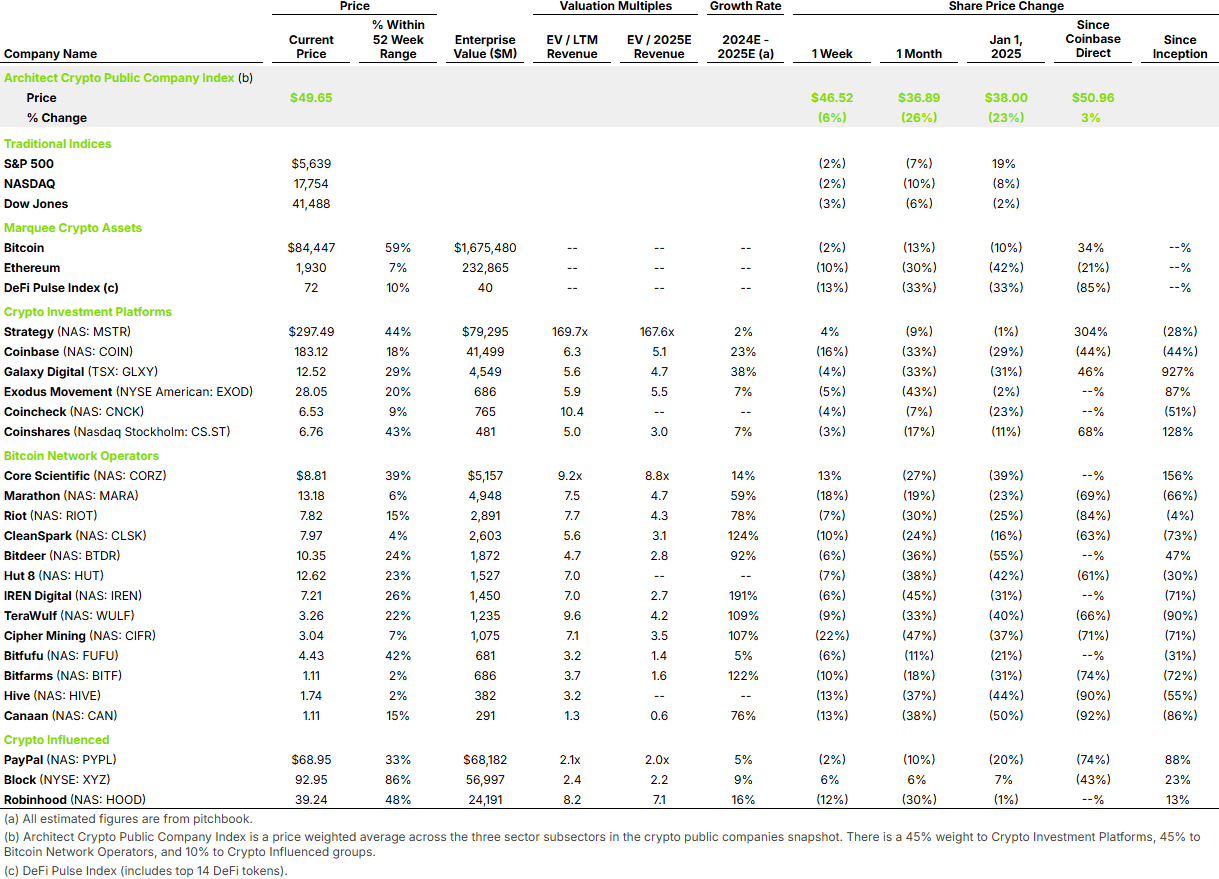

Another week of volatility is behind us, and the aftermath looks much like that of previous weeks. The average company in our Crypto Investment Platforms and Bitcoin Network Operator groups fell by 9% over the past week and is now down by 29% over the last month.

This marks a sharp decline from earlier in the year. When Bitcoin was near its peak in late 2024, our crypto group posted significant gains, with the average company up approximately 200% for the year. While there was a large cushion of gains from the prior year, it has been eroding as the market continues to soften.

For context, the Nasdaq 100, a benchmark for high-growth tech, has declined by 11% over the past month. While our crypto index has dropped nearly three times as much, the broader trend suggests that tech stocks, in general, are moving in the same direction. Notably, this index rose only 25% in 2024—eight times lower than our crypto index, which gained 200%.

Bitcoin has also mirrored the Nasdaq 100, with both falling around 11% over the past month. This highlights the higher risk profile of crypto companies compared to Bitcoin itself, which is the asset at the core of their business models. At the same time, Bitcoin’s movement closely aligns with the top 100 growth tech stocks, suggesting a period of relatively lower volatility.