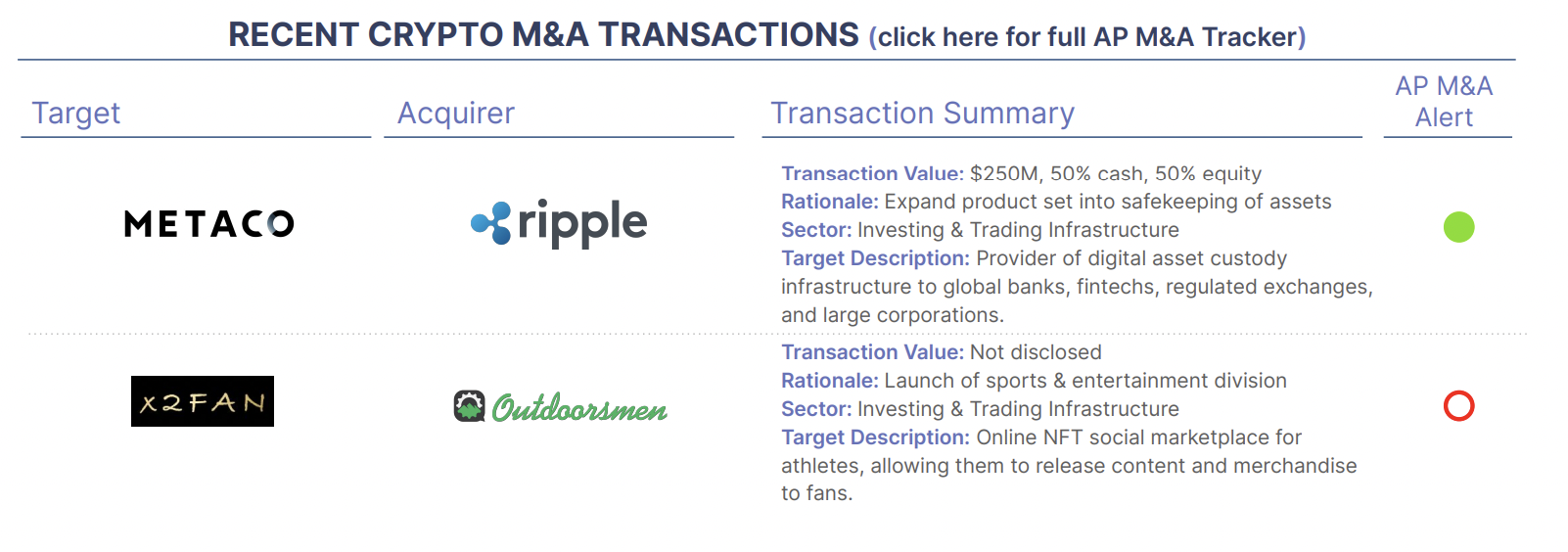

This week we saw the largest crypto deal of 2023 to date, Ripple acquiring Metaco for $250M in half cash and half equity consideration. This marks Ripple’s first large acquisition, emphasizing the importance of custody technology to support their broad aspirations around payments and settlement. See our M&A Alert for details.

There have been a total of 25 acquisitions driven by the theme of digital asset custody. As with this acquisition, the majority were driven by the strategic requirement to own and control the underlying technology. These include Galaxy Digital | GK8 ($44M, Dec 22), Bitpanda | Trustology (value not disclosed, Feb 22), and PayPal | Curv (~$200M, Mar 21).

We anticipate custody will continue to be an active area of M&A, with additional technology-driven transactions. We also anticipate that regulatory requirements will begin to emerge as an important strategic rationale driving acquisitions generally, including for custody. Expect to hear far more about the coming “safeguarding” rule being promoted by the SEC in the US in the context of custody.