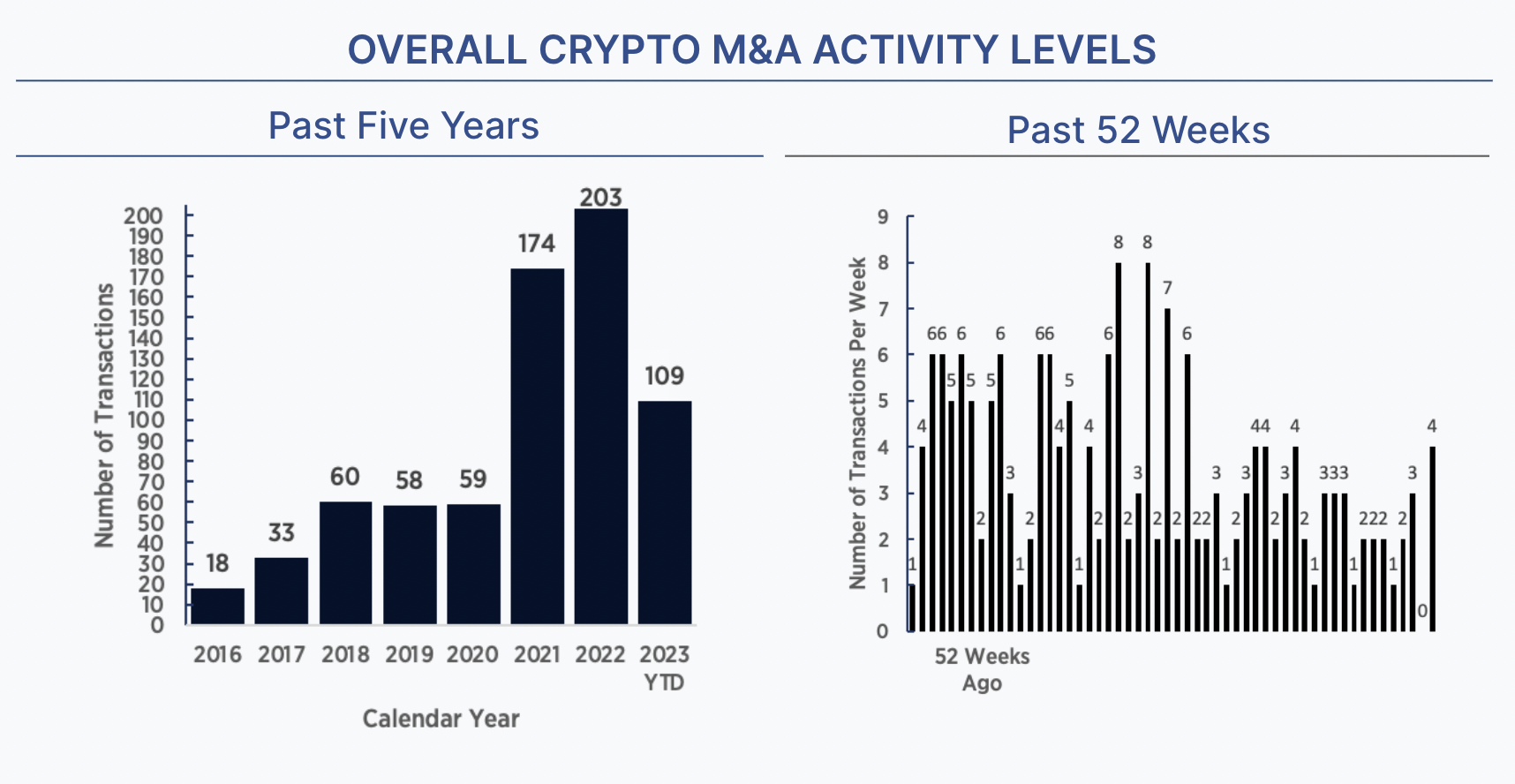

Last week was a slow week in crypto M&A, but September is starting with a bang with 4 deals already announced in this shortened US holiday week.

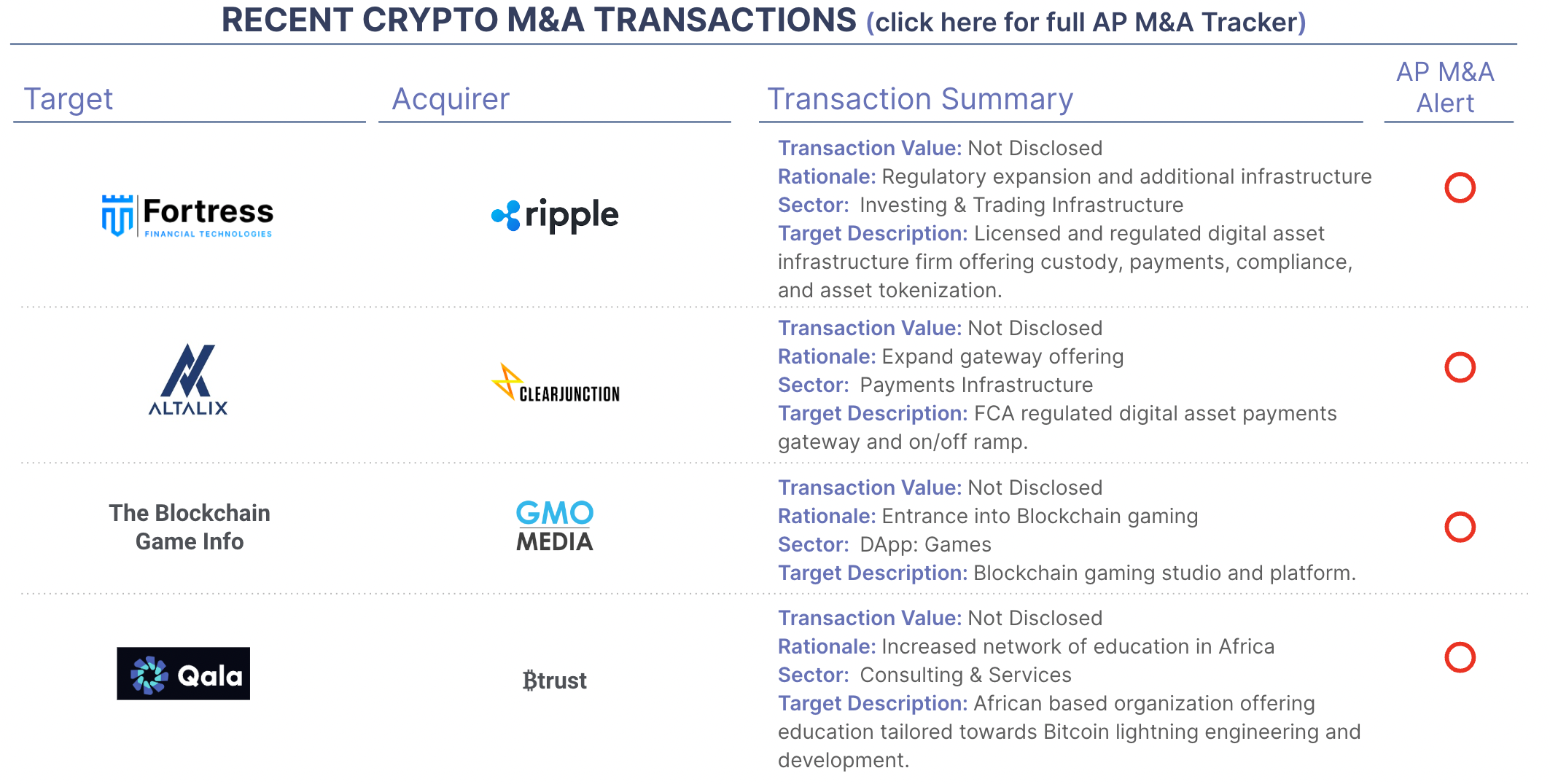

Ripple Acquires Fortress Trust to Expand Regulatory Compliance Capabilities Ripple, a leader in enterprise blockchain and crypto infrastructure, has agreed to acquire Fortress Trust, a Nevada-based financial institution that provides licensed Web3 financial, regulatory, and technology infrastructure. The acquisition will help Ripple expand its regulatory compliance capabilities and offer a wider range of Web3 products and services to its customers. Fortress Trust provides regulatory-compliant solutions to the blockchain industry including a Nevada Trust license, which is one of the most stringent regulatory frameworks in the United States. So Ripple now has a NY BitLicense, 30 US Money Transmitter Licenses and a Payment license from Singapore’s central bank. Ripple has a strong regulatory footprint in the USA, but to achieve their stated goal of “becoming the one-stop shop for enterprises looking to convert, store, and move value on blockchain around the world” they may need to acquire another company with global licenses to expand its international reach. Earlier this year Ripple also acquired Metaco, a crypto custody provider in a $250M deal. Terms were not disclosed and the deal is subject to further due diligence and regulatory approvals.

In another payments-related deal, payments company Clear Junction has acquired UK-based cryptoasset firm Altalix for an undisclosed value which is expected to close in Q4 2023. The acquisition will give Clear Junction access to Altalix’s fiat-to-crypto gateway solutions and its FCA registration. Clear Junction said that the acquisition is not an attempt to become an exchange or trade in digital assets, but rather give them a competitive edge by having both a cryptoasset registration and an electronic money institution (EMI) license. This should allow the combined company the ability to provide both fiat and crypto correspondent account services to regulated institutions.

₿trust, a nonprofit organization funded by Jack Dorsey, has acquired Qala, an organization dedicated to training Bitcoin and Lightning Network engineers in Africa. The acquisition will help ₿trust scale up its programs in Africa and drive the development of Bitcoin open-source engineers from across the Global South. Qala has built one of the biggest online communities of Bitcoin developers in Africa, spanning over 42 countries. Qala CEO Femi Longe and program manager Stephanie Titcombe will join ₿trust as program leads at ₿trust Builders.

It was also announced that GMO Media Inc. acquired Blockchain Game Info from PLAYTHINK, Inc. No further details are available at this time.