News on Macro Economic Data

Major global economies continue to show slow growth. Japan and the UK fell into recession at the end of 2023, and both China and Europe are in prolonged slowdowns. The US economy has been more resilient, much of it fueled by government spending. Last week, Fed Chairman Powell spoke up about the “unsustainable path” of the US government spending and US debt. Government spending, which helped to keep the economy out of recession, also helps maintain sticky inflation making the job of the Fed much more difficult. As an example, if direct government spending is taken out, 2023 growth falls from 2.5% to slightly higher than 1%.

Sticky inflation showed itself this week, as January CPI rose 3.1% YoY, and core inflation (ex-food and energy) rose 3.9%. January’s PPI came in at 0.9% YoY vs. an estimate of 0.6%, and core PPI came in at 2% YoY vs. an estimate of 1.6%. The housing report also disappointed with housing starts down 14.8% and permits down 1.5%.

Many economists believe that the PPI most likely continues to increase due to energy costs and supply chain issues due to global instability, especially in the Middle East. Based on recent economic news, the case supporting multiple rate cuts this year seems to be slipping.

Crypto Public Company Activity

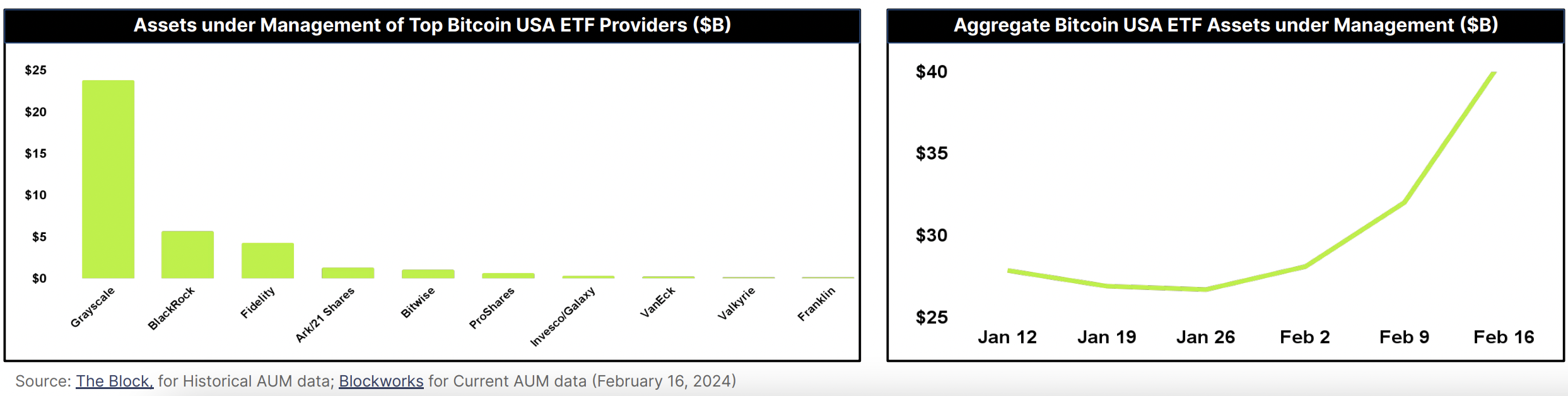

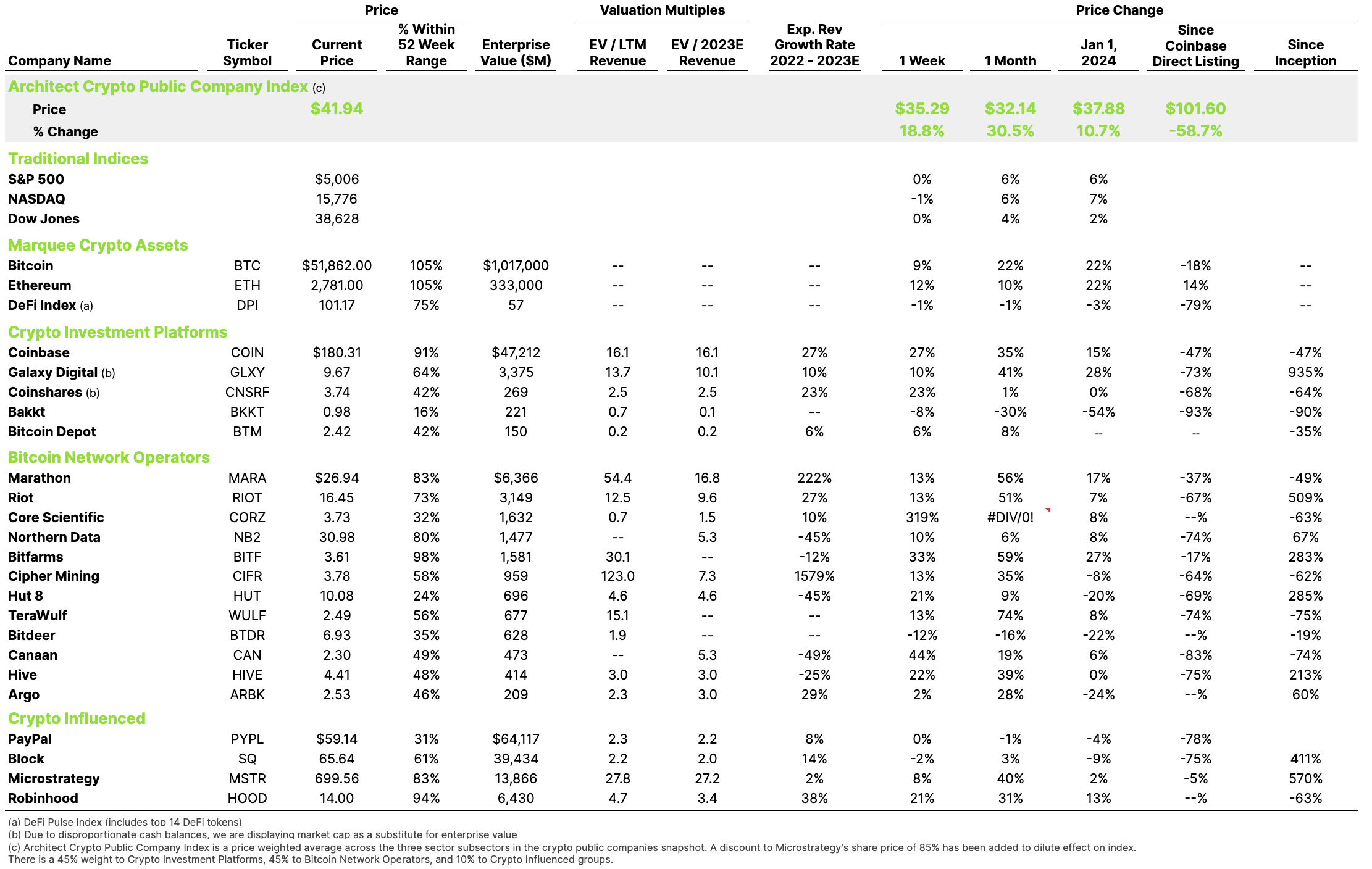

Bitcoin’s approx. 90% rise in valuation over the past six months has had a positive impact on the entire crypto ecosystem. Coinbase (COIN) announced a stellar Q4 2023 earnings report that they say was driven by the excitement around the Bitcoin ETF approvals and an expected improved 2024 macroeconomic environment.

Coinbase reported revenue of $954M and a profit of $1.04 per share beating both top and bottom line expectations. Highlights from the Coinbase report (QoQ improvements noted):

Transaction revenue rose 83% to $529M

Consumer transaction revenue increased 80% to $493M on $29B in trading volume

Institutional transaction revenue increased 161% to $37M on $125B in trading volume

- Subscription and Services revenue rose 12% to $375M

- Custodial revenue increased 24% to $20M

- Net Income was $273M (up from a $2M loss in Q3)

Interesting to note that % of total trading volume for Bitcoin and Ethereum are both down (trading volume was 31% and 15% of overall trading respectively), and the trading volume of Altcoins is up substantially to 42% of the total.

Coinbase’s growing importance is highlighted by the fact that eight of the new ETFs are using Coinbase’s custody service, and 33% of the largest hedge funds (by AUM) are utilizing the Coinbase platform.

This is quite a turnaround as Coinbase emerges from the “Crypto Winter” and regulatory issues.

Shares of Coinbase were up 8.6% today, and up ~140% over the last six months.