October 27th – November 2nd

PERSPECTIVES by Eric F. Risley

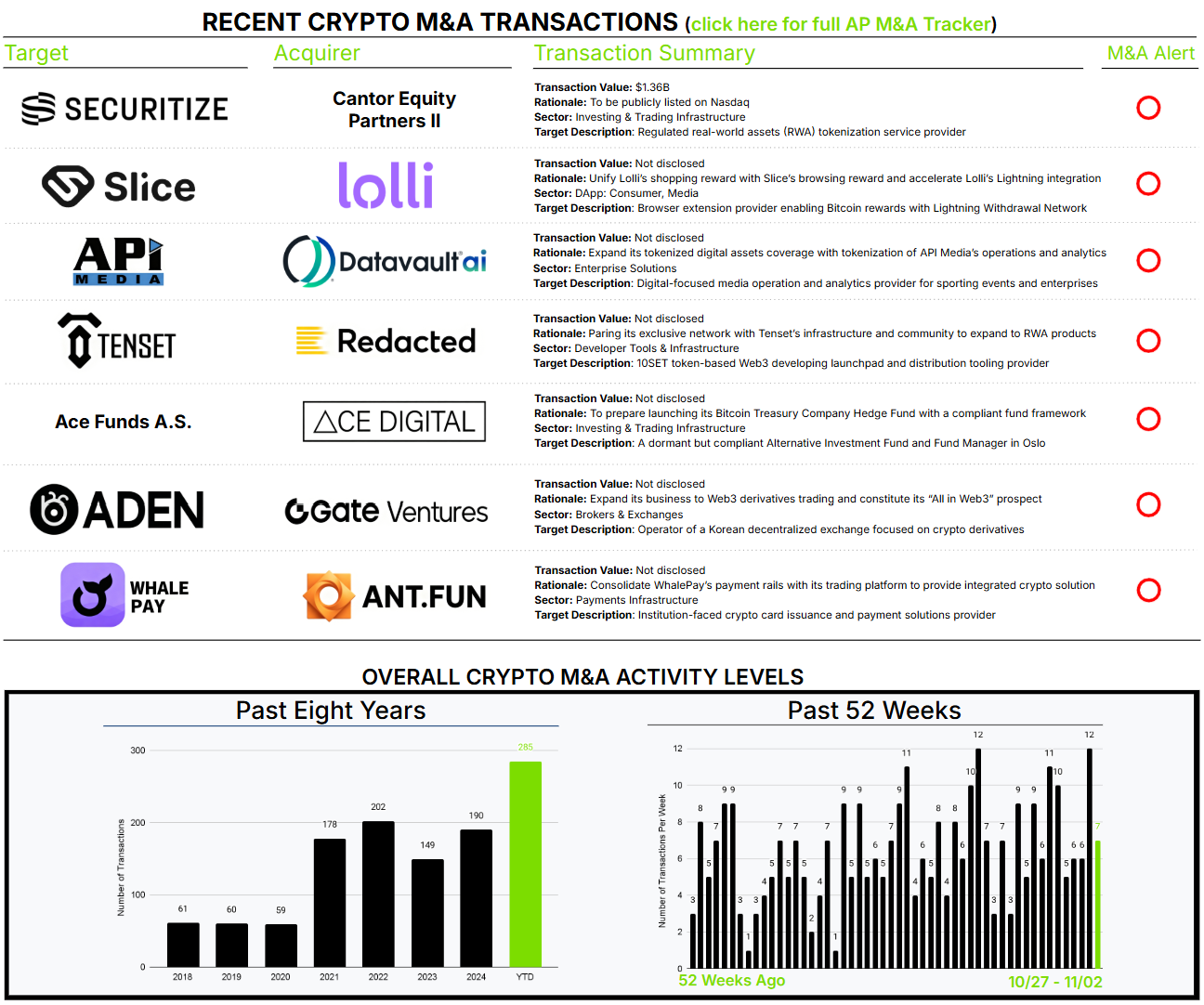

Another public debut was announced this week.

Securitize announced its intent to merge with a public acquisition corporation. This is the fifteenth announced reverse merger over $750M pairing a Special Purpose Acquisition Corporation (SPAC) with an operating company in the crypto sector. Of these announcements, eight were completed, one is pending, and six were abandoned prior to completion, including Circle and Bullish.

Securitize has been a leading pioneer in tokenizing real-world assets (RWA). Clients include:

- BlackRock: tokenized USD Institutional Digital Liquidity Fund “BUIDL”

- VanEck: tokenized U.S. Treasury fund “VBILL”

- Apollo: tokenized private credit fund “ACRED”

- Hamilton Lane: tokenized feeder funds for private-markets strategies

- KKR: tokenized feeder with exposure to Health Care Strategic Growth Fund II

- Exodus: tokenized its stock for trading

The largest category of tokenized RWA is associated with Figure’s tokenized second mortgages. These represent approximately 53% of all tokenized assets ($18.4B). Tokenized money-market funds account for 25% ($8.7B), dominated by BlackRock’s USD Institutional Digital Liquidity Fund (BUIDL).

Tokenization of RWA has been anticipated for the past decade, however, regulatory and practical inhibitors have made progress slow. Acceleration is now likely with more recent regulatory alignment and many announcements by a wide variety of traditional financial institutions that currently control the issuance and distribution of RWA. McKinsey & Company projects tokenization to become a $2T market by 2030.

Today, Securitize remains a relatively small business, with estimated 2025 full-year revenue of $69M and LTM revenue of $46.7M. In H1 2025, the business grew 519% year over year, and from 2024A to 2025E it expects to grow 260% year over year. Furthermore, the business expects to be EBITDA positive this year, with a 24% margin and $17M in EBITDA. Finally, the company values itself at $1,362M. That implies a 19.7x EV/2025E revenue multiple. For comparison, Coinbase is currently trading at 8.5x EV/2025E revenue.

As highlighted in the past, the emergence of a broad array of public businesses building the next generation of financial services is a very good development for our industry.