News on Macro Economic Data

Overall, many economists are projecting a “soft landing” or a shallow recession in 2024, with the Conference Board projecting 0.8% GDP growth in 2024. With inflation remaining persistent, and many companies’ ability to pass those cost increases along being challenged by customer’s ability to pay, there is some sign that the market may be choppy over the next few quarters.

The percentage of companies beating earnings estimates is at the lowest level, except for two points, in the last twenty years – Q1 2020 and the fall of 2008 – two of the darkest economic periods over the last twenty years. An average of 2-3% revenue growth in a 3-5% inflation environment becomes challenging. Much of the market’s gain this year has come from multiple expansion rather than earnings growth. Companies cutting costs, and manipulating earnings is fine for a short period, but on a longer-term basis how the S&P 493- less the magnificent 7 behaves going forward is a looming question.

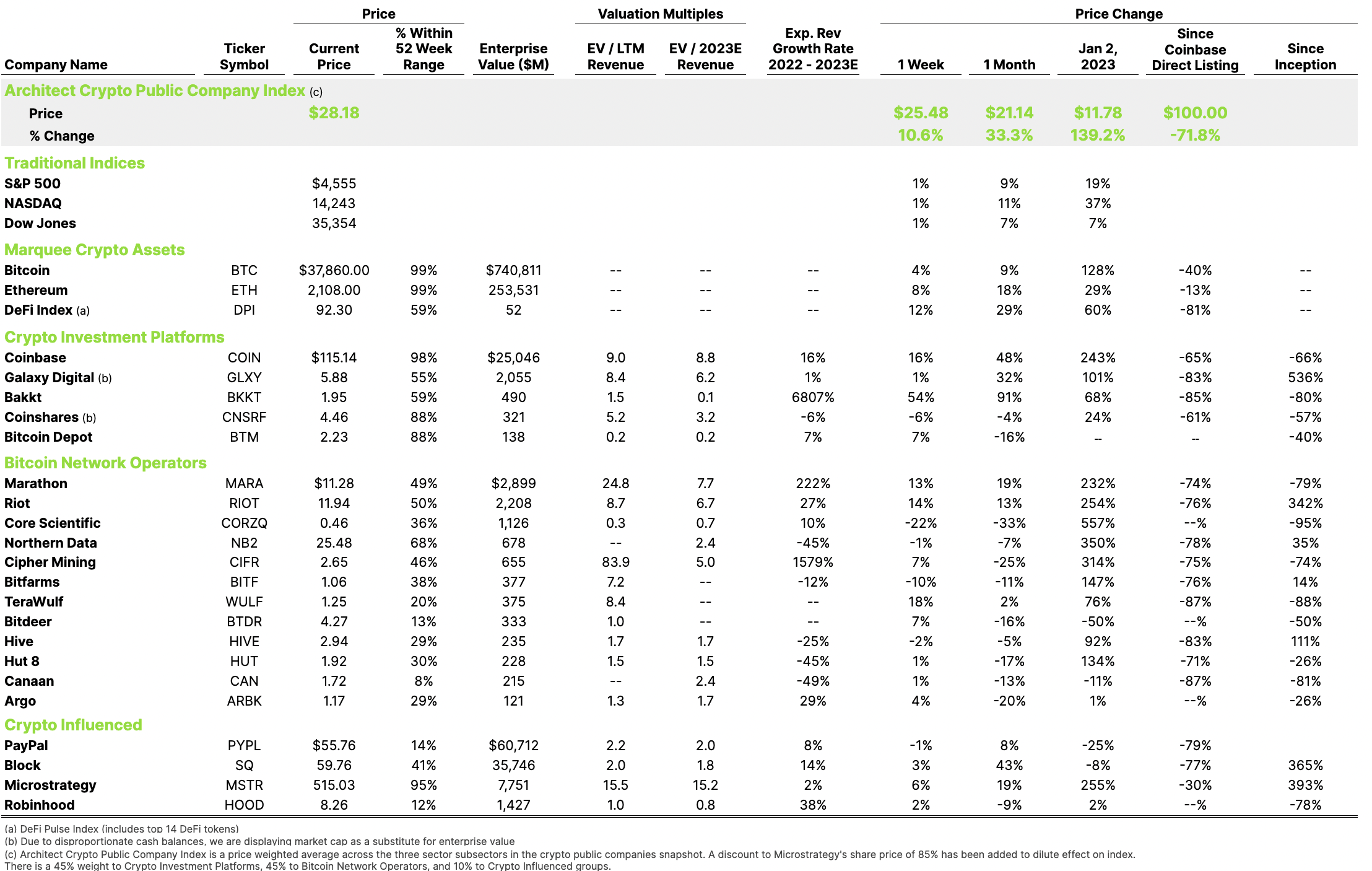

Crypto Public Company Activity

There was no bigger news this week than the status of Binance.

Binance – the world’s largest crypto exchange, and Changpeng Zhao (“CZ”), the founder of Binance pled guilty to failing to adhere to anti-money laundering and other laws. The government proved multiple bad actors utilizing the platform, and the company admitted to money laundering, unlicensed money transmitting, allowing ransomware hackers to operate, and sanctions violations.

As part of the settlement Binance is to pay a $4.3B fine, CZ will personally pay a $50M fine and step away from the company, and CZ faces a 1-10 year prison term with a sentencing hearing to be held sometime in 2024

This action is a great example of the government’s focused enforcement regarding illicit activities involving crypto. To add to the government’s actions this week, the SEC also sued Kraken alleging it is operating as an unregistered securities exchange.

These actions only add to the perception of illicit activity within the crypto industry. There is much good in the crypto industry and the industry must prove these actions are not the norm. Additionally, this action provides a strong market opportunity for those firms acting in the US with stronger governance, such as Coinbase ( also under a government suit regarding operating an unlicensed security exchange, brokerage, and clearing agency).

This link provides an update on crypto firms facing regulatory charges this year.