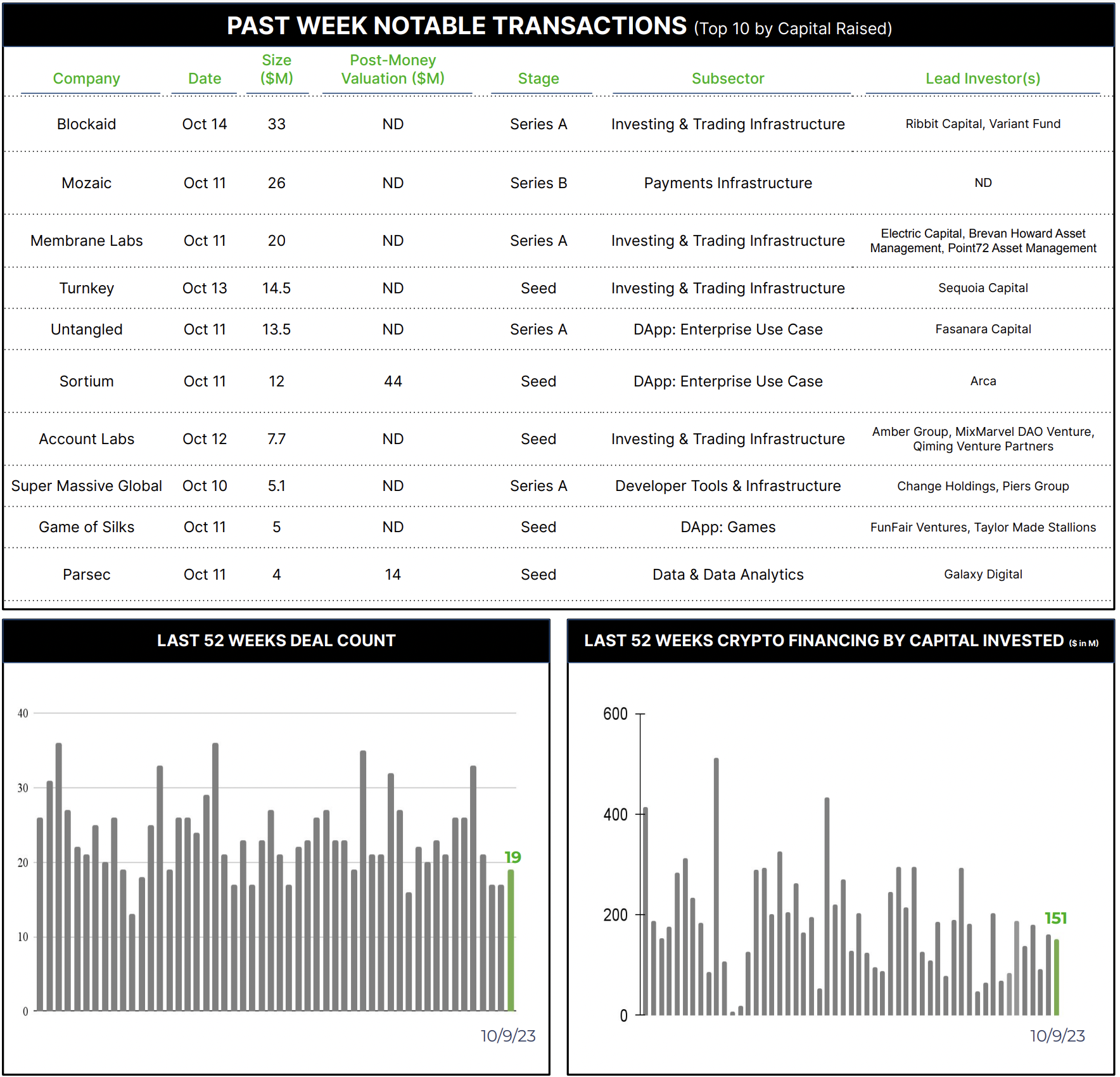

19 Crypto Private Financings Raised ~$151M

Rolling 3-Month-Average: $131M

Rolling 52-Week Average: $185M

Conferences & Events

Architect Partners is co-hosting an event with The Tie and Gemini on Thursday, October 19th at The Tie’s office (link here to register). We will also be at Money2020 (October 22 – 25).

Private financing activity proved consistent this week with 17 financings for the third week running, and healthy proceeds of $151M. Infrastructure deals continued to dominate.

Selected Highlights

Membrane Labs, a crypto-lending and trading platform, closed a $20M Series A from a respectable cohort of investors including Brevan Howard, Point72, Jane Street, and Two Sigma. Proceeds will be used to build sophisticated infrastructure to meet institutional needs for spot, derivatives, lending and collateral management activities. This includes the option to use decentralized settlement using smart contracts as escrow agents to avoid counterparty credit risk, or to opt for traditional “sign and send” settlement through Membrane’s customizable, modular tech platform.

Why Notable?

2022’s crypto-market implosions largely obliterated lending and prime brokerage capacity for the digital asset markets, leaving a liquidity void that impedes institutional trading and remains largely unfilled. Membrane hopes to unify the industry’s diverse custody and wallet solutions, and thus facilitate market liquidity with its tech-driven risk management and customizable bilateral trade management on a custody-agnostic settlement network. Their recent financing round stands out with an impressive mix of top tier traditional financial investors with more crypto-focused capital providers.

Untangled Finance, raised $13.5M to expand their on-chain solutions for tokenized private credit. The lead investor, London-based Fasanara Capital, also opened two private tokenized credit pools on the platform to put their mouth where their money is. Untangled’s platform is built on the Celo network, and will extend Ethereum and Polygon using Chainlink’s cross-chain interoperability protocol to create a multichain interoperable credit pool. Untangled is initially targeting fintech lending, such as invoice/trade finance and consumer salary lending, and green infrastructure projects. They offer some innovative tools such as a built-in liquidation engine and credit assessment model to anticipate default risks, as well as auction-based withdrawals to facilitate early liquidity for credit pool investors.

Why Notable?

Untangled is positioned in the middle of one most anticipated digital asset developments this year. Tokenized asset and collateral management is an extremely hot opportunity, and featured quite prominently at Goldman Sachs’ digital asset event in New York last week. Traditional heavyweights are poised, with JPMorgan executing the first tokenized derivative trade this week on the heels of BlackRock’s tokenized money market fund the week before, both utilizing JPM’s Tokenized Collateral Network, and Franklin Templeton’s own tokenized money market fund launched a few weeks prior.

Patterns

Capital focus shifted back toward infrastructure this week, with a sub-emphasis on bridge transactions bringing to market tools that facilitate institutional interest in tokenization, collateral management and liquidity management.