December 8th – December 14th

PERSPECTIVES by Eric F. Risley

The past two months have been challenging from a crypto asset price performance perspective. Since its October 6, 2025 high of $124,752, Bitcoin is down 28.7%, and the DeFi Pulse Index has dropped by 40.4% over this same time period.

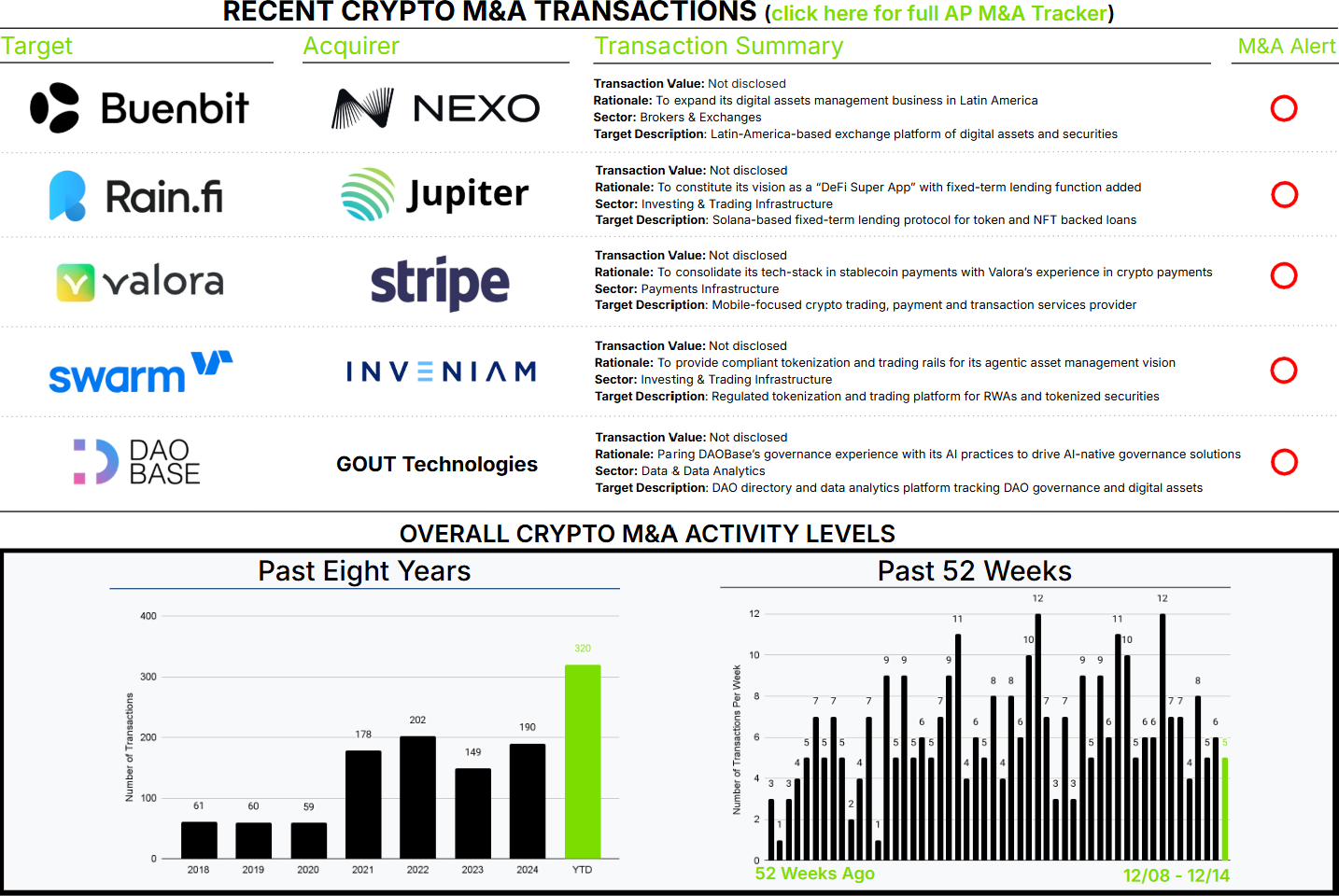

Has this challenging market adversely impacted crypto M&A? Resoundingly no.

M&A certainly has its own cycles, however, we are experiencing a continuation of a trend that began in earnest in late 2024: a strategic imperative to build, sometimes using M&A as a powerful tool. In fact, the number, quality, and geographic diversity of acquirers has increased substantially. Perhaps most notably, traditional financial services firms of all forms are increasingly active, unlocking an area of demand that dwarfs the crypto industry itself.

Part of this strategic imperative is driven by the solidification of acceptance that crypto assets, in their varying forms, represent a legitimate, institutionally acceptable, and scaled asset class. Look no further than the proliferation of ETFs and the offering of direct Bitcoin and Ethereum access by traditional firms like Fidelity, Franklin Templeton, and WisdomTree.

A second, even more profoundly impactful potential is tokenization. Yes, this is a decade-old idea that has disappointed more often than not, but it is proving to be changing quickly. Leaders like Figure have proven a value proposition that goes far beyond a tokenized version of a security. Simply put, the origination, distribution, and trading of financial instruments can deliver many benefits, albeit ones that are not yet fully realized.

Third, Decentralized Finance (DeFi) experiments are demonstrating that individuals and institutions can successfully interact directly via software to create markets at scale. Decentralized exchanges now represent 21% of all spot crypto trading volume, and borrow/lending platforms like Aave have over $22B in outstanding loans. While these remain more “experimental,” time will offer the necessary stress testing, which promises to allow their elevation into long-term viable financial markets.

Lastly, payments are in the early stages of embracing a fundamental recasting of the core rails, as articulated very well by Kyle Samani at Mulitcoin this week.

M&A is just getting started.