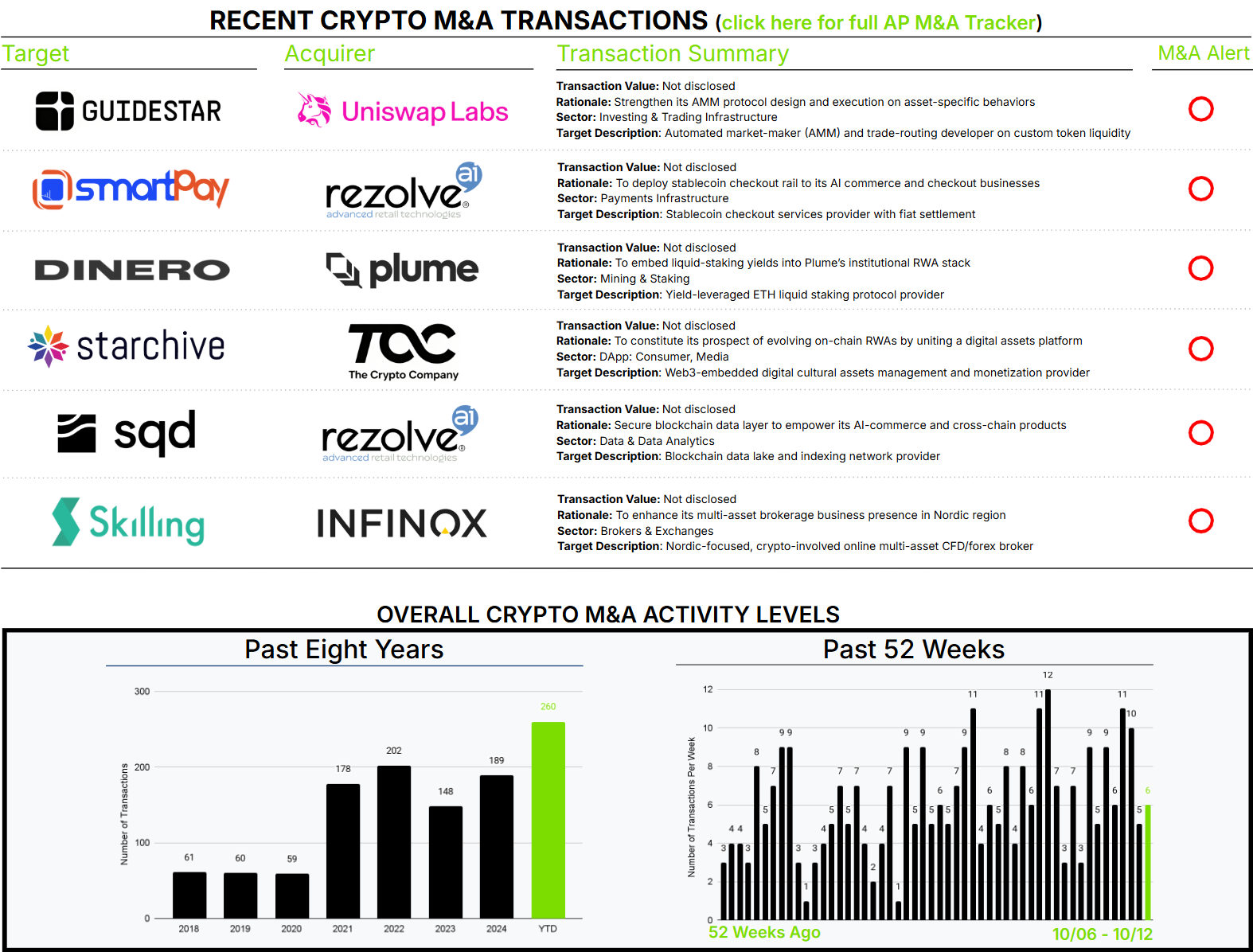

Trying something different today. A simple summary of transactions announced this week with links to learn more.

Skilling, developer of a forex and CFD trading platform for shares, commodities, and cryptocurrencies, agreed to be acquired by an investor group that owns INFINOX and M4Markets on October 9th, 2025, subject to regulatory approval. The platform offers training tools and demo accounts to help traders build strategies with a user-friendly, transparent experience (source).

SQD (Subsquid), developer of a data-network platform for blockchain information extraction and transformation, was acquired by Rezolve AI on October 9th, 2025. SQD delivers cost-efficient, retrieved on-chain data across many chains via a decentralized data lake, query engine, and modular indexers for next-gen dApp use cases (source).

Starchive, developer of an AI-powered digital media management platform for creators and rights-holders, entered a definitive agreement on October 9th, 2025 for The Crypto Company to acquire 50.1 percent of the company, with closing expected around October 17th, 2025 subject to conditions. The product organizes, enriches, and shares large libraries of assets and metadata through secure, easy dashboards (source).

Dinero, developer of a blockchain platform to scale yield for protocols and users, was acquired by Plume on October 8th, 2025. Dinero enables staked-token borrowing, liquidity provision, and leveraged staking rewards through a two-token model (pxETH and apxETH) (source).

Smartpay, developer of blockchain payments that pair stablecoin spending with instant fiat conversion, was acquired by Rezolve AI on October 7th, 2025. The solution supports crypto payments for consumers while settling merchants in local currency to improve acceptance and inclusion. The press release cites over $1 billion in USDT transaction value in the twelve months ending September 30th, 2025 and confirms instant fiat settlement via Brain Checkout (source).

Guidestar, a developer of DEX automated market-making and smart trade-routing technology, was acquired by Uniswap Labs on October 6th, 2025 (source).