Bridge M&A: The Most Important Transaction Category No One Is Talking About

Here’s the uncomfortable truth this industry needs to hear: crypto doesn’t win alone. And neither does traditional finance.

Crypto owns “better, faster, cheaper.” Settlement in seconds, not days. Programmable money. Transparent, immutable ledgers. That’s real. But what crypto doesn’t have, and can’t organically build in any reasonable timeframe, are the deep client relationships, regulatory trust, business process expertise, and institutional credibility that traditional providers have spent decades earning. Those aren’t features you can ship in a software update.

This is why what we call bridge M&A, transactions that deliberately connect crypto-native capabilities with traditional finance infrastructure, is the most strategically important category of deal activity in our industry right now.

Consider two landmark transactions. Stripe’s $1.1 billion acquisition of Bridge brought stablecoin payment rails inside the world’s most trusted internet payments platform, traditional acquiring crypto. Ripple’s approximately $1 billion acquisition of GTreasury went the opposite direction, a crypto-native company buying a Fortune 500 treasury management platform that processes $12.5 trillion in annual payment flows. Crypto acquiring traditional. Both recognized the same fundamental reality: neither side has a complete solution.

And here’s what the market still underappreciates. Companies like Figure aren’t really “crypto companies.” They’re an enterprise software company using blockchain as an architectural advantage. Figure is collapsing the entire mortgage lending lifecycle, origination, underwriting, closing, servicing, and secondary market execution, into a single platform, displacing the patchwork of point solutions that lenders have cobbled together for decades. That’s not a crypto story. That’s a technology transformation story enabled by crypto-based technology.

Bridge M&A has just begun. It will and must accelerate in both directions. The companies that recognize they need what the other side has will define the next era of financial services, and other industries.

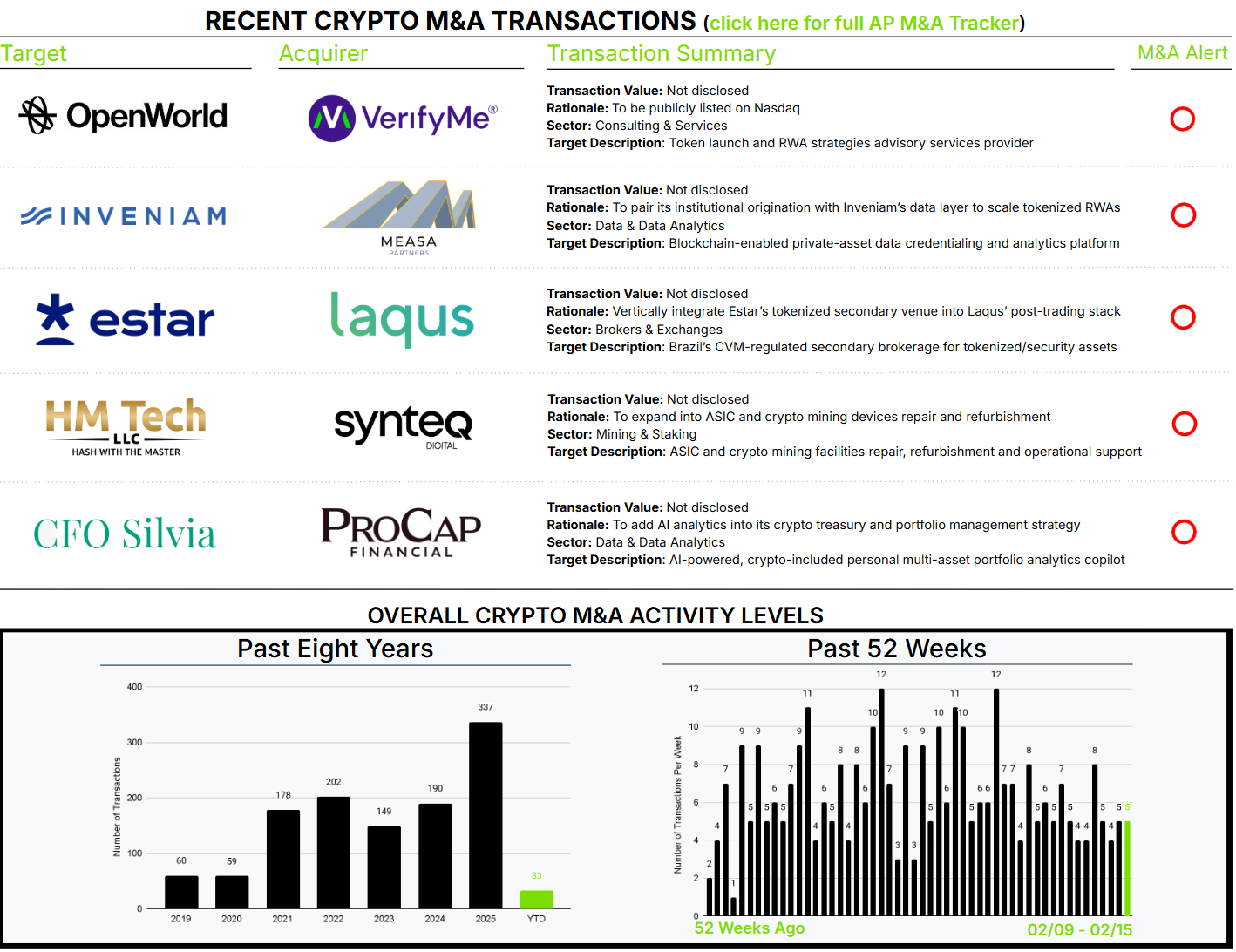

Unfortunately, this week’s activity showed none of this…