Download the full report above.

Elliot Chun spoke with Talia Kaplan at CNBC Crypto World to discuss key takeaways from Architect Partners’ Q2 Report (Interview linked here at the 04:00 mark).

Prepared by Architect Insights

State of the Crypto Markets

Since our founding fifteen years ago, we have published strategy and market research that we call Architect Insights to separate the signal from the noise. We do our best to speak in plain language, simplify without losing the nuance, present the facts clearly and in context, and share a bit of perspective. Each of our team members has earned perspective from direct experience closely collaborating with senior management, Boards of Directors, and investors for multiple decades.

Major Positive Inflection Point Happening Now

We are now beginning a major growth phase for the crypto and digital asset industry, which will make our past look quaint. This Architect Partners Q2 2024 M&A and Financing Report highlights why we have confidence in that statement. Highlights include:

1. Confidence and Momentum are Back

As the second quarter of 2024 ends, our self-induced crypto winter is past. Professionalism, risk management, ethical behavior, and “doing it right” are finally becoming the foundational principles of crypto. When challenging situations arise, I’m often reminded that the eventual resolution is worth the journey. Crypto, as an industry, is now in a far better place than two years ago.

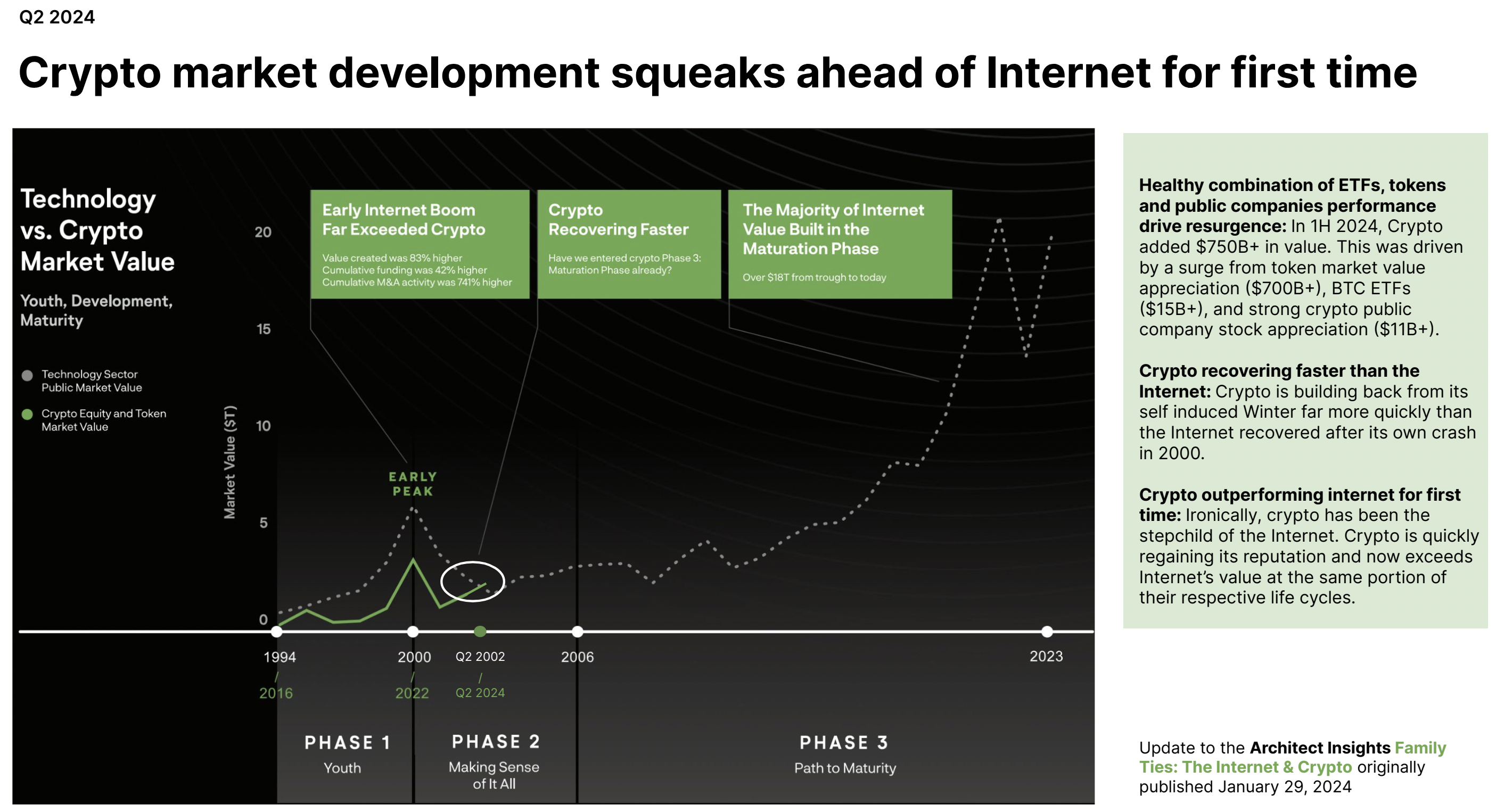

2. Crypto Has Surpassed the Internet for the First Time

Architect Partners published “Family Ties: The Internet & Crypto” earlier this year. Our thesis, born from personal experience with both disruptions, is that the internet and crypto have strikingly similar distinguishing characteristics.

A refresh of our data-led analyses validates the claim that crypto is in a “far better place” today. For the first time in history, the total value created by the crypto industry has now exceeded the pace of the internet. (see page 4)

3. Green Lights are Flashing for Crypto Mergers & Acquisitions

The announced transaction value in Q2 2024 exceeds the combined value from the past eight quarters, at $2.7B, a crypto sector record high. (see page 5)

4. Private Financings are Recovering

Seed and early-stage financings remain active and comprise the majority of transaction count and capital committed. Growth stage financings remain muted. (see page 6)

5. Public Companies Increasingly Active

The Architect Partners Crypto Index of public market value was up 24% year-to-date. Bitcoin outperformed with a 35% gain, but crypto beat the overall equities market, as represented by the S&P 500’s gain of +15% over the same period. (see page 7)

Other Highlights

We’ve also conducted a deep dive into subsector dynamics and much more in the following report. We always appreciate feedback and comments, and as always, our team stands ready if you are considering strategic financing or M&A. Our full team contacts can be found on page 43.

Eric F Risley

Founder & Managing Partner

June 29, 2024