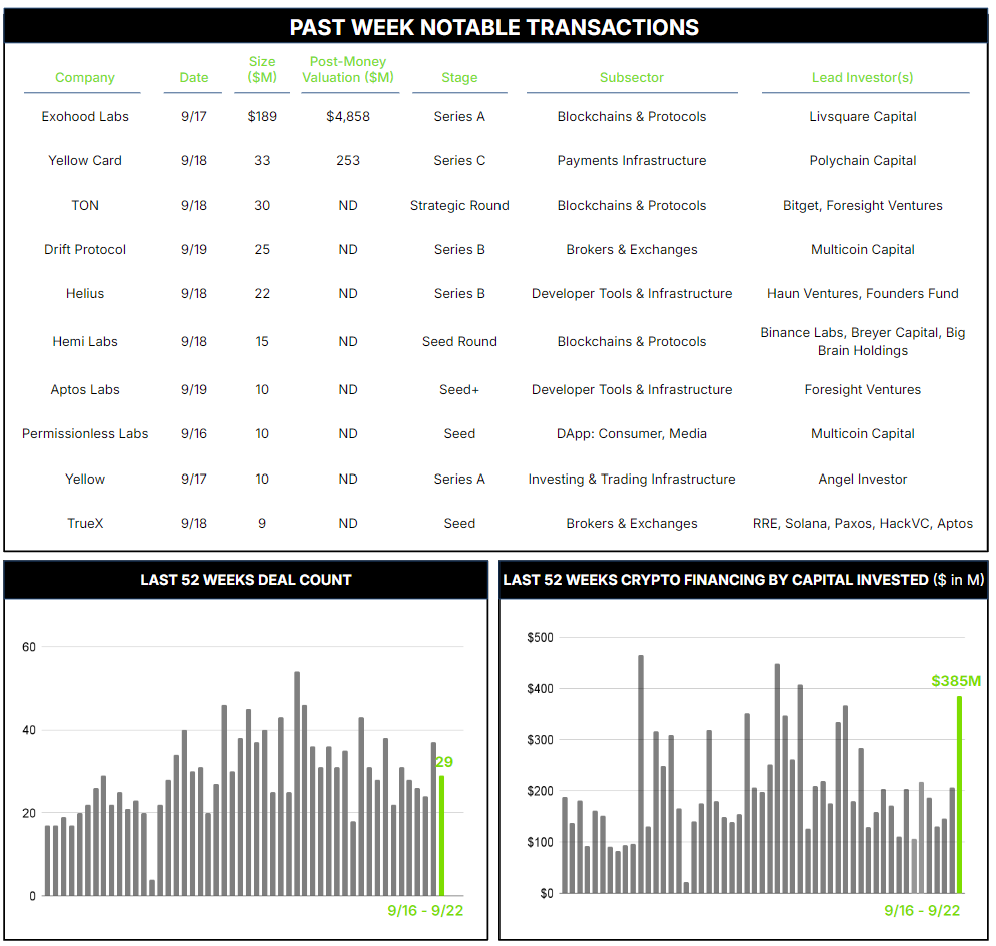

29 Crypto Private Financings Raised ~$385M

Rolling 3-Month-Average: $186M

Rolling 52-Week Average: $206M

Exhood Labs receives $189M

The convergence of blockchain and artificial intelligence (AI) represents a transformative leap in technological innovation, offering unprecedented potential to revolutionize various industries and address complex challenges. By combining the decentralized, transparent, and secure nature of blockchain with the analytical power and decision-making capabilities of AI, this integration creates a synergy that enhances data integrity, improves operational efficiency, and enables new paradigms of trust in digital systems.

Exohood Labs has rapidly established itself as a leader in developing commercially viable solutions that address complex challenges across various sectors. The company announced a $189M investment from Livsquare Capital, a Polish-based Family Office, and pushed their post money valuation to $4.9B.

At its core, Exohood Labs’ focus is on the integration of AI, Quantum Computing, and Blockchain technologies to create powerful, secure, and transparent systems. Their AI research leverages sophisticated neural networks that mimic the human brain’s structure, enabling advanced pattern recognition and data analysis. This AI capability is further enhanced by the exploration of quantum computing, which promises to revolutionize computational power and speed.

Two significant current projects from Exohood include Exania, an AI model designed for scientific research, and GINETTE (Graphic Intelligence Engine for Transformative Technology Experience). GINETTE, an advanced AI engine targeting creative industries such as movie production, video game development, and software engineering.

—————————————

Meet Architect Partners at these upcoming events:

- Permissionless (Oct 9 – Oct 12)

- Money2020 (Oct 27 – Oct 30)

Contact ryan@architectpartners.com to schedule a meeting.