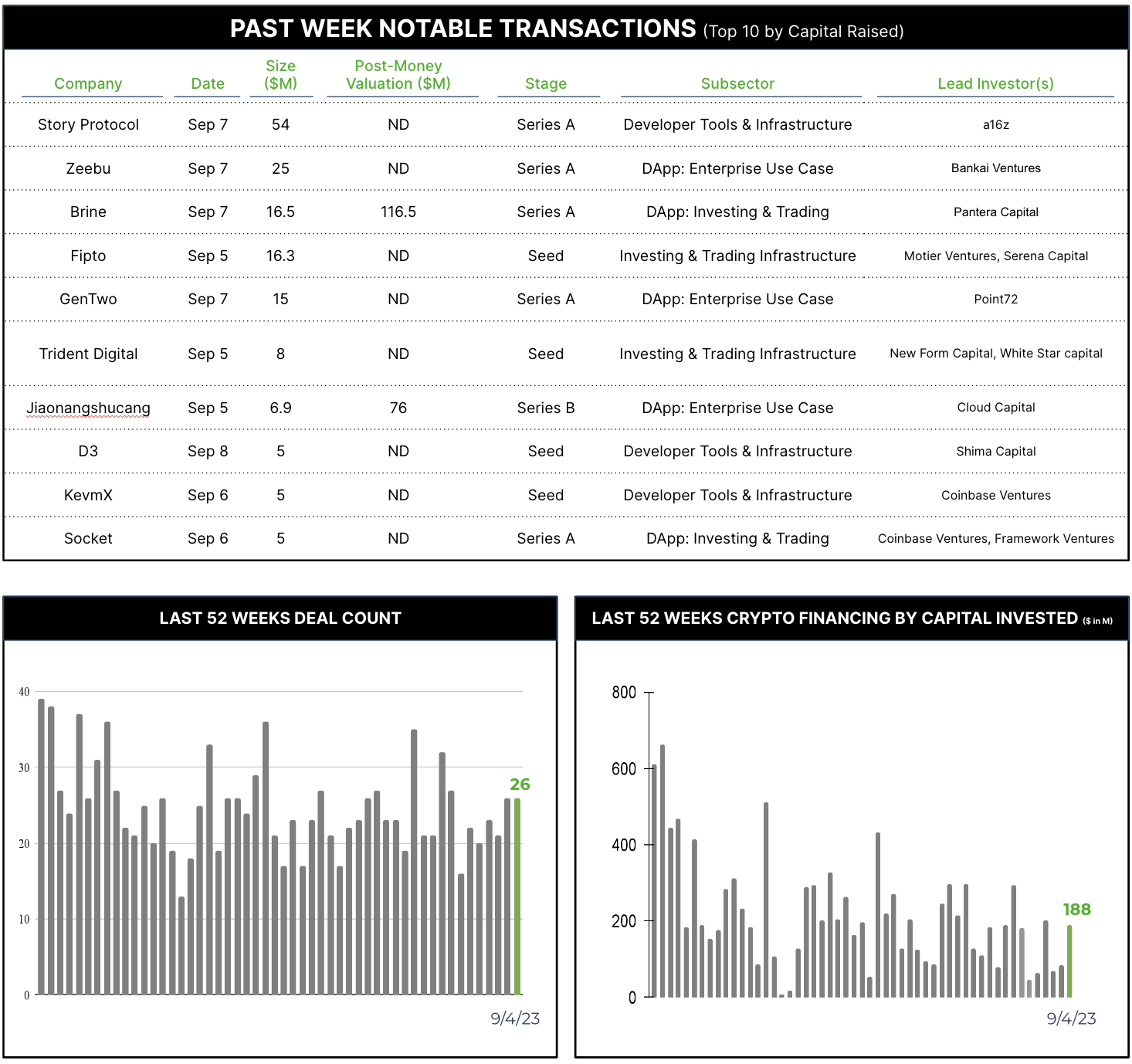

26 Crypto Private Financings Raised ~$188M

26 Crypto Private Financings Raised ~$188M

Rolling 3-Month-Average: $141M

Rolling 52-Week Average: $211M

Segment Overview

Creeping up toward the averages in both amount raised and deal count. Still running below but on the right path.

Selected Highlights

Story Protocol raised $54MM in a Series A. Led by a16z, they join a busy cap table of at least 16 investors. Story Protocol focuses on intellectual property (IP) in the creative arts. The protocol uses the blockchain for tracking and transparent provenance of artists work.

Why Notable? The largest raise for the week with $54MM from a new firm that had with $300K seed funding in May. Larger, earlier raises are the exception these days, but have noted a few more in the past month. Additionally the investors are a mix of notable individuals and notable firms.

ZEEBU raised $25MM with Bankai Ventures leading the investment. ZEEBU has a very particular market, creating a loyalty token and a quasi stablecoin to be used between telecom carriers and the wholesale voice market.

Why Notable? Sector specific stablecoin is a novel use of the still relatively new stablecoin. There has been numerous white papers touting a corporate coin for large firms to move funds internally, and this is the next step by enabling a select sector to use it between each other.

Brine Fi raised $16.5MM at a post money valuation of $116.5MM. Brine Fi is a zero knowledge proof decentralized exchange (DEX). Pantera led the round, with at least six additional investors.

Why Notable? Notable for several things, starting with the valuation. Overall trading volumes have cratered the past year, so a newly launched DEX attracting this valuation is a bit surprising. I follow the exchange segment closely, and am of the view that consolidation is coming as we still have hundreds of exchanges chasing a fraction of the volume.

Patterns

Trading and infrastructure remains the main segment. Over the past few weeks we have been seeing more infrastructure for creatives (like this week’s Story Protocol) starting to expand the potential launched by NFT’s with the maturing of the offering.

Conferences

We will be at Singapore Digital Asset Week + Token 2049 (Sept. 10-21); and Mainnet (Sept. 20-23). If you will be there, let’s schedule time to connect.