News on Macro Economic Data

2024 is looking to be a very interesting year. The predicted recession of 2023 never materialized, and most economists are optimistic for a soft landing in 2024. With that in mind, the Fed suggested 3 interest rate cuts during the year. The market is predicting 6-7 cuts during 2024. A requirement for 6-7 cuts this year doesn’t seem like a vote of confidence regarding economic health in 2024. A recession has always followed a tightening of the money supply, and leading indicators have been declining for 18 months. Thus, it will be interesting to follow, as it’s also an election year. Two key topics for today:

The Fed’s balance sheet doubled to $8T since 2020 which may become a real issue in 2024. The Treasury Department has put out their schedule showing a reduction in bond auctions. The most recent auctions have not gone very well. The Fed, China, and Japan are not buying bonds so yields most likely will have to increase to attract investors driving up long-term interest rates. The Treasury Dept seems instead to be focused on T- bills bringing up issues that may hinder the economy.

The December jobs report came in much stronger than expected at 216K jobs. However, of those jobs 52K were government, 74K were private education and Health Services, and 57K were leisure, hospitality, and retail. The labor force participation rate declined by 683K workers, and multiple job holders continues to rise. Additionally, The Wall Street Journal’s analysis showed that recent job growth trend has been government, health care and social services which means job creation has mostly supported government spending on social services and not jobs that boost the economy.

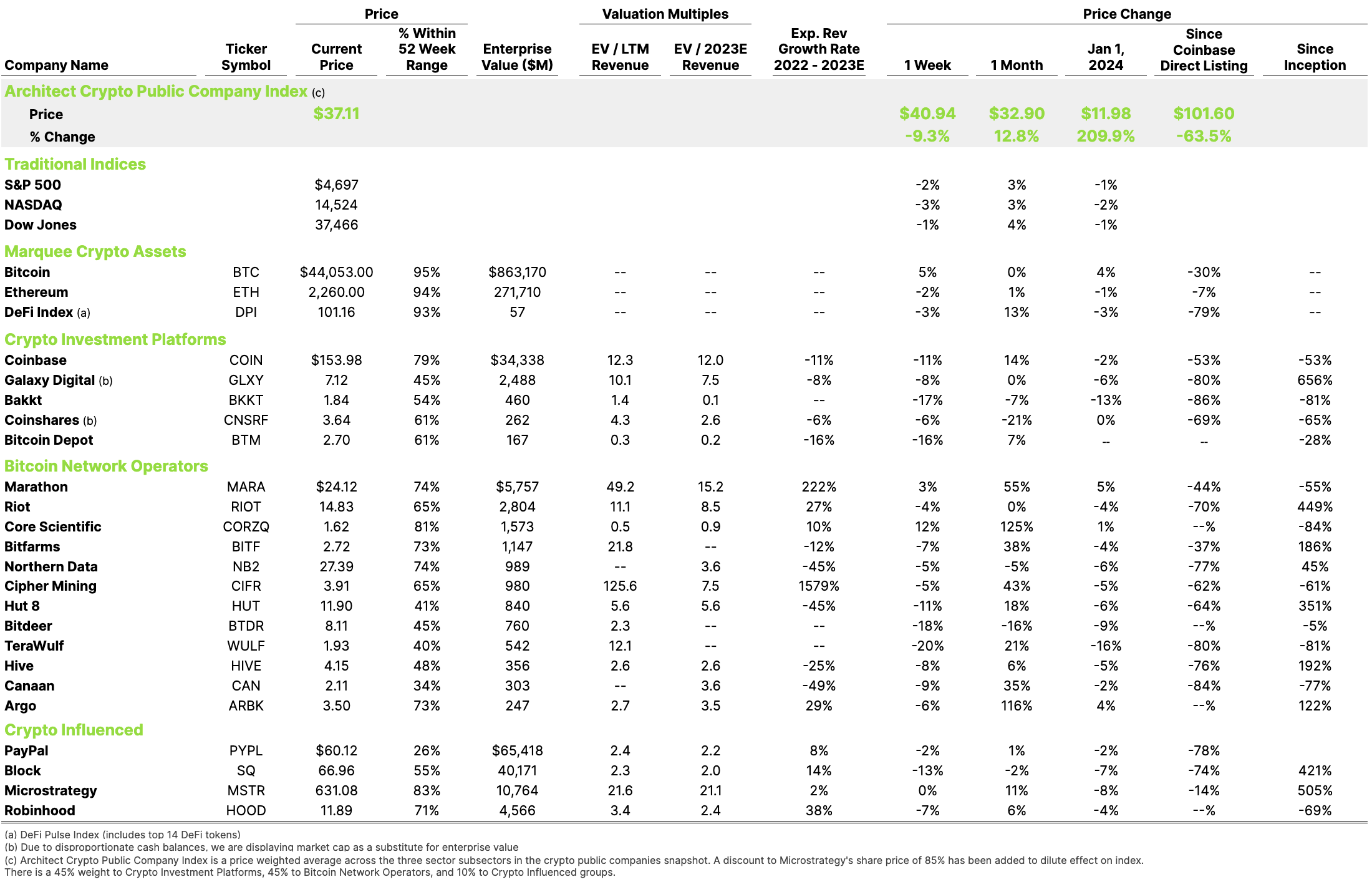

Crypto Public Company Activity

One of the most watched, and arguably the most exciting milestone for Bitcoin in early 2024 is the possible approval of one or more Bitcoin spot ETFs. It represents true institutional acceptance. Aside from the hype, many analysts believe the price of Bitcoin will go higher due to the increased demand generated by ETFs.

This past Wednesday the price of Bitcoin fell more than 10% when Matrixport posted a seemingly very definitive report that Bitcoin spot ETFs, with a reported regulatory approval date of January 10, were ultimately not going to receive approval by the SEC.

The overall reaction to the report, including the 10% drop in the price of Bitcoin, prompted Jhan Wu, Chairman of Bitmain and Matrixport, to defend the analyst and the freedom of Matrixport’s analysts to state their opinions as they see the market. He also denied their report was responsible for the drop in Bitcoin pricing.

Independent of the Matrixport analyst’s view, Grayscale, ARK, and VanEck have received approval for their spot Bitcoin ETFs to trade on their exchange of choice along with approved ticker symbols. These moves do not mean SEC approval of the spot ETFs, but are a key step towards trading once they are approved.

The ETF watch goes on.