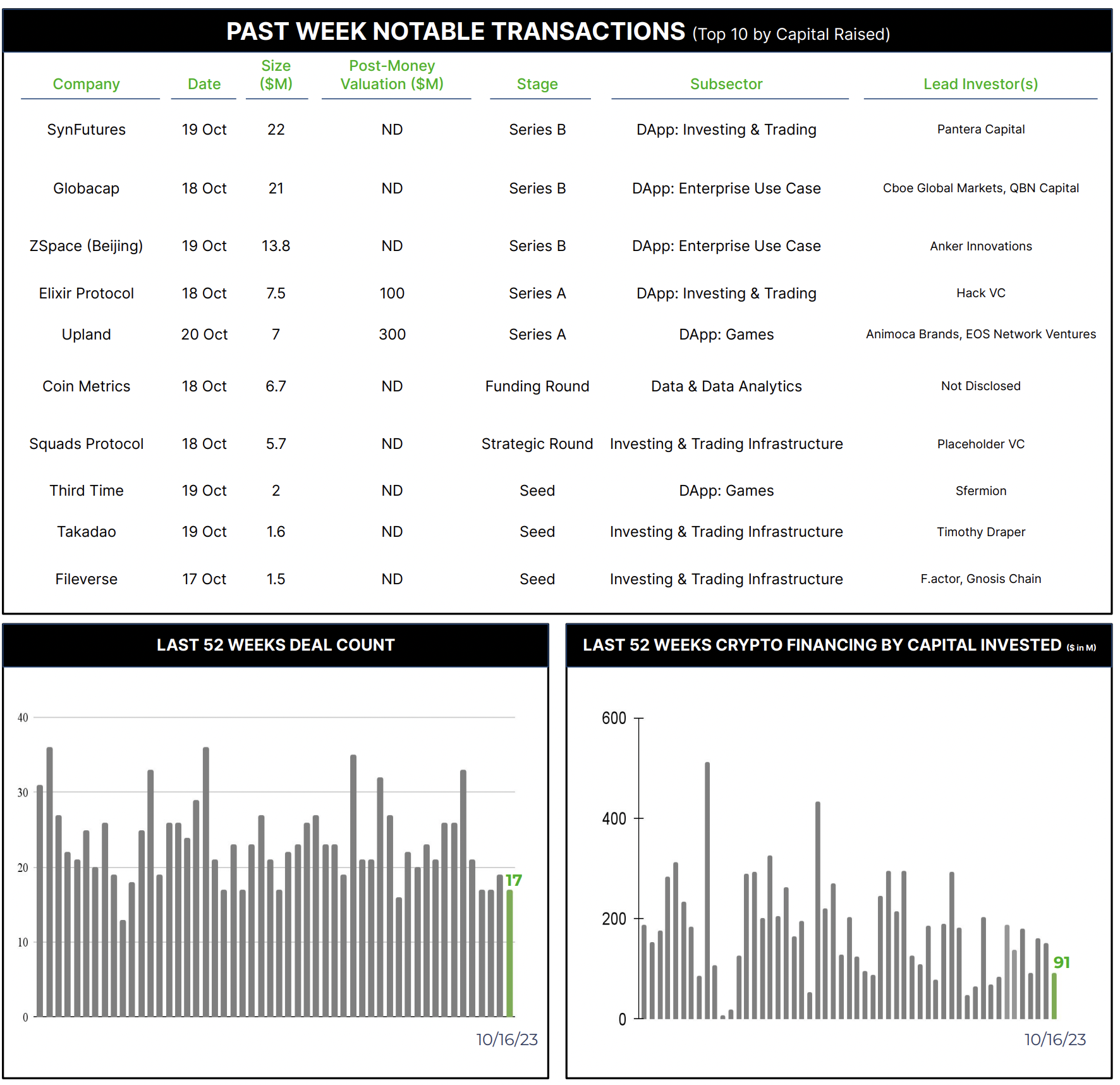

17 Crypto Private Financings Raised ~$91M

Rolling 3-Month-Average: $123M

Rolling 52-Week Average: $182M

This week saw the transaction count remaining steady at 17 for the third week running, although with notably lower proceeds. DApps dominated the top ten board.

Selected Highlights

Globacap, a London-based technology firm focused on private capital markets, completed a $21M Series B financing to ramp marketing, sales, and facilitate geographic expansion. According to co-founder Mules Milston, Globacap is “bringing public markets-like infrastructure to private capital markets to improve access, boost liquidity and remove administrative burdens”. Globacap develops SaaS and white-label solutions for financial institutions – including securities exchanges, banks and asset managers. They seek to reduce costs and improve efficiency through digitized workflow automation for the issuance, administration, transfer and settlement of private capital markets transactions.

Why Notable?

With AUM at $11.7 trillion for 2023 and 20% annual growth despite largely opaque, manual and laborious transaction and admin processes, private capital markets represent a substantial opportunity for automation and digitization. The latest round from credible institutional investors including Cboe Global Markets and the Johannesburg Stock Exchange, suggests a strong market validation for Globacap’s approach.

SynFutures, announced a $22M raise intended to expand engineering and biz dev functions. Concurrently, the Singapore-based decentralized crypto derivatives platform launched its Oyster automated market maker, and hopes that enhanced efficiency and liquidity through Oyster will help address the gap in decentralized exchange derivatives trading volume, which dwarfs spot trading on centralized exchanges but has lagged in DeFi markets. SynFutures is among the largest markets on the Polygon layer-2, with a modest TVL of $6M.

Why Notable?

The round was led by Pantera Capital, with heavyweights Susquehanna International Group and HashKey also joining the round. It is notable not only for its impressive investor mix, but also as a more traditional financing for a DeFi platform. While the valuation and structure of this round were not disclosed, CEO Rachel Lin expressed willingness to consider a native token launch down the road, subject to market conditions and the evolving regulatory landscape.

Crypto data firm Coin Metrics raised $6.7M in a private placement from a new undisclosed investor with a mix of equity, options and “other securities” according to their Form D SEC filing. Coin Metrics provides crypto market, network and price data, and boasts a highly credible suite on its existing cap table with an array of both crypto and traditional institutional investors. The new funds will be used to improve financial intelligence, data authentication and analytics.

Why Notable?

Coin Metrics is emerging as a go-to resource for institutional interest in crypto markets, and has repeatedly received broad investor support. Its 2022 $35m Series C round – led by BNY Mellon and Acrew Capital, with support from Goldman Sachs, Brevan Howard, and Cboe Digital Markets – followed a successful $15M Series B in 2021 included Goldman Sach and Fidelity, and $6M Series A in 2020, led by Highland Capital Partners, with notable Web3 investors Digital Currency Group, Avon Ventures, Raptor Group, Castle Island Ventures, and Coinbase Ventures. Apparently, this recent smaller private placement was facilitated to bring an undisclosed investor into these impressive ranks.