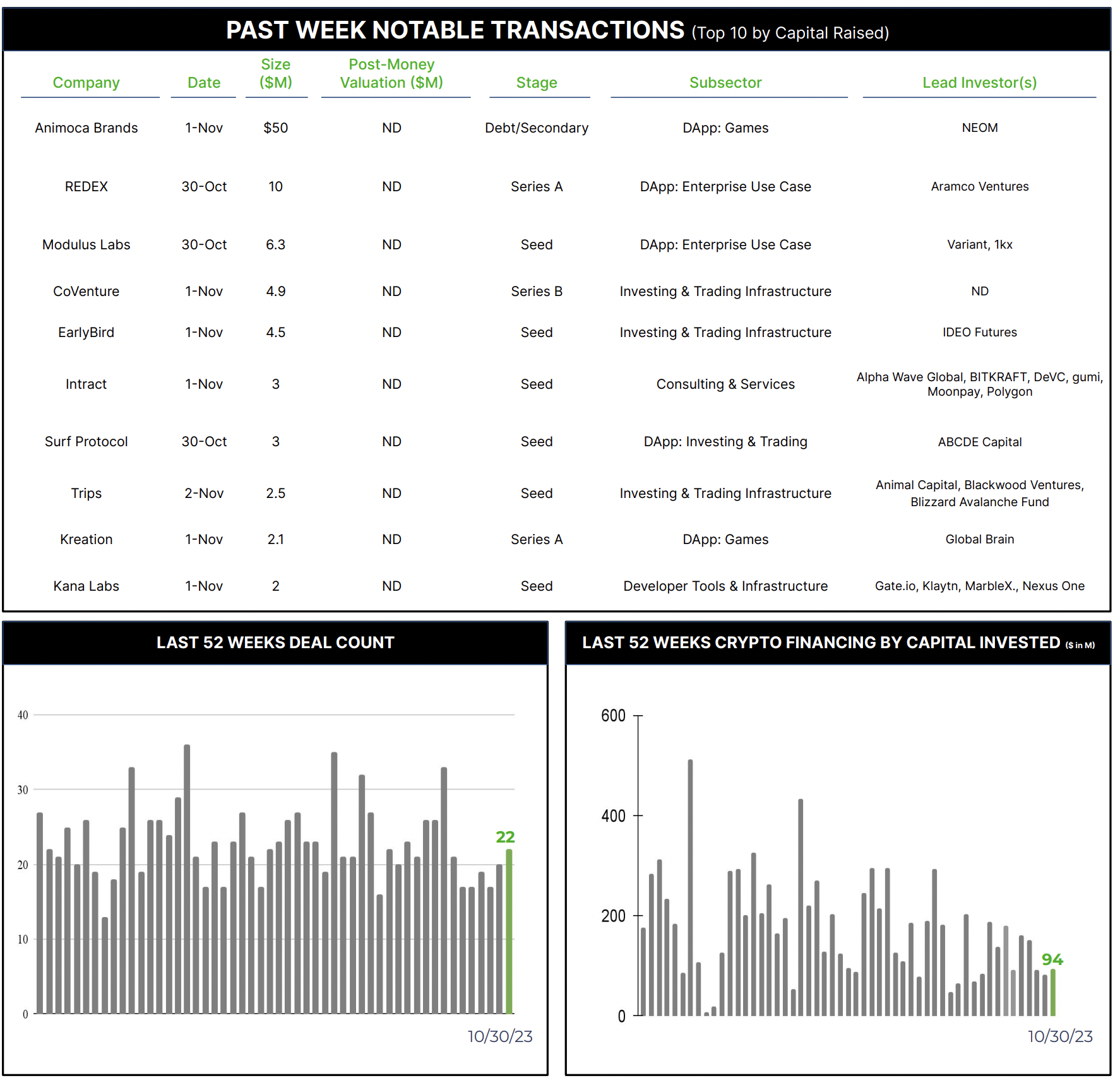

22 Crypto Private Financings Raised ~$94M

Rolling 3-Month-Average: $123M

Rolling 52-Week Average: $182M

Private finance deals showed a modest uptick this week, though remain below both recent and long-term averages for the year. Teams building infrastructure continue to receive strong investor support.

Selected Highlights

The rapid emergence of Artificial Intelligence (AI) has met extremes of both excitement and concern. According to some recent findings, the level of concern may be outpacing the excitement, and led President Biden to issue a sweeping executive order on Oct 30. At the top of the list is how to distinguish the provenance of digital content – where is AI involved, and how can we tell if its output is true?

Enter Modulus Labs, a startup at the intersection of AI and blockchain technology. Modulus recently raised $6.3M in seed funding, and aims to deploy zero-knowledge machine learning (zkML) – a variant of zero-knowledge cryptography that can validate the integrity of blockchain transactions without exposing underlying data – into the AI world where the line between reality and artificially generated content is increasingly difficult to distinguish. Modulus is using ZK-proofs to descry the veracity and integrity of generative content by assessing whether AI has been executed correctly.

Modulus emerged from Stanford, and their seed round presents a highly credible roster – led by Variant and 1kx, with participation from Inflection, Bankless, Blockchain Builders Fund, the Ethereum Foundation, Worldcoin, Polygon, Celestia and Solana. The potential applications are myriad, from price discovery in NFT lending to enhanced and scalable security of generative content that minimizes human involvement in the operation of decentralized protocols. The company also has numerous partnerships brewing that include Ethereum-based applications and, based on the angels in their round, we can anticipate similar expansion on other layer-1’s such as Polygon and Solana.

Making AI accountable through blockchain cryptography is certainly an ambitious undertaking, but its importance is hard to understate if AI will truly become as ubiquitous and transformative as many predict. We applaud the team at Modulus Labs for identifying the need and presenting a potentially credible solution. And we hope the confidence shown by their impressive Seed series investors proves well founded.